BoE´s Bailey: Banking crisis `testing' institutional structures

Bank of England Governor Andrew Bailey earlier said in a speech on Wednesday to the Institute of International Finance in Washington where he is attending International Monetary Fund meetings that he did not believe ´´we face a systemic banking crisis."

In recent trade, further comments have crossed the wires:

We watch QT very carefully, we do not want it to have detrimental impact on markets.

We are not seeing any concerning signs in markets due to QT.

I do not see makings of a repeat of 2007-08 crisis.Shouldn't `aim off' rates decision due to crisis.

Will take financial conditions into account.

"I do not see the evidence that we've got on our hands what I would call ... the makings of a 2007/8 financial crisis. I really don't see that," Bailey said when asked about recent instability in the banking sector.

"The system is in a much more robust condition," he added.

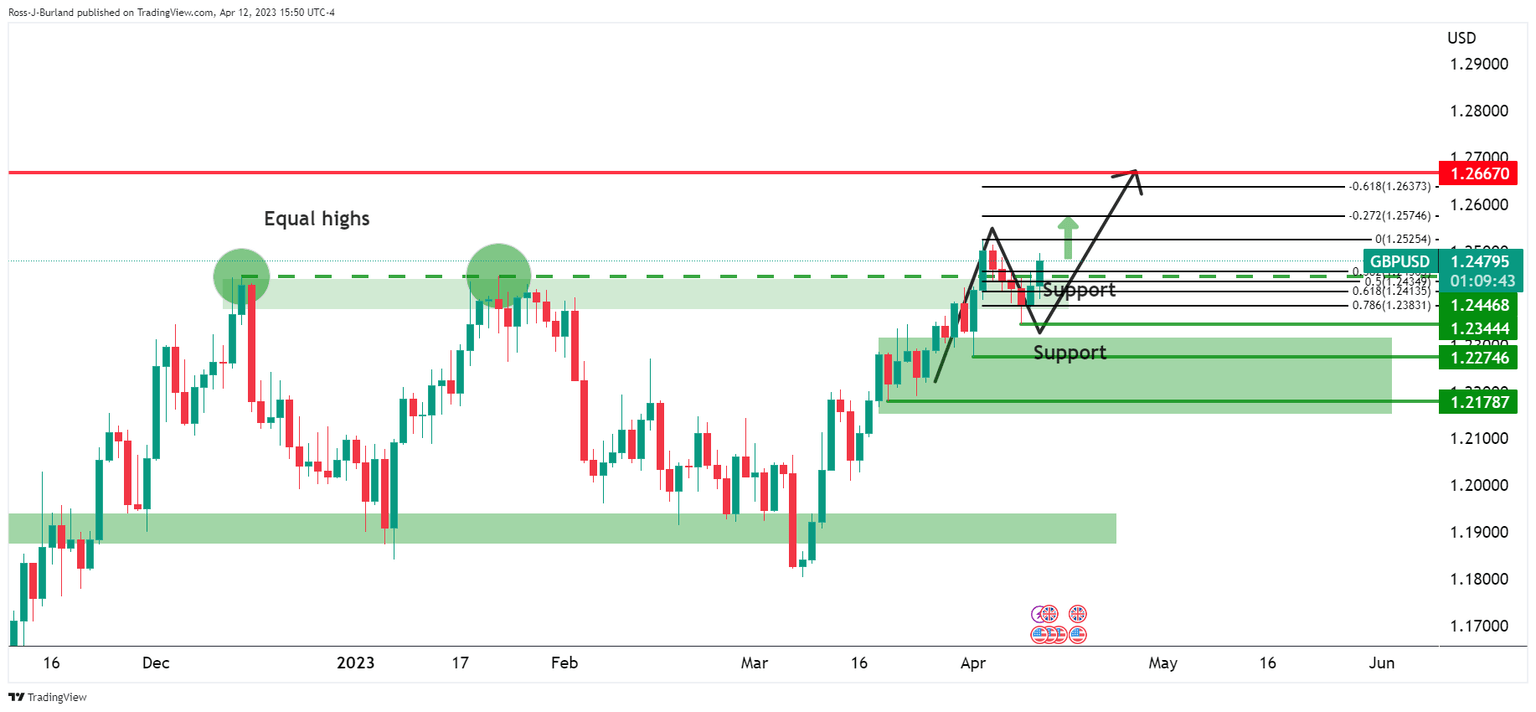

GBP/USD update

The Great British Pound rose towards $1.25 vs. the US dollar, moving closer to a ten-month high of $1.2525 touched on April 4th.

The Pound Sterling is getting a boost from the softer-than-expected US Consumer Price Index data that solidified that sentiment that the Federal Reserve will likely pause its rate hiking cycle soon.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.