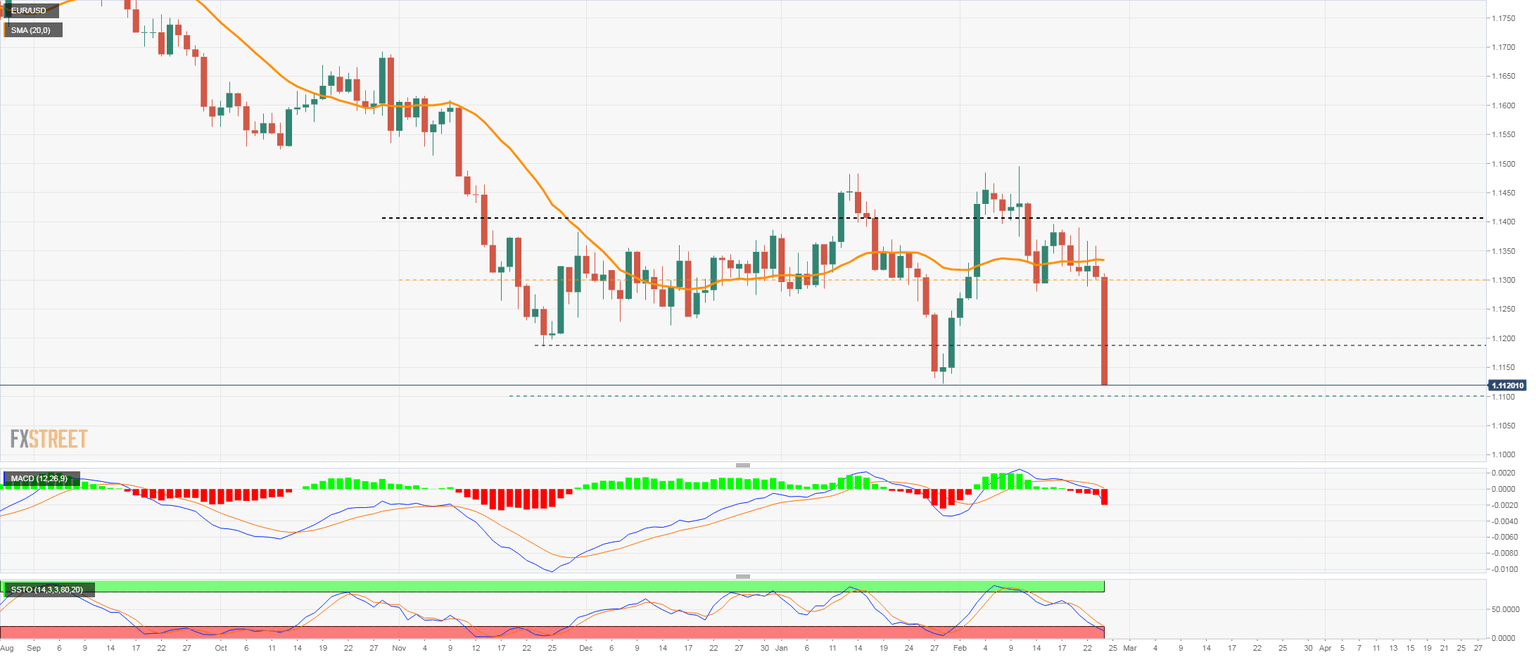

Breaking: EUR/USD breaks under 1.1120 to lowest since May 2020

- US dollar extends gains across the board amid risk aversion.

- Russian invasion into Ukraine shocked financial markets.

- EUR/USD trades at the lowest since May 2020.

The EUR/USD fell under 1.1120 hitting the lowest level since May 2020. The pair remains under pressure after the Russian military invaded Ukraine. The panic mode across financial markets is boosting the US dollar.

How is the Russian-Ukraine war impacting financial markets? Follow our live coverage updates!

So far on Thursday, EUR/USD lost more than 175 pips, the worst daily decline in months. The DXY is up by 1.41% above 97.50 at the strongest since July 2020.

Stocks in Wall Street are falling sharply but off lows. The Dow Jones is down by 2.05% and the Nasdaq by 1.05%.

During the last hours, the US dollar also gained momentum supported by a rebound in US yields highs. The US 10-year printed a fresh high at 1.93% and the 30-year climbed to 2.24%.

Author

FXStreet Team

FXStreet