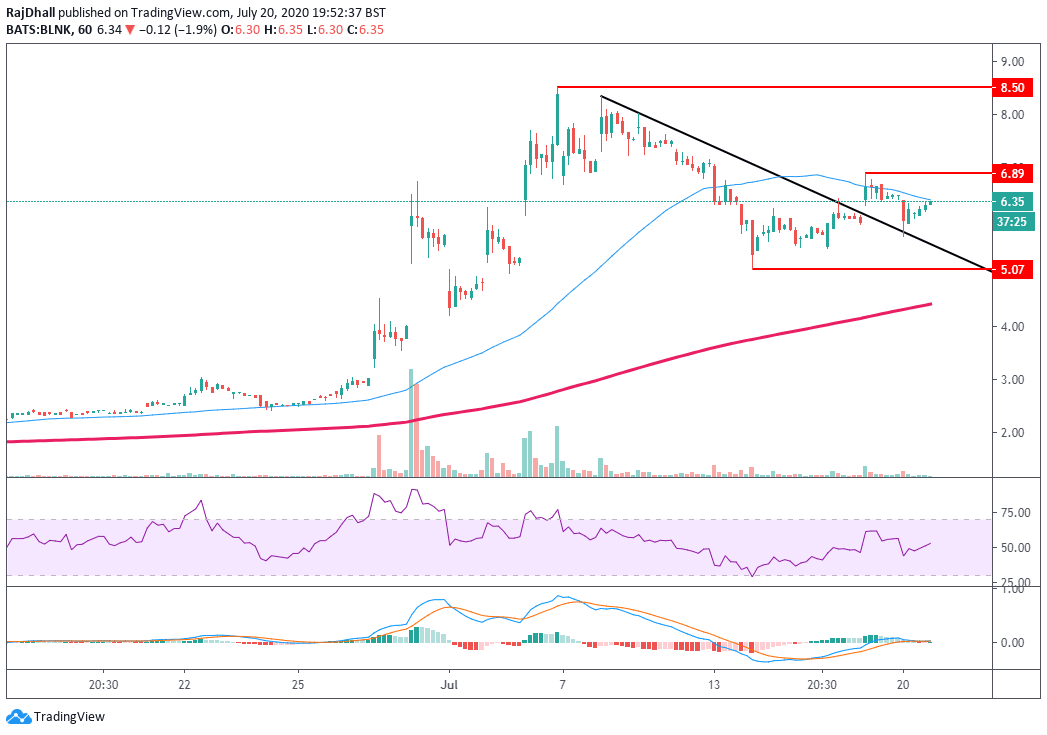

BLNK Stock Price: Blink Charging Company performs perfect technical retest

- BLNK stocks trade -2.17% lower on Monday.

- The trendline has now been broken and retested in classical fashion.

BLNK Stock

Things are still looking good for Blink Charging Company (NASDAQ:BLNK) even as the share price trades 2.17% lower on Monday. The price has now pulled back and tested the black trendline and managed to hold above the USD 6.00 level. The last five hourly candles have been positive but the price is now testing the 55 Simple Moving Average and it could be a sticking point. More importantly, the 200 Simple Moving Average is below the price and this is positive as it is a widely used moving average. The main support on the downside is the wave low at USD 5.07 if this level is broken it could mean more pain is to come for investors. On the upside, the wave high at USD 6.89 is an important level for the bulls. If the aforementioned resistance breaks then the bull trend could be back on the cards.

Looking at the indicators, the Relative Strength Index is above the 50 area which is positive. The MACD is back in the green after printing two red bars and the signal lines are back above the zero level. As mentioned previously the price being above the 200 Simple Moving Average is positive as many equities traders use the moving average as a barometer for the trend.

Author

FXStreet Team

FXStreet