The Bank of Japan's Summary of Opinions is coming out in stages.

Key points

It will take time for Japan to achieve sustained wage growth, must support the economy with macro policy.

Focusing on service prices as demand-pull inflation must be achieved for Bank of Jaopan's price target to be met.

Price rises accelerating not just for goods but for services.

Public's norm on prices may be changing due to big, external shock.Appropriate to maintain current monetary easing, including YCC.

Crucial to generate positive economic, price cycle in order to achieve BoJ's price target

BoJ must keep yields from rising across curve while being mindful of bond market function.

Must spend more time to gauge impact of December decision on bond market function.

Must communicate to markets achievement of price target will take some time.

Expansion of BoJ's market operation tool will help create stable shape of yield curve.

When time for exiting ultra-loose policy comes, boj must check whether market players are prepared for the move.

BoJ must conduct a review of its policy at some point, but appropriate to maintain easy monetary policy for now.

Japan's consumer inflation is likely to slow pace of increase toward latter half of next fiscal year.

Cost-push pressure on prices are starting to ease.

Still see some distance in achieving the BoJs price target.

USD/JPY update

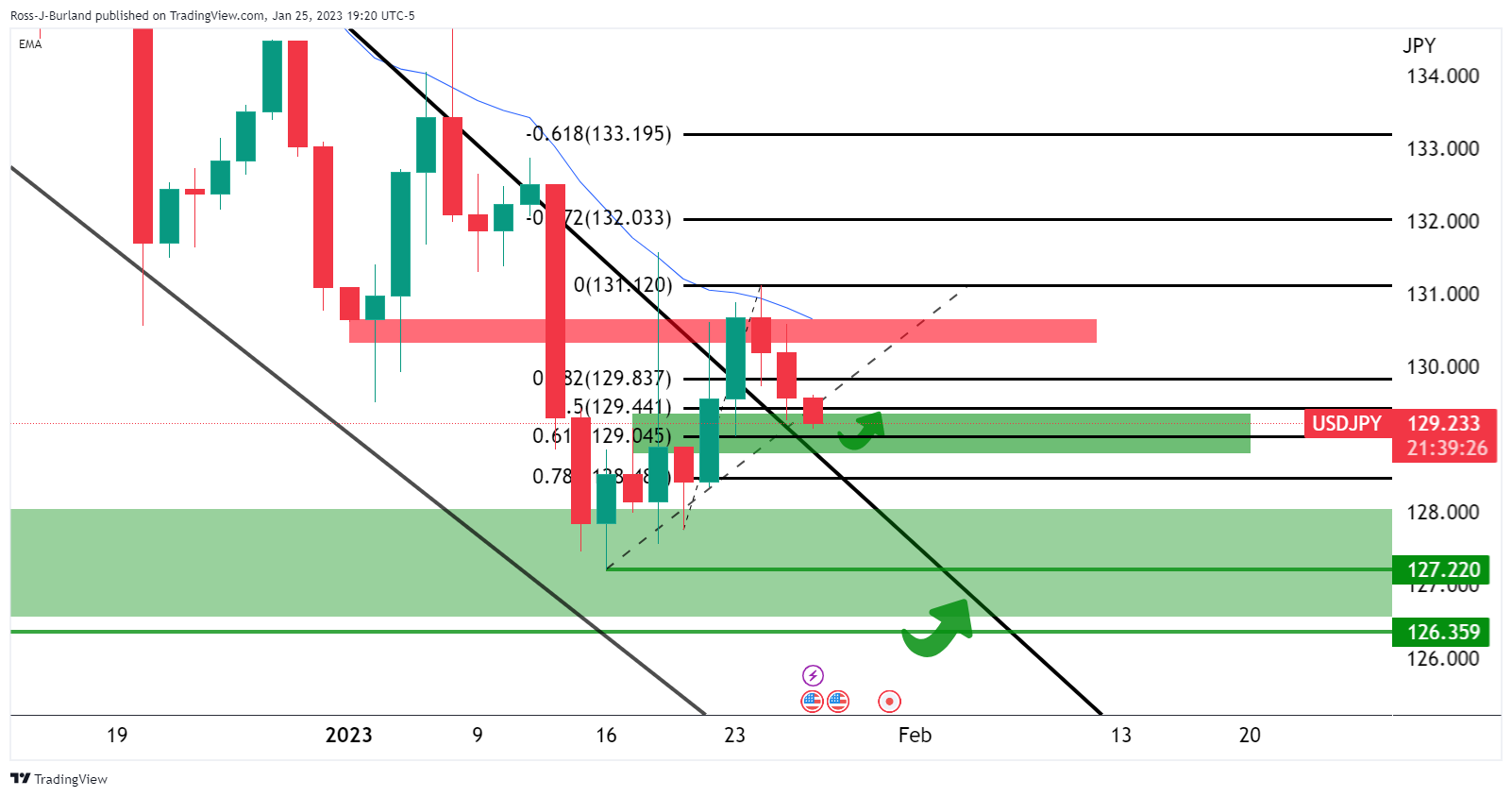

There has been no effect on the Yen but the price action was volatile on Wednesday with the bulls now back under pressure again towards 129.00:

If the bulls commit near 129.00, the has a confluence with the 129.00 figure, then there could be prosp3ects of a move back to test 130.00 before the week is out.

About the Bank of Japan's Summary of Opinions

This report includes the BOJ's projection for inflation and economic growth. It is scheduled 8 times per year, about 10 days after the Monetary Policy Statement is released.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD hovers above 1.0500 amid French political jitters

EUR/USD is trading modestly flat above 1.0500 in the early European morning on Wednesday. The pair gyrates in a familiar range amid a broadly stable US Dollar and French political uncertainty, as the government faces a no-confidence vote in a busy day ahead.

GBP/USD clings to gains below 1.2700 ahead of Bailey's speech

GBP/USD is consolidating gains below 1.2700 in early European trading on Wednesday. Traders refrain from placing fresh bets ahead of speeches from BoE Governor Bailey and Fed Chair Powell later in the day. US ADP Jobs and ISM Services PMI data are also awaited.

Gold price slides below $2,640, fresh daily low ahead of Fed Chair Powell's speech

Gold price attracts some sellers following an intraday uptick to the $2,650 supply zone and hits a fresh daily low during the first half of the European session on Wednesday. The precious metal, however, remains confined in a familiar range held over the past week or so as traders seem reluctant to place aggressive directional bets ahead of Fed Chair Jerome Powell's speech.

Cryptomarket stabilizes after South Korea reverses martial law

Bitcoin hovers near $95,700 on Wednesday, signaling potential weakness as technical indicators suggest a decline, while Ethereum and Ripple stabilize near key levels, hinting at a possible rally following South Korea's reversal of martial law.

The fall of Barnier’s government would be bad news for the French economy

This French political stand-off is just one more negative for the euro. With the eurozone economy facing the threat of tariffs in 2025 and the region lacking any prospect of cohesive fiscal support, the potential fall of the French government merely adds to views that the ECB will have to do the heavy lifting in 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.