BoJ gov Kuroda: Japan's economy picking up

Haruhiko Kuroda, the Bank of Japan's governor, has said now is the stage to continue monetary easing to support the economy.

Key comments

- Japan's economy is likely to recover as the impact of supply constraints and the pandemic eases.

- Aiming for stable and sustainable chievement of price target including wage growth.

- Tightening labour market and price gains so far will reflect in wage negotiations next spring.

- Chances are high for tight job market to drive up wages.

- Labour shift towards high productive areas could push up wages.

- Price gains will extend further toward the year end but will gradually lower after new year.

- Must be vigilant to uncertainties over economic outlook, risks from overseas economy, price trends.

- Expect cpi growth of around 3% this fiscal year but fall to around 1.5% next fiscal year.

Meanwhile, foreign investors have been net buyers of Japanese stocks of late as strong earnings outlook of some domestic companies boosted investor sentiment. Foreigners purchased Japanese stocks worth a net 247.9 billion yen, which compared with 178.89 billion yen worth of net buying in the previous week, data from exchanges showed. This can be offering some support to what has been a downtrodden currency. It has managed, with the support of intervention from the Japanese authorities, to get beyond 140 vs the US dollar in recent trade.

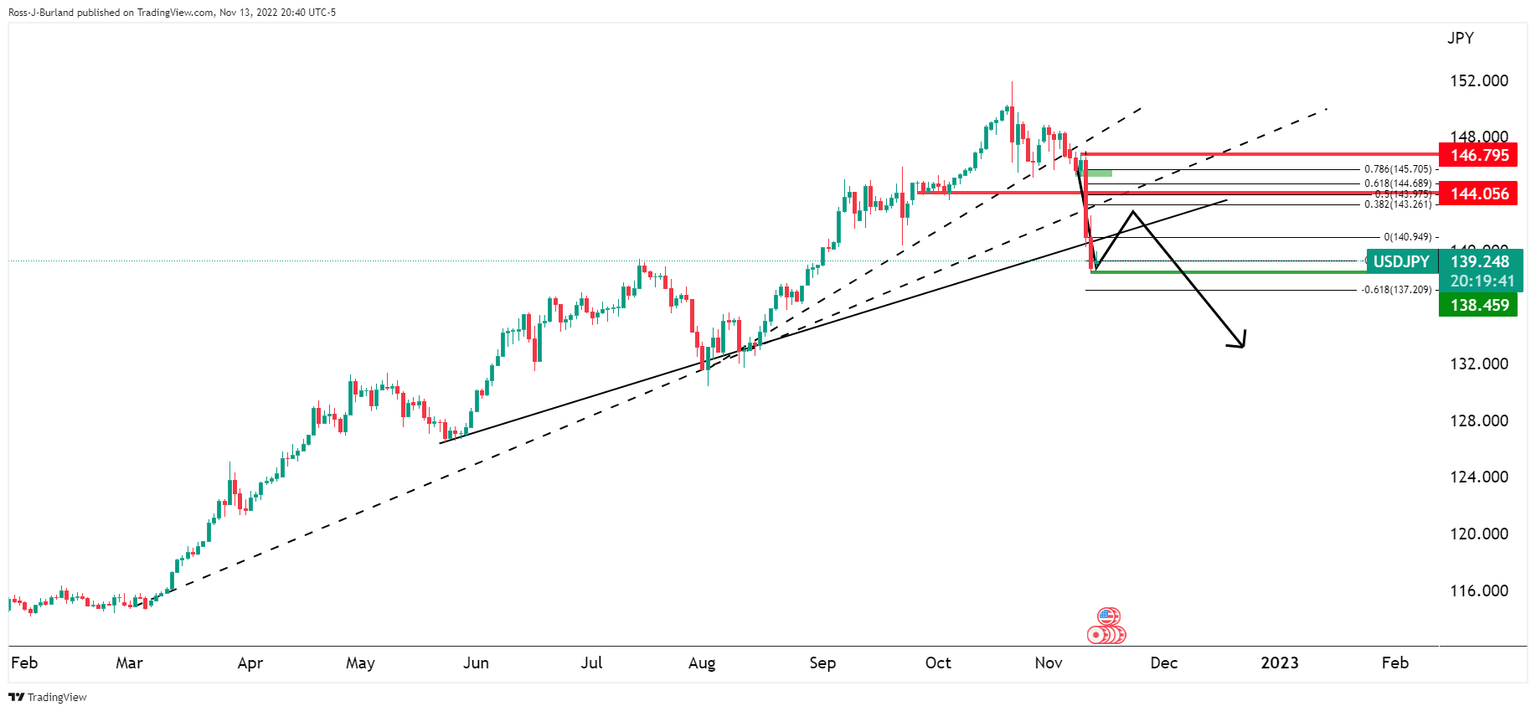

The daily chart, above, shows that the yen is now above critical resistance, USD/JPY support. 133.00/50 is the next objective.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.