Breaking: USD/JPY bears firm on a strong hint that BoJ will drop 0.5% cap in 10Y JGB yields

USD/JPY bears jumped in on a Nikkei news article ahead of the Bank of Japan's meeting on Friday that took USD/JPY down from 141.10 to a low of 139.20 in a flash. The Nikkei reported, '' The Bank of Japan will discuss tweaking its yield curve control policy at a policy board meeting Friday to let long-term interest rates rise beyond its cap of 0.5% by a certain degree, Nikkei has learned, in what would be a shift toward a more flexible policy approach.''

This has flipped sentiment around that had otherwise been expecting a non-event in Friday's meeting considering it was only recently that the BOJ Governor Ueda said there was "still some distance to sustainably achieve 2% inflation target" and that unless their assumptions on the need to sustainably achieve 2% target change the BoJ's "narrative on monetary policy won't change."

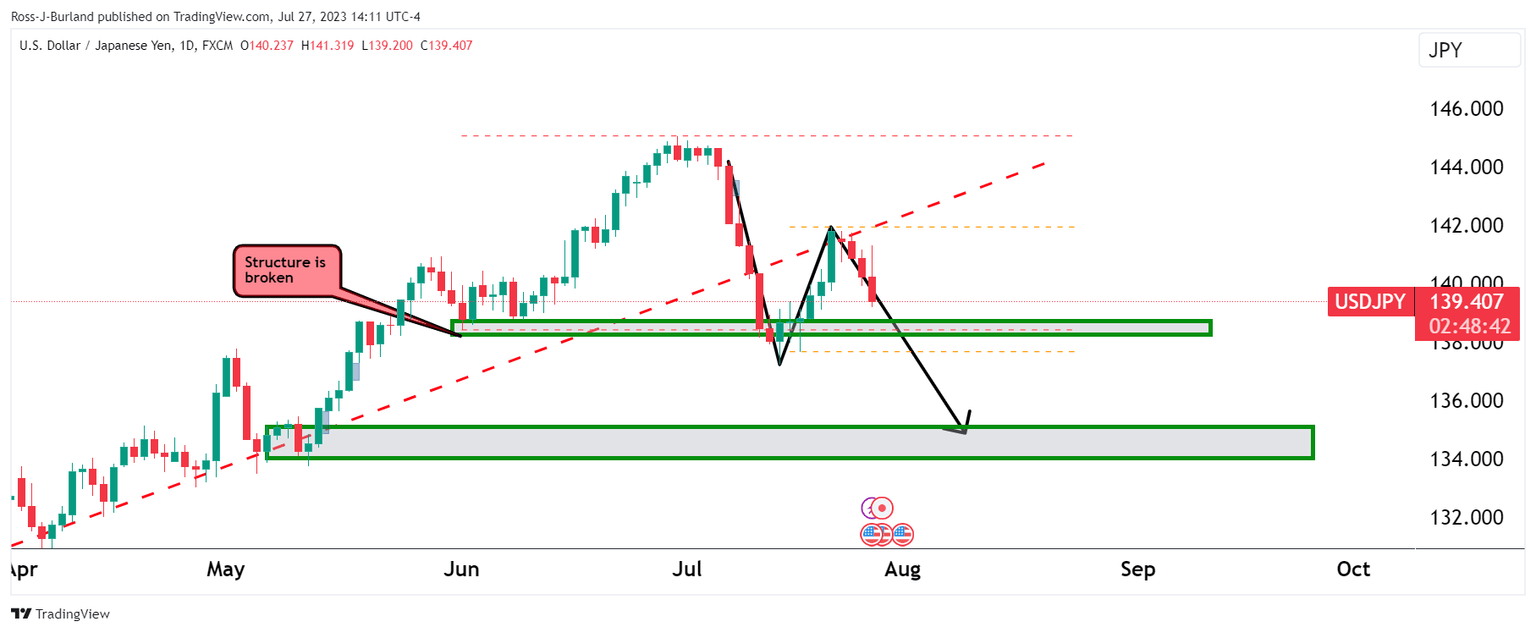

The shift in sentiment is playing into a downtrend in USD/JPY on the charts as follows:

USD/JPY daily chart

With the price being on the backside of the bullish trendline, already breaking below the structure in mid-July, the test of the counter-trendline resistance has led to a sell-off. This down-trend cycle could well continue, especially if the BoJ does indeed communicate a change in the narrative on monetary policy. 134.00 is eyed as a potential support area.

Author

FXStreet Team

FXStreet