Breaking: Why are DISCB shares up so much? Discovery B shares spike 90% as A remains steady

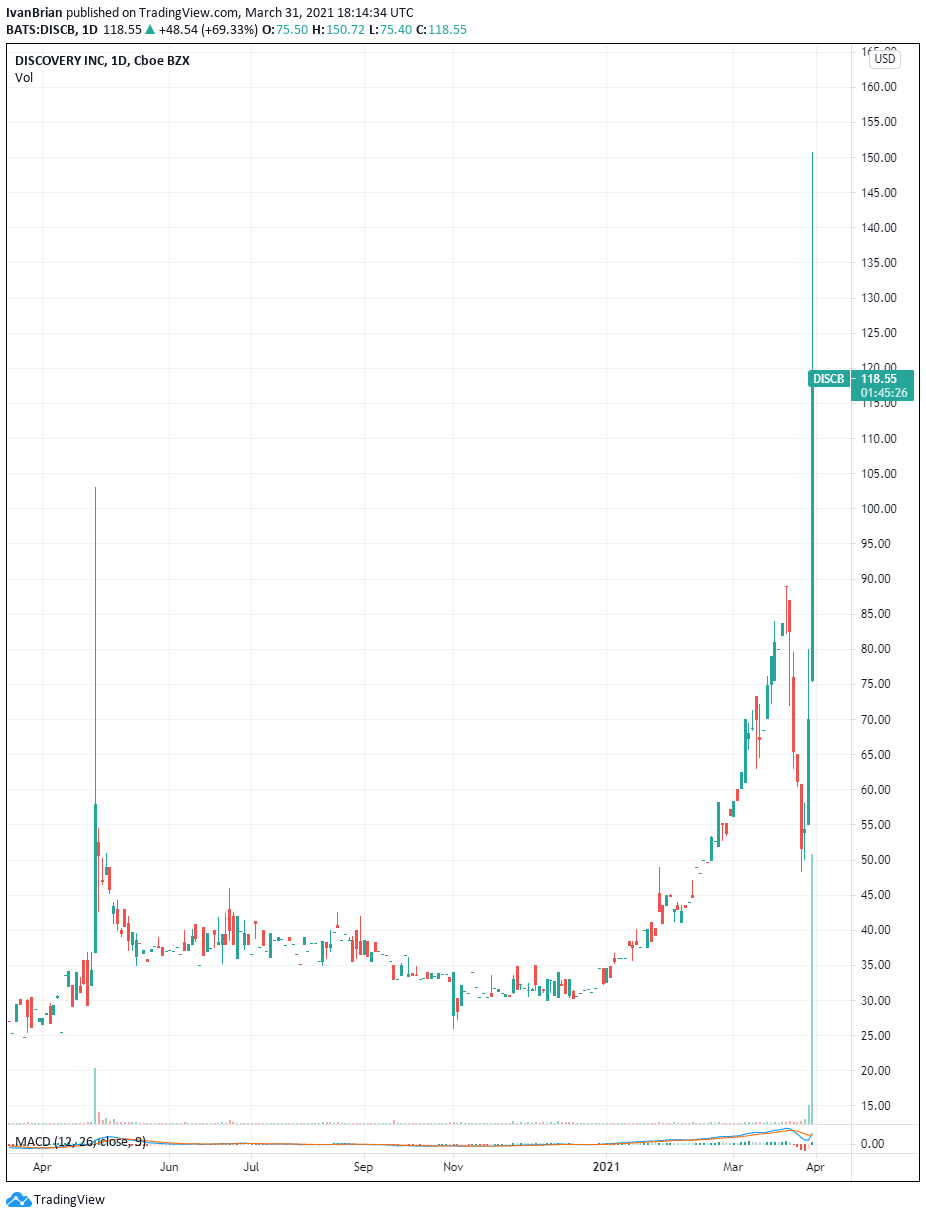

Shares in Discovery Inc have been in the headlights of traders lately as Discovery was rumoured to be one of the positions caught up in the Archegos debacle. Discovery A shares (DISCA) dumped from $78 to $35 as the hedge fund mess unfolded.

However, Wednesday is seeing a huge spike in Discovery B shares (DISCB). These are lightly traded shares held almost entirely by media tycoon John Malone according to Factset, from CNBC. The B shares, DISCB, usually trades around 3,000 shares per day, volume on Wednesday is over one million shares and counting. DISCB shares have been halted numerous times on Thursday.

DISCB shares have different voting rights to the more regular DISCA shares with DISCB carrying ten votes per share as opposed to the DISCA shares carrying one vote.

No reason seems evident for the move but DISCB is one of the top trending stocks across social media with heavy discussion on all retail trading sites and it looks like, as a result, heavy retail trading.

DISCA and DISCB are heavily correlated shares as the chart shows. But this DISCB spike has happened once before back in May 1, 2020. DISCB shares spiked 68% on May 1 2020, again for no apparent reason. Discovery issued a release after the huge move saying it was unaware of the reasons and DISCB shares quickly returned to normal levels.

SILVER SPRING, Md., May 1, 2020 /PRNewswire/ -- Discovery (NASDAQ:DISCA, DISCB, DISCK))) today announced that it is not aware of the reasons for the recent volatility in the price of its Series B (DISCB) common stock. Discovery has not selectively disclosed any material nonpublic information to analysts, investors or others, and Discovery is not aware of any sales or purchase of its Series B common stock by any of its executive officers or directors within the last 30 days. Discovery's management believes it is prudent to advise the market of this given recent fluctuations of its Series B common stock.

So is this a case of deja vu? Clearly, Discovery shares are high on traders minds given recent Archegos speculation. Perhaps some are trading the wrong class of stock or maybe some other reason will become clear. Either way, it seems a highly irrational move in a highly illiquid class and traders are urged to exercise extreme caution.

Discovery has not commented, according to CNBC.

DISCB has a tiny free float (amount of shares available for trading). 321k shares out of a free float of 6.51 million from Refinitiv. This makes is more volatile if interest and volume increaes.

At the time of writing, the author is long DISCA shares. The author has no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.