- A senior US military source says US forces in Iraq are under "missile attack from Iran".

- Gold rallies to fresh highs of $1,591.93 and USD/JPY spikes to the downside to a low of 107.99.

- WTI rallies to a fresh high of $64.43, $66.58 on the radar ahead of $76.88.

This is a developing story.

So far, we know that some 13 missies have been reported launched at the Ain Assad Air Base. White House says they are aware of the attack – US President Trump has been briefed and is monitoring the situation.

Updates (since first publishing of the main headline):

The markets are somewhat relieved as a US official tells CNN there are no reports of US casualties at this time but an assessment is still underway).

- Trump may make a statement tonight.

- US Defense Secretary Esper and U.S. Secretary of State Pompeo have arrived at the White House.

- Chairman of the Joint Chiefs of Staff, Mark Milley, also.

- Iran's guards warn US any aggression against Tehran will get a crashing response - Statement/State TV.

- Iran's guards advise US to withdraw its troops from the region to prevent the killing of more soldiers - Statement/State tv

- Iranian and US fighter jets have taken off – Social media rumours

- Iran says another US retaliation will result in an Iranian attack on Israel.

Footage of missiles launched at US airbase

The Ayn al Asad is an Iraqi Armed Forces and United States armed forces base located in Al Anbar Governorate of western Iraq. The base is also used by UK forces in Iraq. It was the second-largest US military airbase in Iraq during Operation Iraqi Freedom.

Initial key notes

-

Soldiers of IRGC's aerospace unit have launched a successful attack on Al Assad military base – IRGC

-

US Official: No news of damage form the rocket attacks – Reuters

-

Six rockets landed at Iraq's Ain Al-Asad air base that contains US forces - Al Madeen TV

-

Missiles being launched towards Al Asad Airbase in Iraq - Fox News

How will the Pentagon respond?

There are reports in the middle east (unconfirmed as of now) saying at least one US military jet is on fire at Ain Al-Asad base in western Iraq following a barrage of Iran rockets targeting the US base.

Depends on whether there were US casualties.

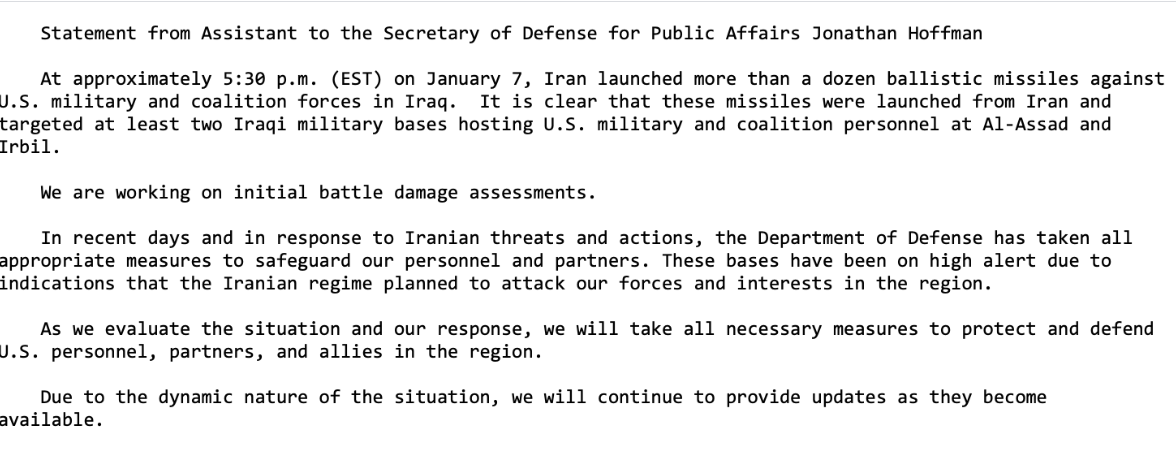

It is unclear how the US will now respond, but the Pentagon has acknowledged and will take appropriate action:

Market reactions, so far

- USD/JPY declines 40 pips to 108 as Iran takes revenge of Soleimani's killing by the US

-

WTI price jumps to 8.5-month high on Iranian retaliation

-

Gold refreshes multi-year top to cross $1600 amid calls of Iran attacks

-

Japan's Nikkei share average falls more than 2 pct after US says Iran launched missiles - Reuters

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD holds gains near 0.6250 but upside appears limited

AUD/USD remains on the front-foot near 0.6250 following the previous day's good two-way price swings amid confusion over Trump's tariff plans. The Aussie, meanwhile, remain close to over a two-year low touched last week in the wake of the RBA's dovish shift, China's economic woes and US-China trade war fears.

USD/JPY: Bulls retain control above 158.00, Japanese intervention risks loom

USD/JPY is off multi-month top but stays firm above 158.00 in the Asian session on Tuesday. Doubts over the timing when the BoJ will hike rates again and a broad-based US Dollar rebound, following Monday's Trump tariffs speculation-led sell-off, keep the pair supported ahead of US jobs data.

Gold traders appear non-committal ahead of US jobs data

Gold price is battling the short-term critical barrier at around $2,635 early Tuesday, consolidating the two-day corrective decline from three-week highs of $2,665. Gold traders refrain from placing fresh directional bets ahead of the top-tier US ISM Services PMI and JOLTS Job Openings data.

Solana Price Forecast: Open Interest reaches an all-time high of $6.48 billion

Solana price trades slightly down on Tuesday after rallying more than 12% the previous week. On-chain data hints for rallying continuation as SOL’s open interest reaches a new all-time high of $6.48 billion on Tuesday.

Five fundamentals for the week: Nonfarm Payrolls to keep traders on edge in first full week of 2025 Premium

Did the US economy enjoy a strong finish to 2024? That is the question in the first full week of trading in 2025. The all-important NFP stand out, but a look at the Federal Reserve and the Chinese economy is also of interest.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.