The British Prime Minister Boris Johnson is speaking shortly to announce a third national lockdown for England where level 5 restrictions could come into play.

Watch live here

Key announcements

- The new variant is 50-70% more transmissible.

- Hospitals under more pressure than at any time since the pandemic.

- We need to do more together.

- A national lockdown tough enough to contain the variant is needed.

- Stay at home.

- Can only leave home for limited reasons.

- The country should move to alert level 5.

- The pace of vaccination is accelerating.

- By mid-Feb, we expect to offer the vaccine to the top priority groups, all care homes, everyone over the age of 70, front line health and social workers and anyone clinically vulnerable.

- We should remain cautious about the time table ahead.

- If roll-out of vaccine is successful and deaths start to fall as the vaccine takes effect, then hope to move steadily to move out of lockdown, schools to go back after Feb half term and move down the tiers.

- Follow rules now, but they will come into law on Wednesday.

- Entering the last phase of the struggle.

- End is in sight and we know how we will get there.

Meanwhile, the Kingdown has passed the milestone of 50,000 infections every day for a week.

The easing of restrictions at Christmas was expected to fuel the outbreak considering the new variant's speed of transmission, pressuring the NHS to the brink.

The Department of Health chiefs also posted 407 more deaths, up just 14 per cent on the figure recorded last week.

Market implications

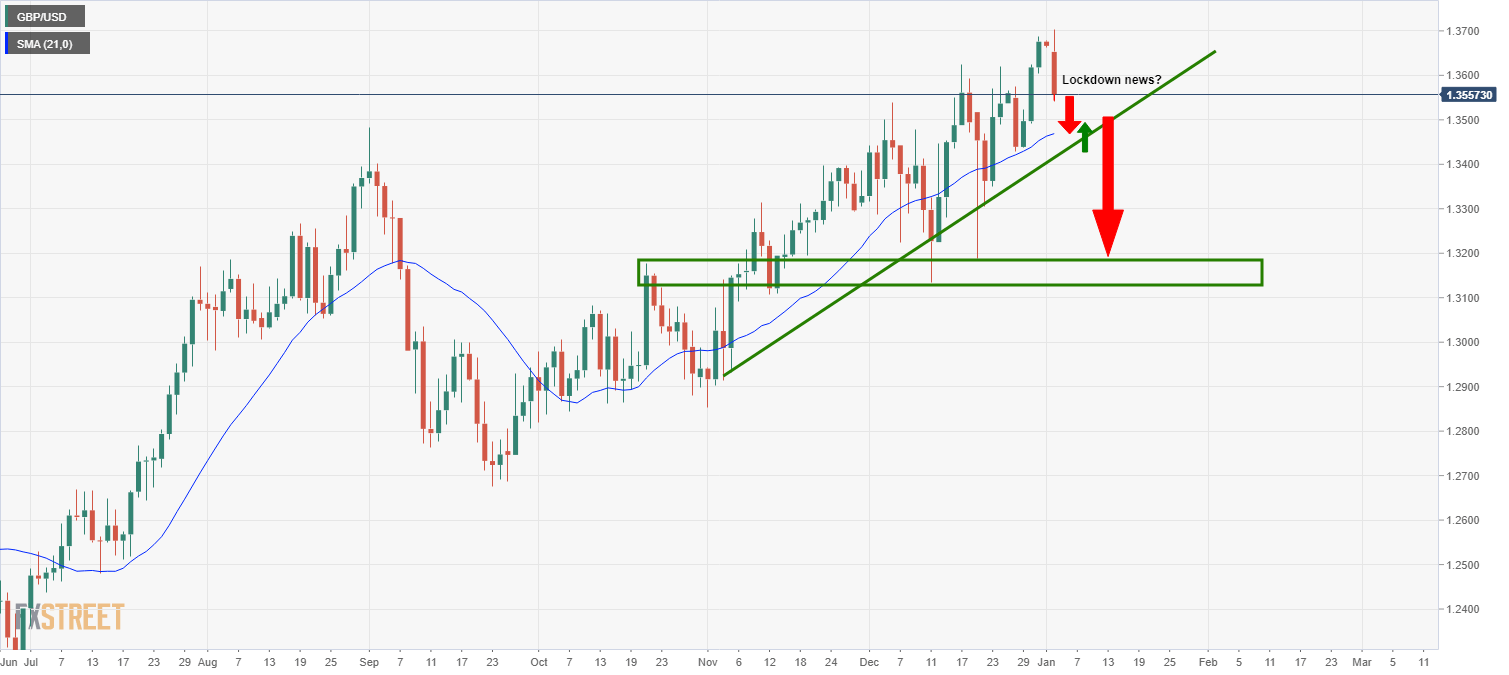

The worst in this data is perhaps not even appeared yet, which is why a national lockdown was expected taking the pound down over 1% on the day.

It can take infected patients several weeks to fall severely ill and succumb to the illness so fatalities are yet to reach their peak and will likely continue to rise at a later stage.

The nation is already printing death tolls not seen since the darkest days of the spring.

Darker days could be ahead for the pound.

A break of the 10-day moving average could be the bull's last dance for a while:

For more on the UK economy and the future of the pound, see here: Post-Brexit and the UK economy: How will the pound fare in a covid vaccine world?

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD treads water just above 1.0400 post-US data

Another sign of the good health of the US economy came in response to firm flash US Manufacturing and Services PMIs, which in turn reinforced further the already strong performance of the US Dollar, relegating EUR/USD to the 1.0400 neighbourhood on Friday.

GBP/USD remains depressed near 1.2520 on stronger Dollar

Poor results from the UK docket kept the British pound on the back foot on Thursday, hovering around the low-1.2500s in a context of generalized weakness in the risk-linked galaxy vs. another outstanding day in the Greenback.

Gold keeps the bid bias unchanged near $2,700

Persistent safe haven demand continues to prop up the march north in Gold prices so far on Friday, hitting new two-week tops past the key $2,700 mark per troy ounce despite extra strength in the Greenback and mixed US yields.

Geopolitics back on the radar

Rising tensions between Russia and Ukraine caused renewed unease in the markets this week. Putin signed an amendment to Russian nuclear doctrine, which allows Russia to use nuclear weapons for retaliating against strikes carried out with conventional weapons.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.