Breaking: EUR/USD jumps above 1.08 as German Manufacturing PMI beats with 47.8

Markit's German Manufacturing PMI for February beat estimates with a score of 47.8 points, far above 44.8 expected and 45.3 recorded in January. The score remains below 50 – reflecting ongoing albeit slower contraction in the eurozone's largest economy's industrial sector. Nevertheless, the rise from the lows – despite growing fears of the coronavirus disease – is boosting the euro.

The services PMI dropped to 53.3 points, below 53.8 estimated by economists. These forward-looking surveys have been showing a significant gap between the sectors for a considerable time. Markit has noted that the outbreak is having a faily limited impact on the manufacturing sector.

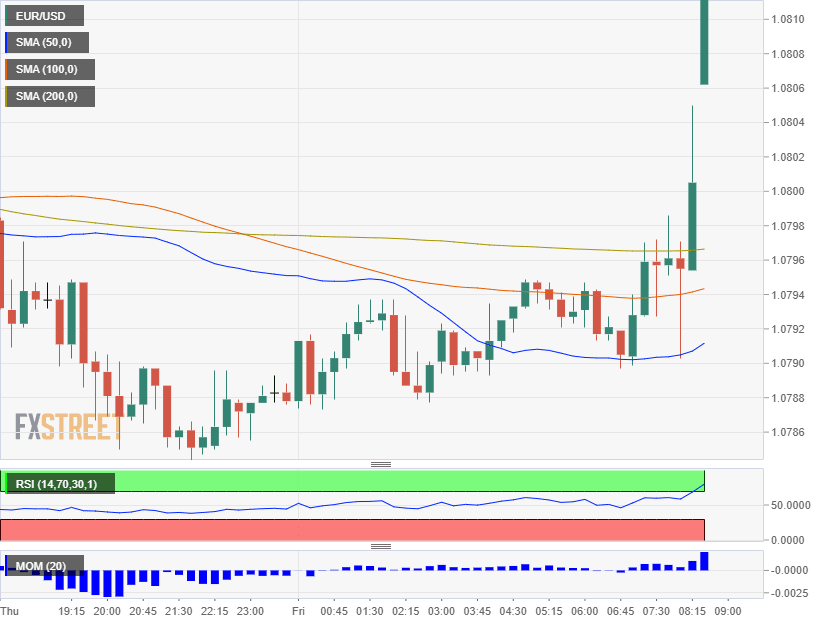

EUR/USD has jumped to 1.0818, advancing from a daily low of 1.0783.

-- more to come

Markit's preliminary Manufacturing Purchasing Managers' for February was expected to drop from 45.3 to 44.8 points – below the 50-point threshold separating expansion and contraction. The Services PMI was projected to slide from 54.2 to 53.8 points.

Earlier, the French Manufacturing PMI dropped to 49.7, worse than 50.7 expected. The Services PMI in the euro area's largest economy jumped to 52.6 against 51.3 expected.

EUR/USD has been consolidating its losses around 1.08 ahead of the publication. The US dollar has been storming the board amid coronavirus fears, upbeat American economic performance, and the Federal Reserve's reluctance to cut rates.

Figures for the whole eurozone are due out next.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.