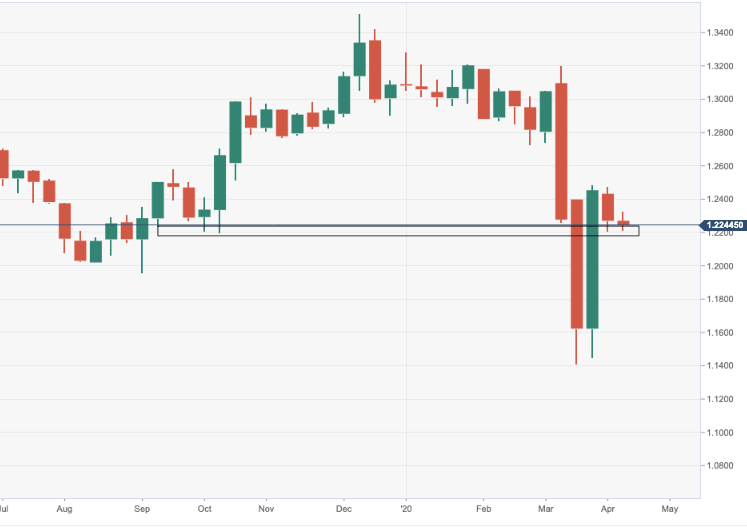

UK PM Boris Johnson has been taken to intensive care and the pound is under pressure. GBP/USD dropped from 1.2305-1.2241.

Johnson was admitted into St. Thomas' Hospital in London on Sunday following 10-days of fever during his spell of self-isolation. However, the headlines were that his admission had just been precautionary. Evidently, there are complications as the condition in the UK PM has worsened.

A No 10 spokesman said

'Since Sunday evening, the Prime Minister has been under the care of doctors at St Thomas' Hospital, in London, after being admitted with persistent symptoms of coronavirus.

'Over the course of this afternoon, the condition of the Prime Minister has worsened and, on the advice of his medical team, he has been moved to the Intensive Care Unit at the hospital.'

The PM has asked Foreign Secretary Dominic Raab, who is the First Secretary of State, to deputise for him where necessary. The PM is receiving excellent care, and thanks to all NHS staff for their hard work and dedication.'

This is a developing story and there are now headlines, sometime after the original posting of this news, that although Johnson is in intensive care, he is not on a ventilator. The news was reported by CNN.

In updates, it is reported that the PM was experiencing breathing difficulties and was given oxygen.

Volatility in GBP crosses

The pound dropped heavily on the knee-jerk as UK politics once again takes centre stage. "The PM has asked Foreign Secretary Dominic Raab, who is the First Secretary of State, to deputize for him where necessary," according to the government's statement.

GBP/USD has dropped 90 pips to a low of 1.2305 following the news but has since moved back to trade in the mid-1.2230s as markets digest the headlines an await further updates as to the PM's condition. After all, it would likely take something more convincing to break the weekly support structure.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Ethena Labs launches new UStb stablecoin backed by BlackRock's BUIDL token

Ethena Labs announced on Thursday that it has released a new stablecoin product, UStb. The new stablecoin will be fully collateralized by BlackRock's USD Institutional Digital Liquidity Fund and function similarly to a traditional stablecoin.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.