- Nasdaq: BLNK drops 15% on Tuesday but still up 39.5% for the week.

- Blink Charging company positioned for EV future.

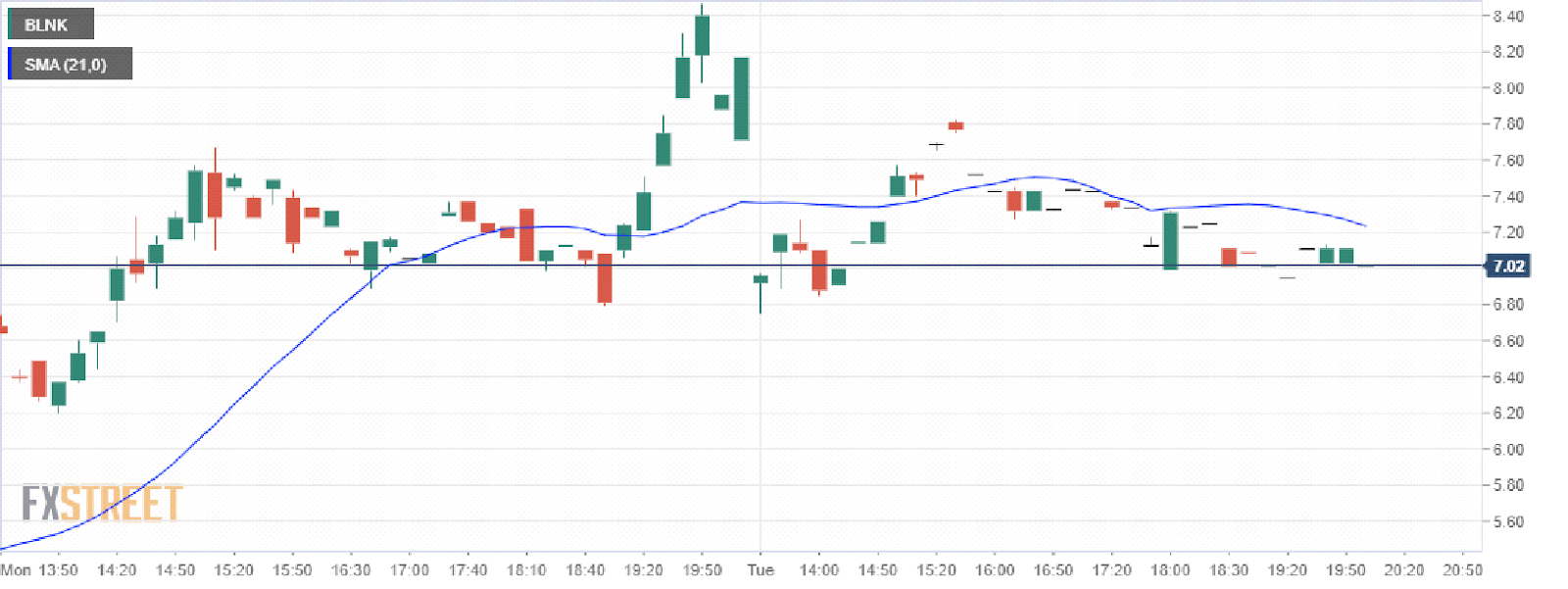

After a huge 59% jump on Monday, following Michael D. Farkas CEO of Blink Charging Company’s appearance of Fox Business, the stock gave back 15% of the gains on Tuesday. The close was not only at the 52-week high but also the record high for Nasdaq: BLNK.

Blink Charging Company’s CEO has made many positive announcements for the company recently. Tuesday’s biggest insight was that the company was working on a “touchless charging system” after stating that “there are 11,000 more germs on a gas pump than on a toilet.” This was after also affirming that Blink Charging Company is still growing during the COVID-19 crisis.

Nasdaq: BLNK has already deployed 23,000 charging stations which include both portable and mobile stations directed at the service industry. They see their charging systems mostly used in an urban environment and with better battery technology drivers will only have to charge an EV once a week. No matter which battery technology and which auto company wins the EV war, Nasdaq: BLNK is in a good position to provide the juice they will need.

Blink Charging Company was very pleased with Apple adding a new feature to their Apple Maps App in late June which shows Electric Vehicle Charge Routing Capabilities which will include routing to Blink Charging Company’s charging stations.

Nasdaq: BLNK loses some gains

Nasdaq: BLNK opened with profit-taking at $6.95, below its previous day’s close of $8.40/share. Most of the day was spent around the $7.25/share mark, with a brief bull run that brought Blink back up to 7.82/share, only to drop back down to the close of $7.095/share. Blink Charging Company is up more than 275% year to date from its January $1.88/share price.

Currently, 15 of 17 moving average indicators show Nasdaq: BLNK as a “Buy” with one “Neutral”(Ichimoku Cloud Base Line) and one new “Sell” for the day “Sell”(Hull Moving Average yesterday was a “Buy”). The 11 Oscillators have changed to Majority “Buy” from yesterday’s hold of, two “Sell” seven “Neutral/Hold” and two “Buy”, to today’s one “Sell” one “Neutral/Hold” and three “Buy”.

There is only one analyst that is covering Blink Charging Company and they currently have the stock as a “Buy” with a target price of $5 (it is well above this price level now) with expected earnings per share (EPS) of -0.10. This rating has not changed since their last review.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD climbs to multi-month highs above 1.0850

EUR/USD gathers bullish momentum and trades at its highest level since early November above 1.0850 on Friday. The US Dollar struggles to shake off the bearish pressure as investors await February employment data, allowing the pair to stretch higher.

GBP/USD reclaims 1.2900 as USD selloff continues

Following a consolidation phase in the Asian session, GBP/USD regains its traction and trades above 1.2900 in the European session. Ahead of the highly-anticipated US jobs data, retreating US Treasury bond yields weigh on the USD and support the pair.

Gold holds steady above $2,900 ahead of US NFP

Gold price remains confined in a range above $2,900 on Friday as traders keenly await the US NFP release. Rising trade tensions, the risk-off mood, and a weaker USD lend support to the precious metal. Bets for more interest rate cuts by the Fed contribute to limiting losses for XAU/USD.

Nonfarm Payrolls forecast: US job growth set to rebound in February after weak January data

Nonfarm Payrolls are expected to rise by 160K in February, following the 143K increase reported in January. The Unemployment Rate is forecast to remain unchanged at 4%.

February CPI preview: The tariff winds start to blow

Consumer price inflation came out of the gate strong in 2025, but price growth looks to have cooled somewhat in February. We estimate headline CPI rose 0.25% and the core index advanced 0.27%. The moderation in the core index is likely to reflect some giveback in a handful of categories that soared in January.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.