Breaking: EUR/USD breaks fresh 2022 lows, 1.1020

EUR/USD drops to print a fresh low of 1.1020 on the news that the Zaporizhzhia Nuclear Power Plant, a few kilometres from Enerhodar, has been attacked.

The Plant spokesman says Russian troops have begun shelling Europe's largest nuclear power station in Ukraine.

Russian forces were battling for control of a crucial energy-producing city in Ukraine’s south and closing in on the country’s largest nuclear power plant.

Russian tanks and infantry on Thursday entered Enerhodar, a city on the Dnieper River that accounts for about one-quarter of Ukraine’s power generation.

The river Dneiper runs right through the centre of Zaporizhzhia and the region is one of the most agriculturally productive in the world.

The concerns are that a large scale nuclear accident here wouldn't just be a disaster for Ukraine, it would be for the world.

“We demand that they stop the heavy weapons fire,” said Andriy Tuz, a spokesperson for the power plant in Enerhodar, which Russians have begun shelling. “There is a real threat of nuclear danger in the biggest atomic energy station in Europe.”

Ukraine's foreign minister Kuleba says Russians must immediately cease the fire, allow firefighters, establish a security zone.

''If it blows up, it will be 10 times larger than Chornobyl'' - RTRS

Russian army is firing from all sides upon Zaporizhzhia NPP, the largest nuclear power plant in Europe. Fire has already broke out. If it blows up, it will be 10 times larger than Chornobyl! Russians must IMMEDIATELY cease the fire, allow firefighters, establish a security zone!

— Dmytro Kuleba (@DmytroKuleba) March 4, 2022

EUR/USD H1 chart

The price is dropping into fresh 2022 lows and 1.1020 has acted as a support, so far. However, a break there will likely open risk for a significant downside continuation to mitigate the weekly imbalance of the early 2020 summer rally. 1.0780s eyed, as follows:

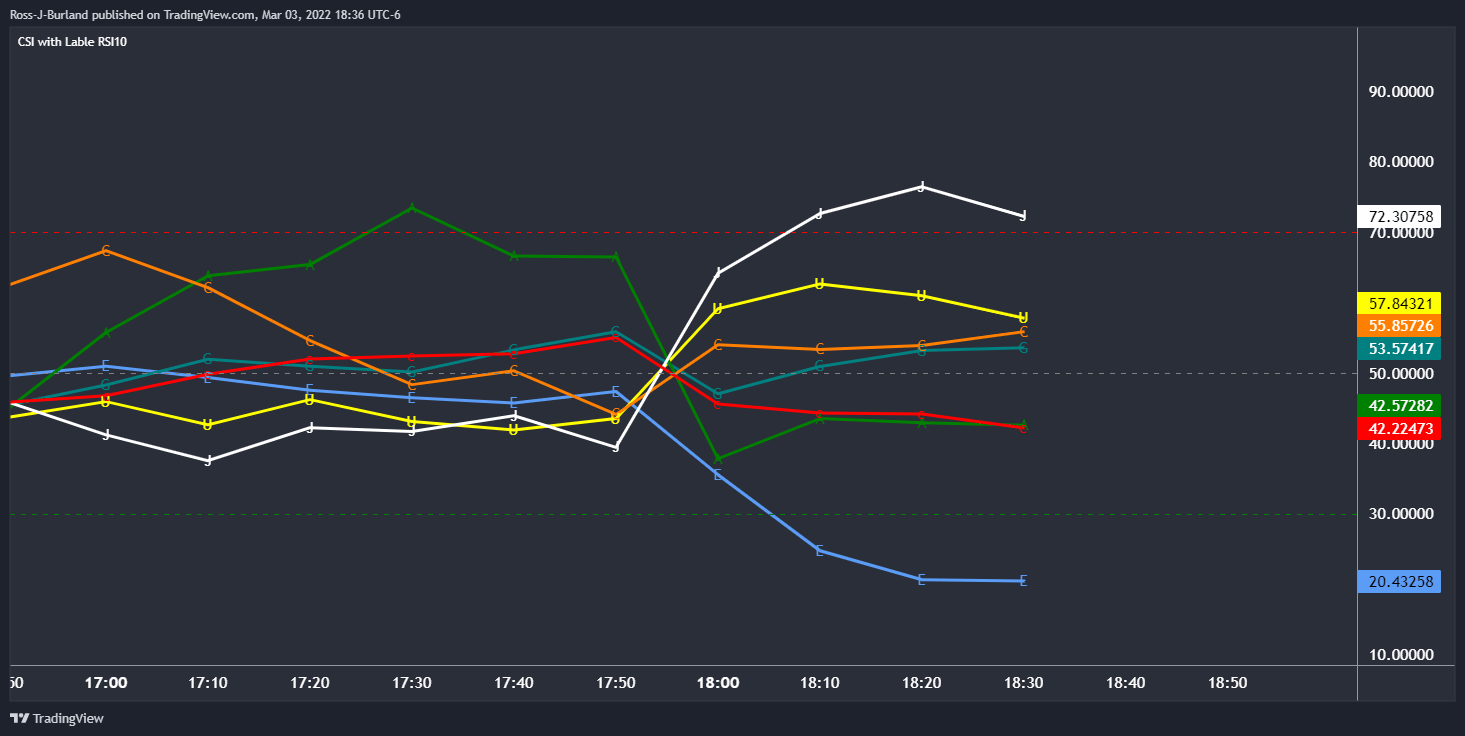

Meanwhile, the yen and US dollar are picking up the safe-haven bid as seen on the 10-min CSI:

Author

FXStreet Team

FXStreet