Breaking: USD/JPY bulls smash through 143.50

Traders keep lifting the offer in USD/JPY which is now taking on the laws of gravity and denying hungry bears a free lunch. Instead, the price has skyrocketed through 143.50 to score a fresh bull cycle high of 143.59 ahead of the Tokyo open.

The move was highlighted as a prospective opportunity in analysis from the New York session as follows:

The Japanese Finance Minister Shunichi Suzuki attempted to jaw-boned the currency yesterday but that did nothing to prevent it from falling to a 24-year low on Tuesday. Even at such lofty heights, this might have fuelled the bull's appetite even more so given that the Japanese authorities will eventually need to step in and control the weakness of the currency. When pressed to comment on the impact of a weak yen on the economy, Suzuki said "a weak yen has both merit and demerit, but sharp moves are undesirable." The yen has slumped nearly 26% now since the start of the year, on diverging monetary policies between Japan and the United States.

Suzuki reiterated that sharp yen moves were "undesirable" and that he was watching rising volatility in the exchange market with a "great sense of urgency". "It's important for currencies to move stably, reflecting economic fundamentals," Suzuki told reporters at the finance ministry.

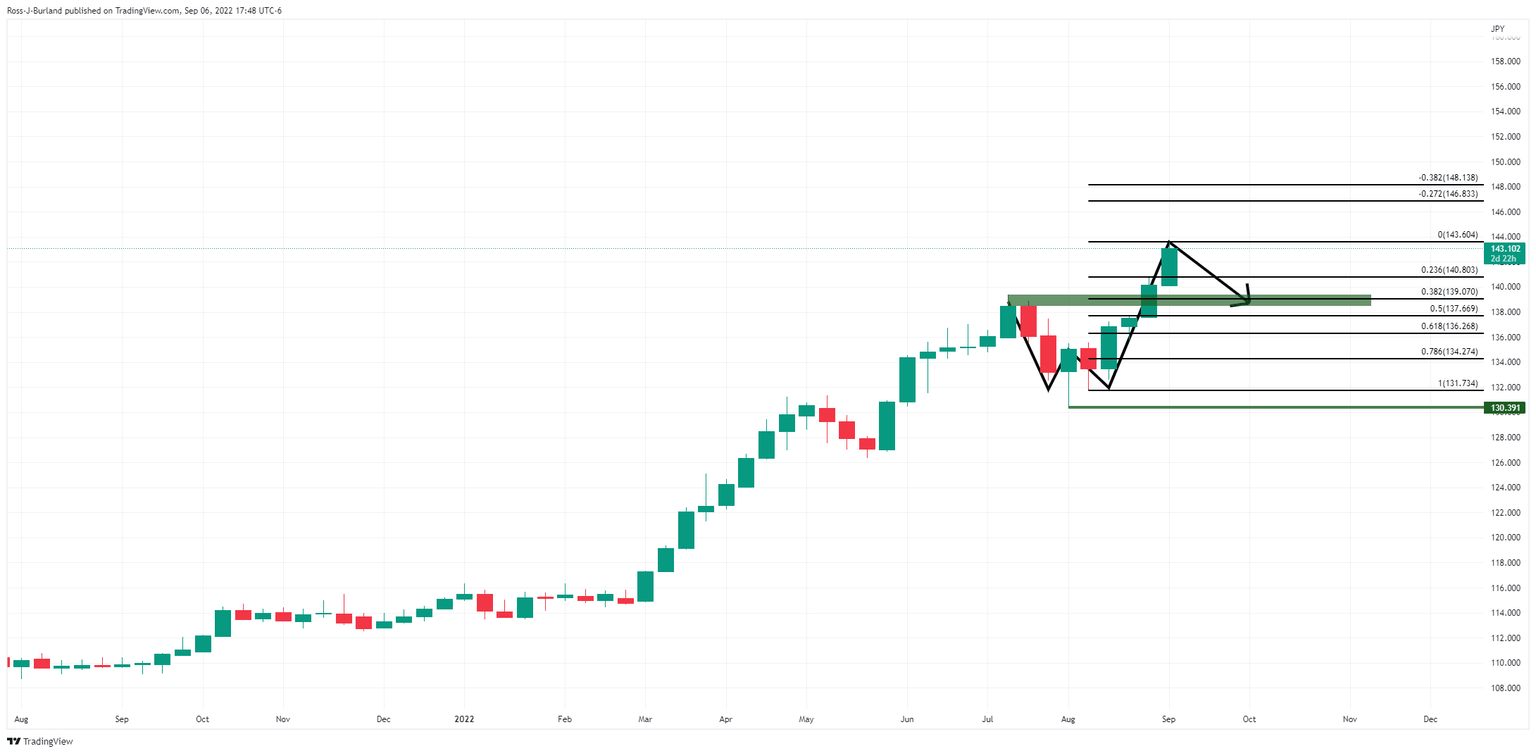

USD/JPY weekly chart

The weekly chart shows the price in a harmonic pattern which could see a move into the prior resistance in due course. As it stands, we have a 38.2% Fibonacci confluence with the prior swing highs near 139 the figure.

Author

FXStreet Team

FXStreet