Bit Digital (BTBT Stock) is the low set?

With Bitcoin having rallied over 40K from the March 2020 low, Crypto and Blockchain markets continue to show potential. Bit Digital is a company that experienced a large vertical rally in late 2020. After that, it has been correcting the whole rally in a large wave II.

Bit Digital touts itself as one of the world’s largest publicly-listed bitcoin mining companies. Bit Digital is a sustainability-focused generator of digital assets with large-scale, global mining operations representing a currently-owned maximum hash rate of 1.603 EH/S

After ralling from 28 cents to a peak of 33.00, and then recently declining to a low of 3.39, traders should be aware of the extreme volatility inherent in the Bitcoin Mining sector. Lets take a look at the charts.

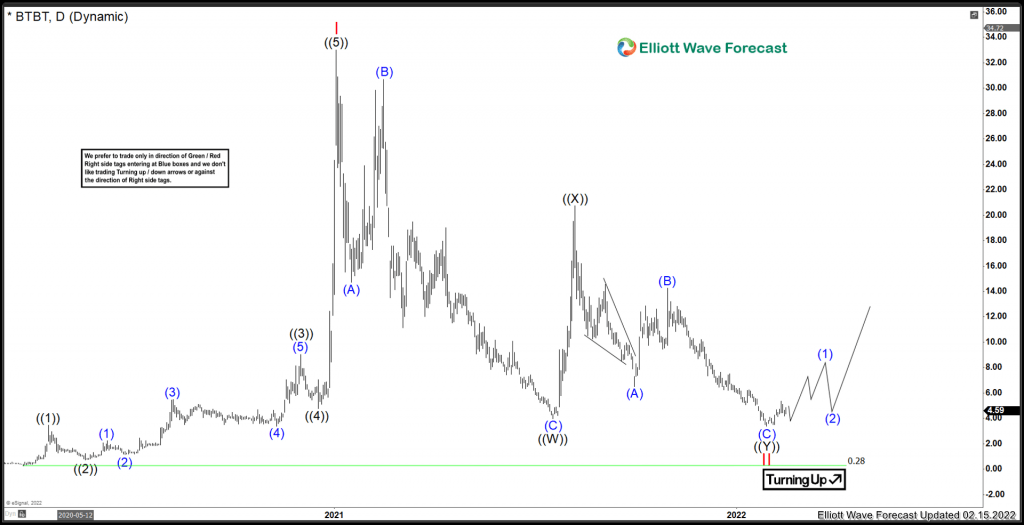

Bit Digital Elliott Wave view daily

Longer term term view from the all time low in March 2020. In Summary, there was a 5 waves advance with a very extended 5th wave. This impulse peaked in January 4/2021 at a price of 33.00. After that, a long pullback has taken place. This pullback found support in July 2021 where a bounce in ((X)) took place. It has been very choppy since the major peak in Early 2021. With the most recent data and momentum RSI Readings, it is favoured that this stock has struck a low at the recent Jan 28/2022 low. This date has proven to be a market wide cycle low date. For now, as long as prices remain above the Jan 28 low of 3.39 further upside is favoured to take place.

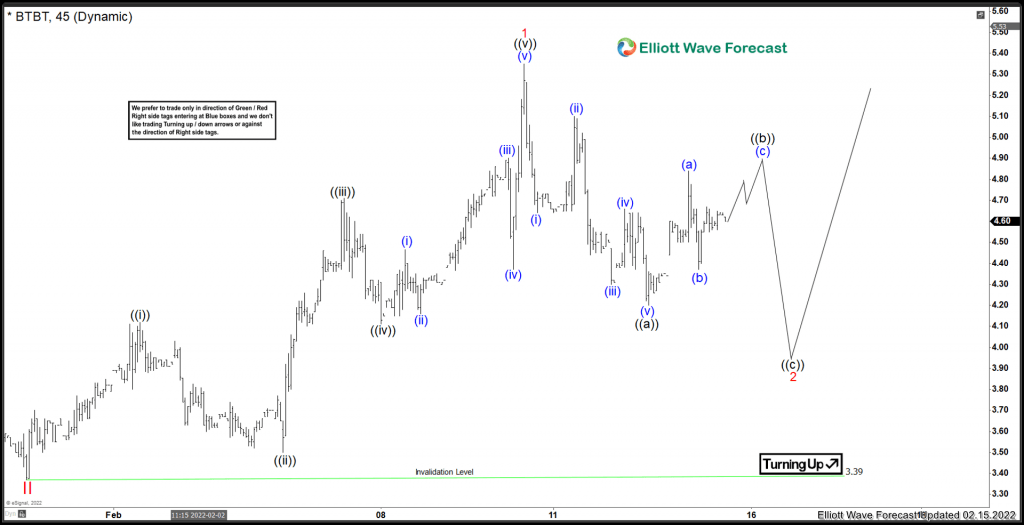

Bit Digital Elliott Wave view 1h

Shorter cycle view from the Jan 28/2022 low. Bit Digital shows a clean 5 waves higher into the Red 1 peak. Red 1 peaked on Feb 10 @ 5.25. Momentum is suggesting that a pullback to correct the rally from Jan 28 is underway. There is 5 waves down into ((a)) presently, and now a reaction higher. The expectation would still be for another swing lower in ((c)) of Red 2, before moving higher. As long as the low of 3.39 remains intact, further upside is favoured to take place after ((c)) of 2 is set.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com