- NASDAQ: BNGO is set to reverse its gains and crash after announcing a fresh public offering.

- BioNano Genomics may be trying to cash on the recent massive rally.

- The firm's genetic breakthrough may allow it to recover once the dust settles.

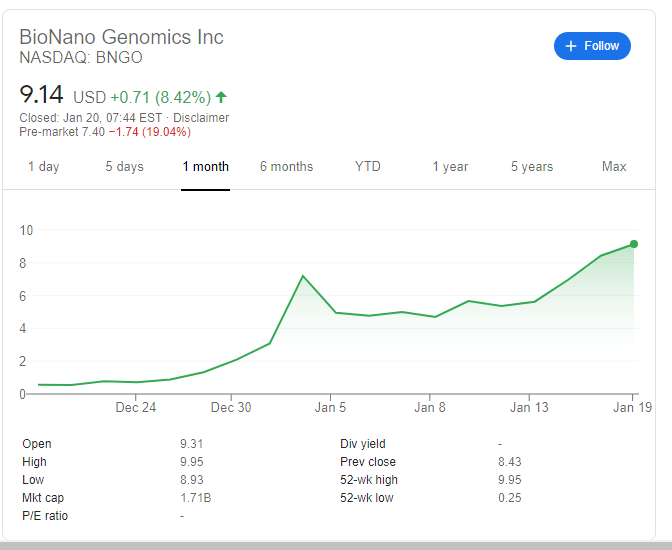

The company giveth, the company taketh away – BioNano Genomics (NASDAQ: BNGO) shares are set to suffer on Wednesday, reversing a substantial portion of its gains. Premarket trading figures are pointing to a drop of roughly 20% to $7.27 from the previous close at $9.14. It can get substantially worse.

The San Diego-based genetics firm has announced it is offering new shares at only $6. Does management value the company's worth some 35% below what investors are willing to pay? Is BioNano in dire economic straits, forcing a firesale?

These questions and others may compound the damage inflicted on NASDAQ: BNGO as investors digest the news on the day that Joe Biden is inaugurated as US President. The incoming administration is emphasizing the role of science in society and may channel funds to Research and Development – that may benefit BionNano.

BNGO stock price

Apart from a Biden boost, will NASDAQ: BNGO rise despite the low pricing? It is essential to note that this is not the first time such news is floated. Earlier this year, reports of issuance sent shares below $5, and now the firm is worth much more. Can it swiftly recover?

The answer depends mostly on BioNano's products – all related to genetic treatment. The company announced progress in several fields, from the autism spectrum, identifying reasons for severe COVID-19 illness and cancer treatments. Upbeat news on what the company produces and discovers could prove more significant than financial developments. Neverteless, shares will likely suffer badly before attempting a recovery.

More Best Stocks to Buy Forecast 2021: Vaccines and zero rates to broaden recovery

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD remains near 1.0400 post-US PCE

The US Dollar’s inconclusive price action allows some recovery in EUR/USD, keeping the pair around the 1.0400 region following the release of PCE inflation data for the month of January.

Gold slumps to fresh multi-week lows below $2,840

Gold stays under bearish pressure and trades at its lowest level in three weeks below $2,840. The uncertainty surrounding the Trump administration's trade policy and month-end flows seem to be weighing on XAU/USD, which remains on track to snap an eight-week winning streak.

GBP/USD clings to gains just above 1.2600 after PCE data

GBP/USD remains positively oriented in the 1.2600 neighbourhood as the Greenback is navigating a vacillating range following the PCE inflation release.

The week ahead – US Payrolls, ECB rate meeting, ITV results – W/c 3rd March

Having seen the Federal Reserve keep rates on hold last month the US labour market continues to show remarkable resilience, despite seeing a slowdown in hiring in January, after a blow out December number.

Weekly focus – Tariff fears are back on the agenda

While the timing of the EU measures remains still uncertain, Trump surprised markets on Thursday by signalling that the 25% tariffs on Canada and Mexico will be enacted when the one-month delay runs out next Tuesday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.