Breaking: Non-Farm Payrolls smashes expectations with 266K, USD rises

The US economy gained 266,000 positions in November, far above expectations of 180,000.

The return of GM strikers to workers added fewer jobs than expected and revisions added 41K. Wage growth rose by only 0.2% monthly but surprised with 3.1% yearly. The unemployment rate dropped to 3.5% but it came on top of a drop in the participation rate.

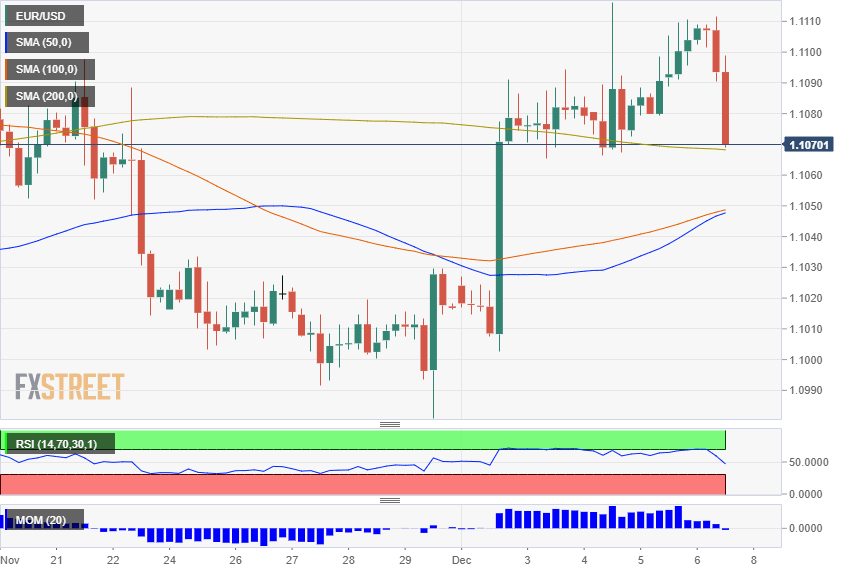

The US dollar is rising across the board with EUR/USD falling to 1.1074. GBP/USD is down to 1.3121, and USD/JPY is above 108.80.

Follow all the Non-Farm Payrolls updates live

Here is how the move looks on the EUR/USD chart:

Non-Farm Payrolls figures

- Non-Farm Payrolls: 266K, expected 180K, previous 128K

- Average Hourly Earnings (YoY): 3.1%, expected 3%, previous 3%

- Average Hourly Earnings (MoM): 0.2%, expected 0.3%, previous 0.2%

- Revisions: +41,000, previous 95,000

- Unemployment Rate: 3.5%, expected 3.6%, previous 3.6%

- Participation Rate: 63.2%, expected 63.3%, previous 63.3%

- U-6 Underemployment Rate: 6.9%, previous 7%

- Average Workweek: 34.4, expected 34.4%, previous 34.4

November Non-Farm Payrolls background

ADP's Employment Change report for the private sector badly disappointed with an increase of 67,000. On the other hand, the employment component of the ISM Non-Manufacturing PMI indicated elevated hiring.

The NFP feeds into the last Federal Reserve decision of the year, due on December 11. The Fed is set to leave rates unchanged but may provide hints toward the next moves.

See Fed Preview: Is the bar higher for hiking? Powell's may down the dollar, three things to watch

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.