The Federal Open Market Committee minutes have been released which are so far sending the US dollar DXY index a touch softer. The softness in the greenback come as there were no discussions on larger rate hikes.

At the May 3-4 meeting, the Fed hiked rates from the expected 50 bp to 1.0% and laid out plans for aggressive Quantitative Tightening to begin in June.

FOMC Minutes

- All participants at the Federal Reserves May policy meeting agreed a half-percentage-point interest rate hike was appropriate; 'most' Judged such hikes appropriate at the next couple of meetings, minutes from May 3-4 meeting show.

- All Fed participants agreed the US economy was 'very strong,' labour market was 'extremely tight' and inflation was 'very high,' minutes show.

- Participants agreed fed should 'expeditiously' move monetary policy toward a more neutral stance, and that a 'restrictive' stance on the policy may well become appropriate, minutes show.

- Fed participants saw the Ukraine conflict, china's covid lockdowns posing 'heightened risks,' with particular challenges to restoring price Stability while maintaining a strong job market, minutes show.

- Many participants judged faster removal of policy accommodation would leave the fed 'well-positioned' to assess later this year What further adjustments were needed, minutes show.

- Fed participants emphasized that they were 'highly attentive' to inflation risks and agreed those risks were skewed to the upside, minutes show.

- All participants supported plans to reduce the size of the Fed's balance sheet; 'a number' said after the runoff was well underway, it would be appropriate to consider sales of mortgage-backed securities, and minutes show.

- Participants said Q1 2022 GDP decline contained 'little signal about subsequent growth,' and they expected real GDP would grow 'solidly' in Q2 and be near or above trend for the whole year.

Meanwhile, analysts at Brown Brothers Harriman said, ''our base case remains for another 50 bp hike in September that takes the Fed Funds ceiling up to 2.5%, which many consider close to neutral. However, it’s worth noting that odds of a 50 bp move in September have fallen to less than 50% now from fully priced in at the start of May.''

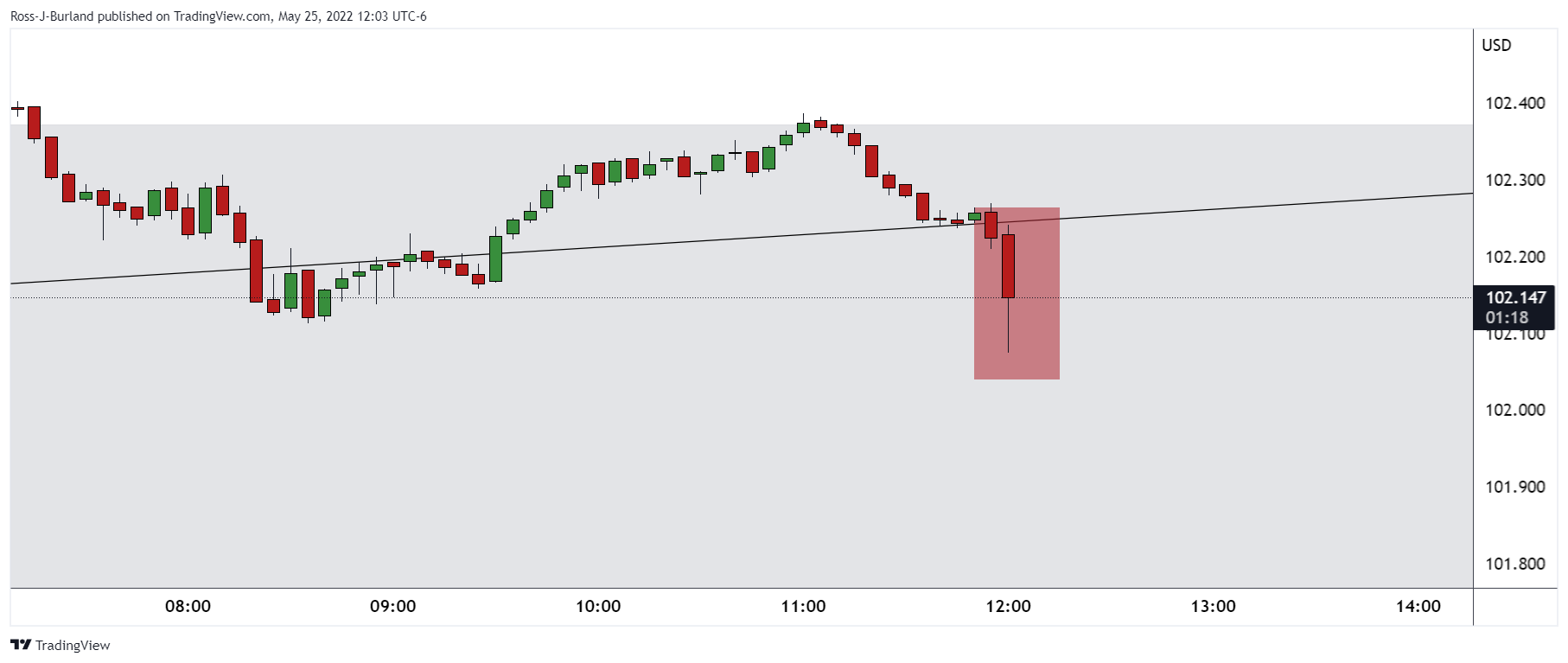

DXY reaction so far...

This was the knee jerk reaction that propelled the euro higher from support as follows, in accordance with the pre-event analysis:

EUR/USD technical analysis

For the minutes and sessions ahead, the pair could be based here and result in a higher correction from support:

The softness in the greenback come as there were no discussions on larger rate hikes.

About the FOMC minutes

FOMC stands for The Federal Open Market Committee organizes 8 meetings in a year and reviews economic and financial conditions, determines the appropriate stance of monetary policy and assesses the risks to its long-run goals of price stability and sustainable economic growth. FOMC Minutes are released by the Board of Governors of the Federal Reserve and are a clear guide to the future US interest rate policy.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD struggles to hold above 1.0400 as mood sours

EUR/USD stays on the back foot and trades near 1.0400 following the earlier recovery attempt. In the absence of high-tier data releases, the cautious risk mood helps the US Dollar hold its ground and forces the pair to stretch lower.

GBP/USD declines below 1.2550 on renewed USD strength

GBP/USD loses its traction and trades below 1.2550 in the second half of the day on Monday. The US Dollar (USD) benefits from safe-haven flows and weighs on the pair as trading conditions remain thin heading into the Christmas holiday.

Gold drops to $2,620 area as US bond yields edge higher

Gold struggles to build on Friday's gains and trades modestly lower on the day near $2,620. The benchmark 10-year US Treasury bond yield edges slightly higher above 4.5%, making it difficult for XAU/USD to gather bullish momentum.

Bitcoin fails to recover as Metaplanet buys the dip

Bitcoin hovers around $95,000 on Monday after losing the progress made during Friday’s relief rally. The largest cryptocurrency hit a new all-time high at $108,353 on Tuesday but this was followed by a steep correction after the US Fed signaled fewer interest-rate cuts than previously anticipated for 2025.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.