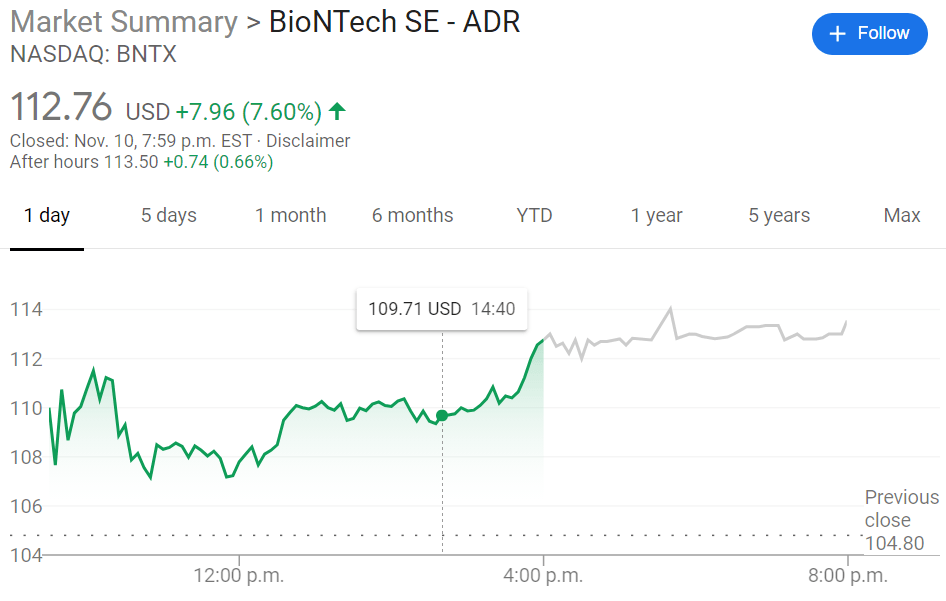

- NASDAQ:BNTX continues its surge as it gains 7.60% on Tuesday.

- BioNTech and Pfizer announced a 90% efficacy for their COVID-19 vaccine candidate trials.

- With up to 1.3 billion doses being produced for 2021, BNTX is a long-term pay in the biotech field.

NASDAQ:BNTX did well to partner with American pharmaceutical giant Pfizer (NYSE:PFE) as the two firms have produced one of the most historic vaccines of our lifetime. BioNTech’s stock continued its gains on Tuesday, adding a further 7.60% as investors piled into the German company, a day after its game-changing announcement. Shares of BNTX are now up nearly 500% for the year and investors who took a chance on the little known biotech company back in March when the partnership with Pfizer was first announced are celebrating the successes of the vaccine candidate BNT162b2.

It seems like great timing as the global financial markets were already rallying around the likelihood of a Joe Biden administration in the White House, when the Pfizer and BioNTech announcement sent the markets through the roof. Democratic president-elect Biden himself has supported the wearing of masks and pledged that the first thing he will do when taking the office is to tackle the coronavirus pandemic in America. Having 1.3 billion doses of BNT162b2 ready for distribution in 2021 will definitely help with that.

BNTX Stock Forecast

While having an FDA approved vaccine on the horizon has provided investors and the world with optimism, the world is still months away from having widespread access. BioNTech also has a series of oncology treatments, with twelve different candidates currently at some stage of clinical testing. Despite all of these, BioNTech reported a nice jump in third quarter revenues that are clearly connected to its work with Pfizer, and this could spike even more next quarter, as the companies announced they would be seeking FDA approvals as early as next week.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD weakens below 1.0900 on trade tensions

The EUR/USD pair loses ground to around 1.0880 during the Asian trading hours on Thursday. The escalating trade tension between the United States and the European Union exerts some selling pressure on the Euro against the Greenback.

Gold price retains positive bias for the third straight day; remains close to all-time peak

Gold price attracts buyers for the third successive day and climbs to the $2,947 region during the Asian session on Thursday, back closer to the all-time peak touched on February 24.

GBP/USD maintains position above 1.2950 near four-month highs

GBP/USD attempts to extend its gains for the third successive day, trading around 1.2960 during the Asian session on Thursday. The GBP/USD pair rises as the US Dollar faces headwinds amid ongoing tariff uncertainty from Trump and growing concerns over a potential US recession.

Ethereum: Staking could be catalyst to drive ETH's price 'more than Pectra upgrade': K33 Research

Ethereum traded around $1,860 in the Asian session on Thursday as its price remained largely subdued by bearish sentiment weighing on the general crypto market.

Brexit revisited: Why closer UK-EU ties won’t lessen Britain’s squeezed public finances

The UK government desperately needs higher economic growth as it grapples with spending cuts and potential tax rises later this year. A reset of UK-EU economic ties would help, and sweeping changes are becoming more likely.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.