Breaking: WTI plummets on dying OPEC+ alliance

The price of oil is in focus in for the start of this week with additional turmoil in the markets following the weekend updates surrounding the coronavirus, at the core of geopolitical and market havoc. WTI dropped to a low of $32.80.

Firstly, crude prices went into a tailspin on the news of the OPEC+ abolishing oil production restrictions. This follows Friday's updates and lack of consensus between Russie and Saudi Arabia proposing a cut to crude output. In what appears to be a retaliation aimed at Russia fr breaking the alliance, the Saudis are hatching plans to increase its oil output in April to 12 million barrels a day – a record amount – if need be. More on this here.

Coronavirus update

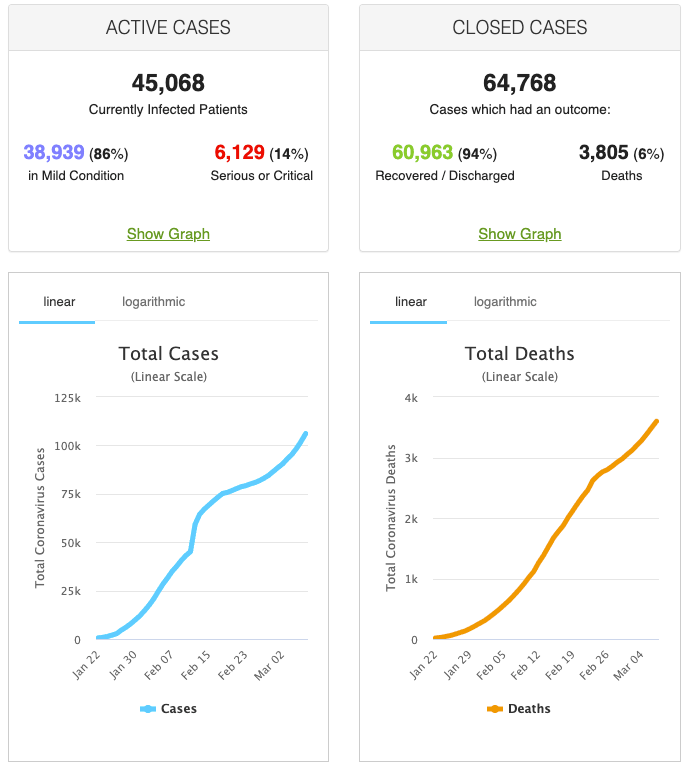

Meanwhile, the latest on the coronavirus – 109,836 cases globally with 3,805 deaths and 60,963 recovered. There are 86% of current cases in mild condition and 14% critical. There are 94% recovered/discharged and 6% deaths from 64,768 cases that are now closed.

Source: China's NHC and www.worldometers.info/coronavirus

Risk-off supporting EUR/USD

EUR/USD is picking up a bid at the start of the week and will b a key focus with the Europan Central Bank on the cards. The rally has moved to a critical liquidity pool on the daily charts:

Author

FXStreet Team

FXStreet