Breaking: RBNZ keeps QE, OCR unchanged

The Reserve Bank of New Zealand and MPS was not expected to announce any further changes today and instead acknowledge that there is now less need for monetary stimulus than it thought at its November review.

RBNZ key takeaways

OCR Unchanged.

The RBNZ kept the large scale asset purchase program at NZ$100b, maintaining the current stimulus level as the economic outlook remains highly uncertain.

RBNZ says prolonged monetary stimulus necessary.

Says large scale asset purchase programme maintains at nz$100 bln.

Says funding for lending programme unchanged.

Says economic outlook ahead remains highly uncertain.

Says inflation and employment will remain below remit targets over the medium term.

Says operational work to enable the OCR to be taken negatively if required is now completed.

Prepared to lower OCR if required.

How did the NZD react?

The kiwi has been bid in the build-up to the event given that the Gross Dometic Product, inflation, employment, commodity and houses prices have all been a lot former than forecast last time around by the central bank.

On the event, the NZD/USD dropped to test hourly support to then rally.

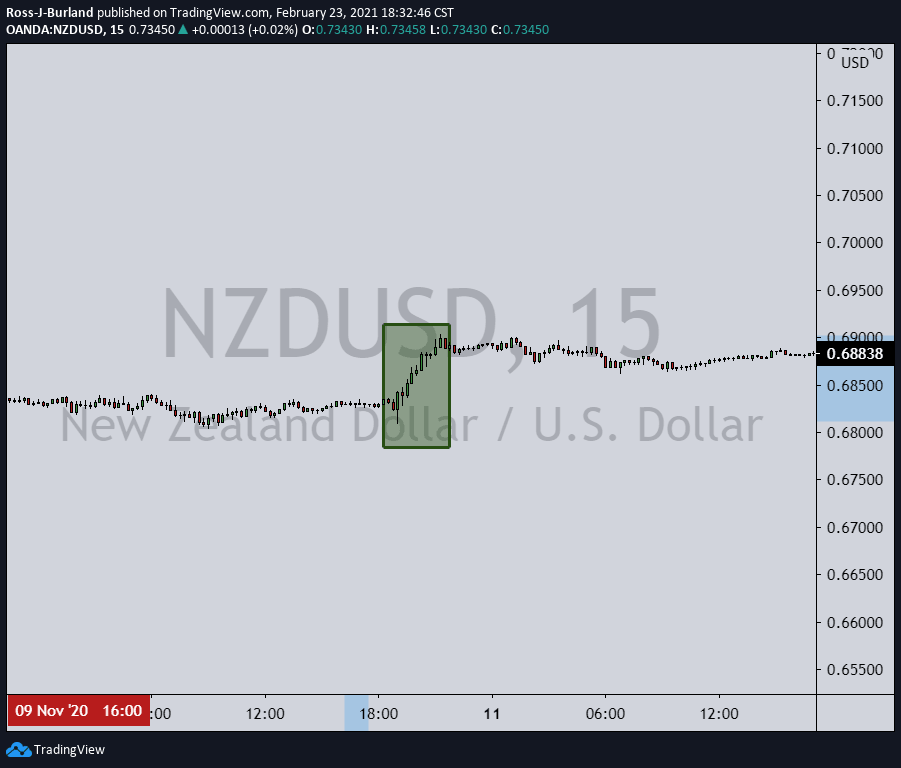

At the prior meeting back in November, the price rallied over 90 pips after an initial drop in the first hour of trade post the announcements:

With that being said, the upside is also limited considering that RBNZ has noted that the accommodation shall remain in place for some time.

In the prior analysis, NZD/USD Price Analysis: Bulls reload ahead of RBNZ, it was stated that the event would be a volatile one and reduced risk is a common practice around the event.

As expected, the price dropped initially and then rallied to the target on a second attempt:

Live market

A positive risk to reward ratio enables the trader to be profitable over multiple trades, in this case, consisting of one loss and one win and a ratio of 1:2.

About the RBNZ interest rate decision and rate statement

The RBNZ interest rate decision is announced by the Reserve Bank of New Zealand. If the RBNZ is hawkish about the inflationary outlook of the economy and raises the interest rates it is positive, or bullish, for the NZD.

The RBNZ rate statement contains the explanations of their decision on interest rates and commentary about the economic conditions that influenced their decision.

Author

FXStreet Team

FXStreet