Bifurcated market, lousy market breadth: Is a crash looming or a bull run brewing? [Video]

![Bifurcated market, lousy market breadth: Is a crash looming or a bull run brewing? [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Nasdaq/nasdaq-marketsite-times-square-nyc-2001-39895830_XtraLarge.jpg)

The weakness reflected in the S&P 500 equal weight ETF in conjunction with the lousy market breadth painted a contrast with the leading index Nasdaq 100 and some of the mega-cap growth stocks.

Does it mean a crash is coming or a bull run is brewing? Watch the video below to find out how to use price volume analysis with the Wyckoff method to derive a directional bias.

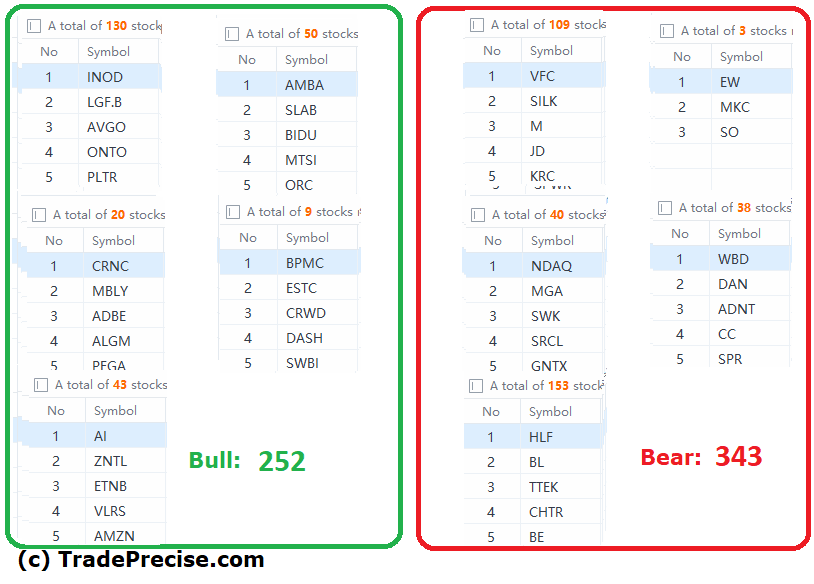

The bullish setup vs. the bearish setup is 252 to 343 from the screenshot of my stock screener below pointing to a negative market environment.

Despite there being more bearish setups than bullish setups, one can still be profitable when trading the outperforming industry groups and stocks (e.g. XLK, SMH) as long as there are valid trade entries providing a decent reward to risk.

Now is not the best time for entry for the semiconductor leaders due to overbought and overextended, but to sell into strength to scale out partially and keep trailing stop for the rest of the positions.

Based on the long/short volume in the leveraged ETF chart as discussed, there is a breakout in the momentum and a rotational play into other tech industry groups is possible until the emergence of excessive supply.

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.