Breaking: RBNZ leaves official cash rate unchanged at 0.25% as expected

The Reserve Bank of New Zealand's Monetary Policy Statement is out.

There are no forecasts published, so there’s no need for the RBNZ to be prescriptive about precisely when they expect to kick off hikes, but the key notes are as follows:

RBNZ leaves the official cash rate unchanged at 0.25% as expected ...

Additional notes

- MPC agreed to reduce current stimulatory level of monetary settings.

- Will halt additional asset purchases under the large scale asset purchase (LSAP) programme by 23 July 2021.

Press release

The Monetary Policy Committee agreed to reduce the current stimulatory level of monetary settings in order to meet its consumer price and employment objectives over the medium-term.

The Reserve Bank will halt additional asset purchases under the Large Scale Asset Purchase (LSAP) programme by 23 July 2021. The Committee will keep the Official Cash Rate (OCR) at 0.25 percent and the Funding for Lending Programme unchanged.

NZD/USD reaction

As per the prevent analysis, NZD/USD Price Analysis: Bears look for a downside daily extension below 0.6920, the focus was on the downside from a technical standpoint on the daily chart:

However, the immediate reaction is a bid ...

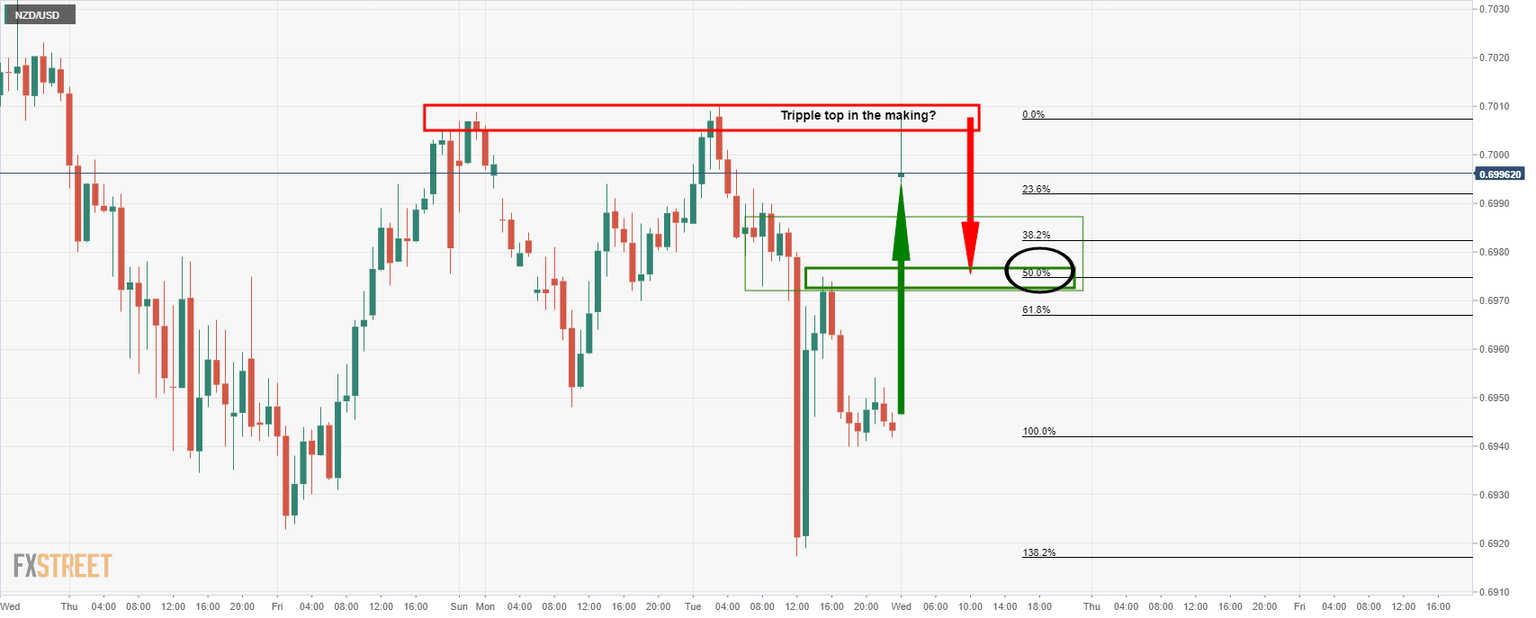

Hourly chart

This leaves an over extended W-formation on the chart and prospects of a triple top:

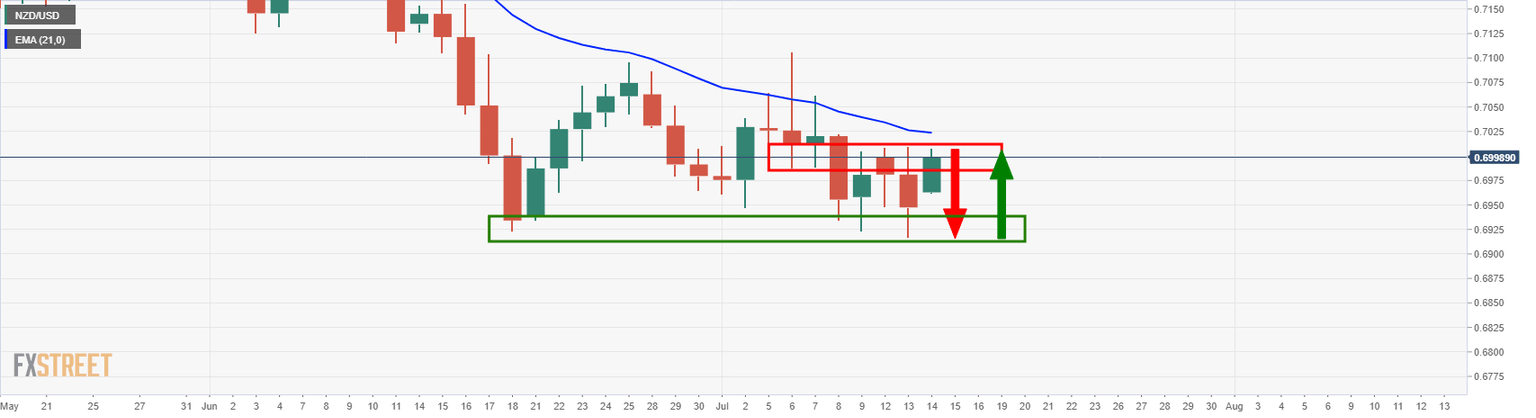

This is making for the potential of a trapped market scenario on the daily chart as follows:

For the rest of the week, Consumer Price Index data will now be the next event which is out on Friday, and then the key Q2 labour market data due in three weeks.

Author

FXStreet Team

FXStreet