Breaking: Aussie data dump crashes AUD/USD

Australia's data dump, including Gross Domestic Product and the monthly Consumer Price Index have been released and have crushed AUD/USD by around 20 pips on the miss of expectations.

- Australia Weighted CPI YoY Jan: 7.4% (est 8.0%, prev 8.4%).

- Australia GDP SA QoQ Q4: 0.5% (est 0.8%, prev 0.6%) - Australia GDP YoY Q4: 2.7% (est 2.7%, prev 5.9%).

AUD/USD update

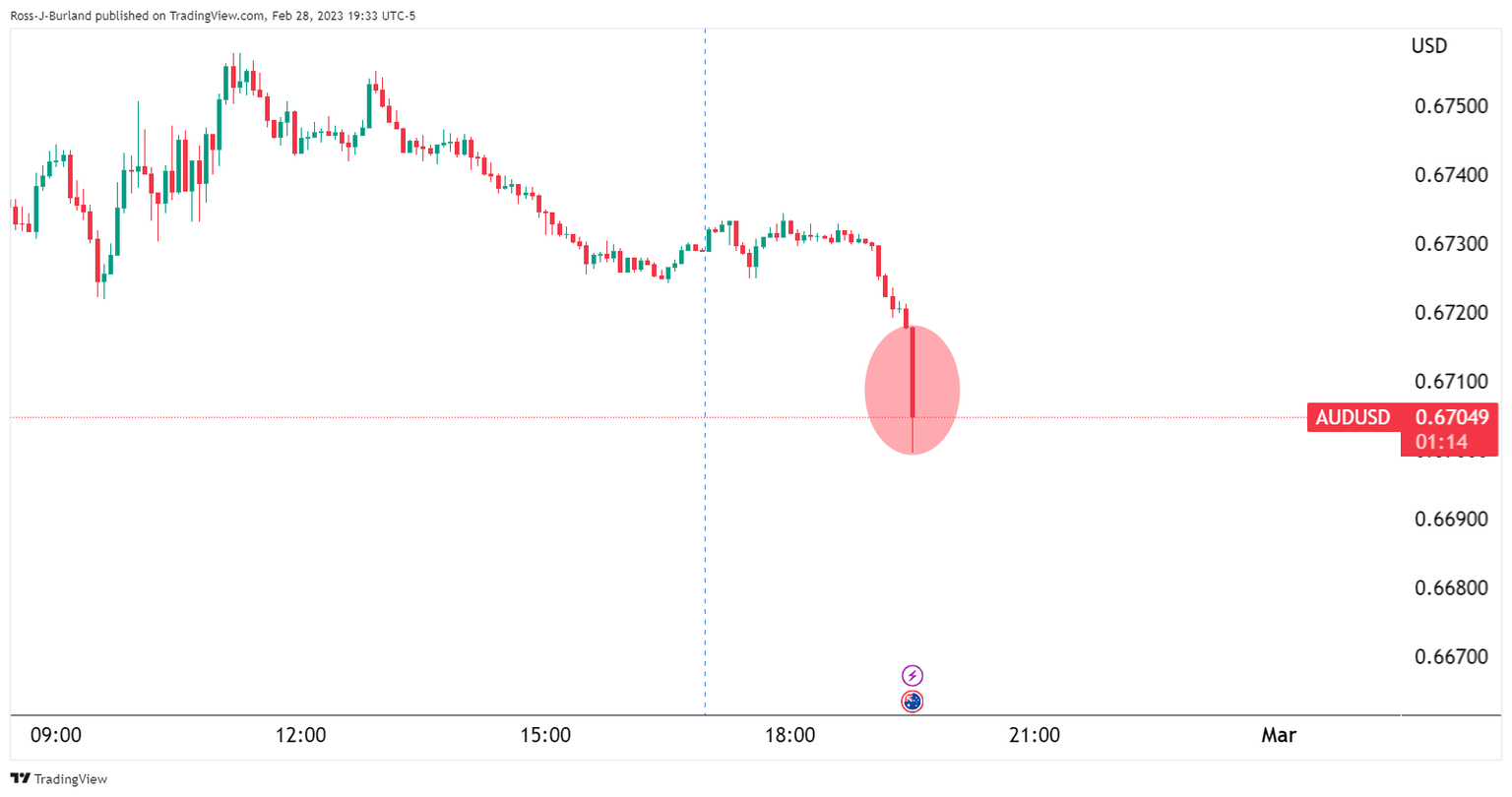

As a result, AUD/USD dropped as follows:

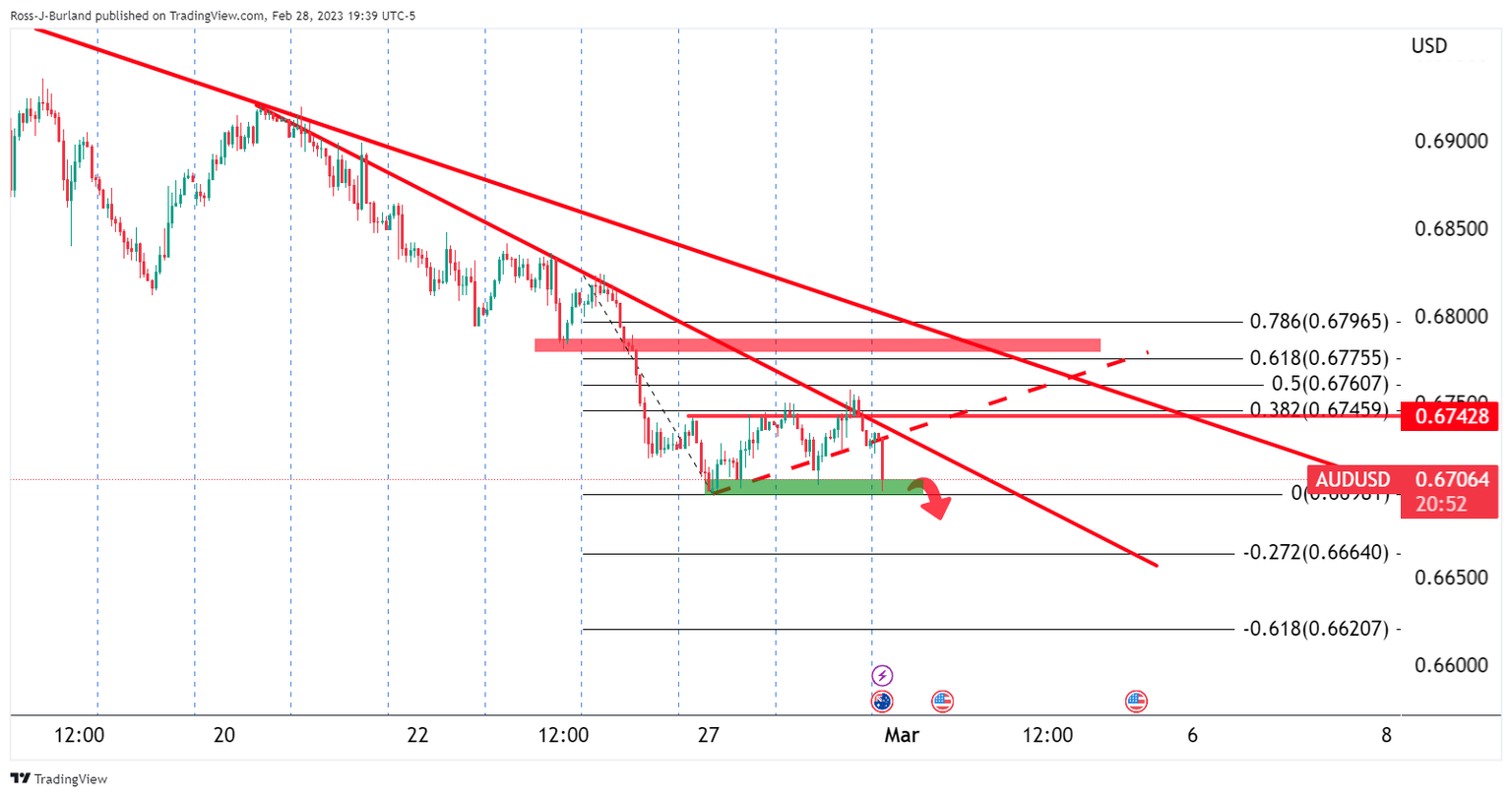

AUD/USD has now broken a trendline support, invalidating the thesis for a stronger correction in the meantime, resisted by the 50% mean reversion of the prior bearish impulse:

The data would be expected to continue to weigh on the Aussie as aggressive monetary tightening is likely cooling the economy and therefore cast a move dovish sentiment over the Reserve Bank of Australia.

About the Gross Domestic Product

The Gross Domestic Product released by the Australian Bureau of Statistics is a measure of the total value of all goods and services produced by Australia. The GDP is considered as a broad measure of the economic activity and health. A rising trend has a positive effect on the AUD, while a falling trend is seen as negative (or bearish) for the AUD.

About the monthly Consumer Price Index

The monthly Consumer Price Index (YoY), released by the RBA and republished by the Australian Bureau of Statistics, is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of AUD is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. A high reading is seen as positive (or bullish) for the AUD, while a low reading is seen as negative (or bearish). Note: This indicator started to be published in 2022 and it updates the price change for the last 12 months in Australia in a monthly basis, instead of the quarterly period of the main Australian CPI.

Author

FXStreet Team

FXStreet