- BP shares fall over 7% on Monday as Rosneft pressure mounts.

- UK government said to pressure BP into selling its stake.

- BP announces on Sunday that it will dispose of Rosneft stake.

BP stock is falling sharply this morning following its Sunday announcement that it would dump its stake in Russian energy giant Rosneft. BP stock closed at $30.73 in New York on Friday, and already the shares are trading some 7% lower at $28.57 in Monday's premarket session.

BP Stock News

BP is Europe's second-largest energy company. Bowing to pressure from the UK government among others, BP announced on Sunday that it would dump its stake in Russian oil and gas firm Rosneft. BP holds a near 20% stake in the Russian energy firm and it is highly profitable for BP. The Rosneft stake accounts for nearly 50% of BP's oil and gas reserves and accounts for over 30% of BP's total production. Current BP CEO Bob Looney and BP's former CEO, Bob Dudley, will both step down from the Rosneft board.

"Like so many, I have been deeply shocked and saddened by the situation unfolding in Ukraine, and my heart goes out to everyone affected," Looney said. "It has caused us to fundamentally rethink BP's position with Rosneft. I am convinced that the decisions we have taken as a board are not only the right thing to do but are also in the long-term interests of BP." Looney said.

BP went on to say it will result in two material changes to results for the first quarter in 2022. "As a result of the resignations of BP’s nominated directors, BP has determined that it no longer meets the criteria set out under International Financial Reporting Standards (IFRS) for having “significant influence” over Rosneft. BP will therefore no longer equity account for its interest in Rosneft, treating it now as a financial asset measured at fair value. This will result in two material changes to BP’s financial reporting and finances in the results for the first quarter of 2022."

BP now expects "a 7-9% EBITDA per share CAGR between 2H19/1H20 through 2025 at oil prices of $50-60 per barrel" and forecasts EBITDA from resilient hydrocarbons to come in about $2 billion lower by 2025.

BP Stock Forecast

This is likely to be dominated by oil and gas prices, both of which are underpinned by the conflict. Currently, oil prices are nearly double that $50-$60 expectation. However, this is a significant impact on BP sentiment and could see a retracement to $26 and a consolidation phase. Indeed volume-based support is high from $26 to $24.

BP chart, 20-hour

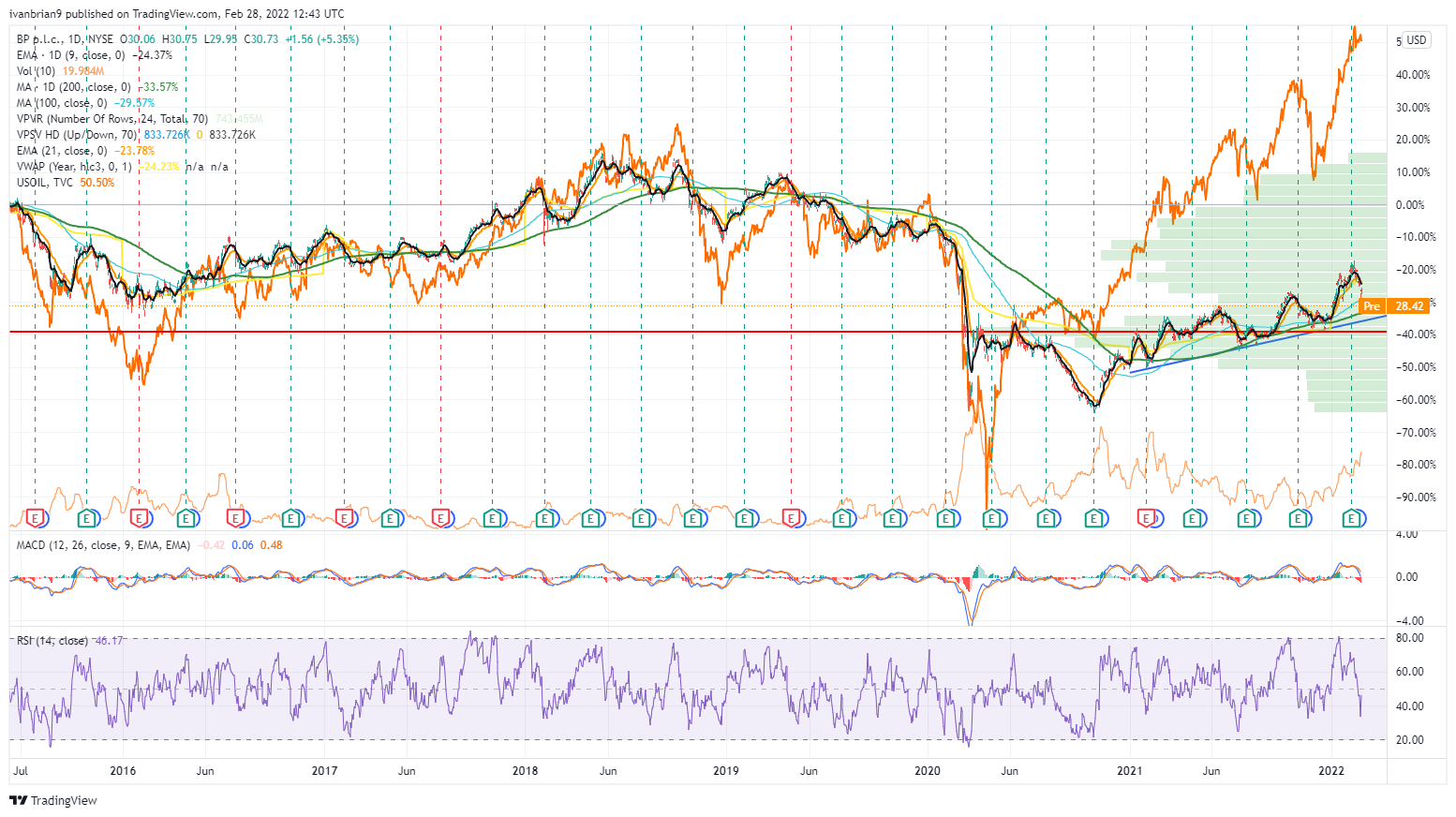

Taking a look at the broader trend, we see how BP stock has been trending lower for some time. We saw a strong spike lower in March 2020, the start of the pandemic when oil prices went negative for some futures contracts as no one wanted delivery and some speculators got caught long. Since then oil prices have recovered sharply, but the BP stock price has not followed suit. Recent results from the sector were strong, and XLE is the strongest performing sector in 2022.

BP chart, weekly

We see how the relationship between oil prices and BP's stock price has broken down recently. Given where oil prices are and are likely to remain, this should provide support to the BP stock price.

BP stock price versus WTI Oil 1-day chart. Oil is in orange.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold moves to record highs past $3,340 Premium

Gold now gathers extra steam and advances beyond the $3,340 mark per troy ounce on Wednesday, hitting all-time highs amid ongoing worries over escalating US-China trade tensions, a weaker US Dollar and lack of news from Powell's speech.

EUR/USD remains in a consolidative range below 1.1400

EUR/USD navigates the latter part of Wednesday’s session with marked gains, although another test of the 1.1400 level remained elusive. The strong bounce in spot came on the back of a marked move lower in the US Dollar, which remained apathetic following the neutral stance from Chair Powell.

GBP/USD alternates gains with losses in the low-1.3200s

Even as the dollar retreats, GBP/USD continues to linger in the 1.3220–1.3230 range, forfeiting much of its intraday rally from multi‑month highs near 1.3300. Softer UK inflation data on Wednesday seem to have capped Cable’s upside.

Bitcoin stabilizes around $83,000 as China opens trade talks with President Trump’s administration

Bitcoin price stabilizes around $83,500 on Wednesday after facing multiple rejections around the 200-day EMA. Bloomberg reports that China is open to trade talks with President Trump’s administration.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.