Best Stocks to Buy Forecast 2021: Vaccines and zero rates to broaden recovery

- Zero/negative interest rates to continue, stimulus boost.

- Swift global recovery with multiple vaccine rollout in H1 2021.

- Our top picks are Delta (DAL), Amazon (AMZN), Kellogg (K), IBM (IBM), Alibaba (BABA).

Given the macroeconomic backdrop of multiple vaccine approvals and distributions, zero or negative interest rates, and pent-up demand, global stock markets will continue the bullish trend but with some important caveats.

Which stocks to buy: Our diversified Top 5 to be bullish in 2021

An expected return for the broader market should materialize, with value, real economy stocks set to catch up. 2020 saw tech stocks lead the rally with a lot of the broader market not fully participating, reflecting the struggling underlying real economy. But with near-limitless cheap credit, expect property and housing stocks to do well and associated stocks such as the construction sector.

Retail has had a torrid year at the hands of Amazon, expect this trend to continue as traditional brick-and-mortar retail is stuck with high rents and large cost and logistics bases meaning they just cannot compete with the likes of Amazon. Financial stocks should see some uptick but will still struggle in a zero-rate environment, but investment banking should continue to benefit from strong equity markets and increased bond issuance both corporate and government. Tech and healthcare have outperformed during 2020 so expect a slowdown in 2021 with consumer discretionary to benefit.

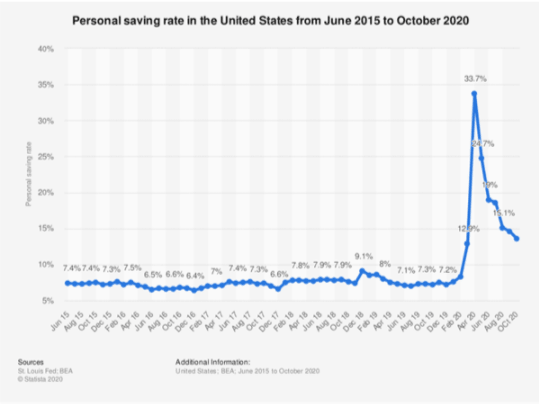

Bonds continue to yield close to or below zero, many deposit accounts now charge for the privilege of minding cash and this is not going to change anytime soon. Both fund managers and the public have stockpiled cash and will need to put it to work in 2021.

Delta Air Lines Inc (DAL): 2020 the perfect storm, it cannot get any worse

- DAL was down 30% in 2020.

- Delta is the biggest transatlantic airline in the world.

- Stimulus and pent-up demand will boost DAL.

If in 2019 you tried to do a black swan exercise to imagine the worst possible environment for the airline industry and Delta (DAL) I do not think it would have been this bad! This is a one in a 100-year event (Spanish flu 1918!) The airline industry has never been this devastated since commercial air travel began.

Global macro recovery play

The second quarter of 2021 should see a swift return to normality as multiple vaccines become widely available. The US personal savings ratio hit a record high in April and remains extremely high.

There is significant pent-up demand to travel for leisure, experiences and business. All this will see a sharp increase in bookings for Q3 and Q4 2021. Airline stocks have struggled lately as forward bookings are still down 89% on last year, but this can be attributed to the surge in US coronavirus cases seen after thanksgiving and the fears over a new strain from the UK. This gives us our DAL buying opportunity. In December 2019, shares in DAL were trading 50% higher in a normal operating environment. Delta is the biggest transatlantic airline in the world so is ideally positioned to be a big beneficiary. From 2015 to 2019, revenue went from $35b to $43b, EPS $5.68 to $7.32 so trending nicely until 2020 and the coronavirus hit.

The US has just announced another massive stimulus package. Interest rates are at record lows for a prolonged period meaning debt costs stay low. DAL stock has already bounced from its sub-$20 May lows to trade as of writing back around the $40 level. A return to normal for 2021 should see DAL stock rerate back to its long-term range of $50-$60 giving us 25-50% upside. Further tailwinds such as prolonged stimulus, low-interest rates, consumer spending and Boeing having to do deals could see DAL push above this range.

Technically speaking

The chart below shows Delta versus the S&P 500, with DAL still well below earlier highs while the broader market has made new highs. MACD turned bullish on DAL near the lows in May 2020 and has stayed that way. DAL is still well below its 200-day moving average.

Amazon (AMZN): You just must own it! $4,000 is the target

- Multiple diversified revenue streams.

- Coronavirus has accelerated the growth of online shopping.

- Plenty more to come, new business streams, no antitrust issues.

Coronavirus has created a monster in Amazon and probably sped up what was going to happen in a few years anyway: the death of the high street or bricks-and-mortar retail in the US. Amazon is now the global high street, shopping mall and discount outlet combined. In recent weeks it has decided to go after the pharmacy business and is still only getting started in online groceries. It has so much cash at its disposal that the mere mention of a new business area sends share prices of existing established stocks in that area into panic mode.

Diversification

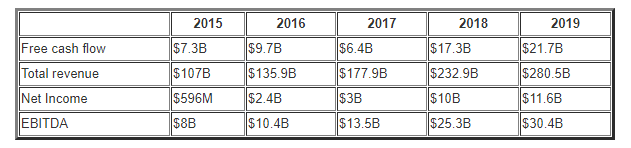

AMZN is probably the most diversified business available to investors.

AMZN is a tech company, a pharmacy company, a food retailer, a Netflix and Apple competitor, AMZN cloud services, the list goes on. It is the perfect defensive stock, growth stock and value stock rolled into one!

The high P/E of AMZN (94 at the time of writing) is often cited as a reason not to buy AMZN. But compared to some of its tech peers recently this now looks cheap. Tesla’s P/E is 1298, yes I know right! AMZN has justified its always high P/E, in 2016-2018 AMZN’s P/E averaged around 200, the stock price went from $800 to $1200 and onwards. AMZN’s P/E peaked at 272 in 2017 and as earnings have lived up to expectations it is naturally coming down with wall street estimating it to drop to 34 by 2023.

The numbers do not lie and for those concerned that a crash is imminent, and cash is king, AMZN had nearly $40b in cash as of its 2019 accounts!

More to come

AMZN has not suffered from antitrust issues so far that befell its predecessors such as Microsoft, Facebook, Twitter, etc. It has ambitious plans to take over the pharmacy space, grocery retailing and deliveries. It is one of the biggest cloud companies with Amazon web services accounting for nearly two-thirds of AMZN’s profit and over half of AMZN revenue. International has a huge scope to add to AMZN’s profit in the future, with only 7% of operating income coming internationally. It has now started to focus on this with Q3 2020 showing a $407m profit versus a loss Q3 2019.

Kellogg (K): Food, defensive and a yield where none exists!

- 4% dividend in a zero-rate world, 15 years of dividend increases.

- Defensive, solid, steady. Every team needs a player like that!

- Food stocks due some catch-up to the broader market.

Usually, when writing top stocks articles the normal thing is to go for the cool and trendy stocks, the ones that everyone talks about, the FANG stocks, Tesla you know who you are! But these stocks have already had a great 2020 while the rest of the world was suffering. Kellogg (K) has not done too badly but when you look at it versus the broader market (chart below vs S&P 500) it is clear that a return to normal should see it play catch up. Oh, and it also pays out nearly 4% dividend when now you must pay someone to mind your deposits!

Source: Tradingview.com

Tackling margin and debt issues

K is solid, boring even some might say but it is safe, and we all eat Kellogg's products and we always will! The dividend is secure with 15 years of K dividend increases. Kellogg (K) has been saddled with problems from its acquisition of Pringles but has reduced its debt/equity from nearly 300% to 230% over the last 4 years. K has had margin pressure recently as revenues continue to grow steadily but profits for the last five years are down nearly 20%, the company has blamed rising commodity input costs and aims to adapt and where possible pass these on.

Steady she goes

Kellogg’s (K) most recent results from October for Kellogg (K) were solid if unspectacular.

EPS beat by $0.05, revenue $3.4b in line with consensus, increased FY2020 outlook, we are not buying Amazon here but a solid steady stock which will continue to pay out a steady dividend.

International Business Machines IBM: A tech stock but not as we know it

- Investors have lost faith in management over the last number of years.

- New CEO in place going after the cloud market: in with the new, spin out the old!

- With a 5% dividend, IBM is a top dividend stock.

Again, trying to do some bottom picking here! IBM is the original tech stock and has been overlooked in the last number of years.

The sleeping giant that missed the tech boat

Recent financials have been steady but soundly unspectacular, revenue, net income, free cash flow have all been flat for the last 5 years. Current P/E is 14 but was as high as 25 in 2017. IBM is a sleeping giant, it just has been sleeping too long, but that is about to change.

Ex Redhat CEO shooting for the cloud

IBM is going after the huge cloud market. It currently has a 5% market share but is lining up significant investments and acquisitions. Microsoft (MSFT) holds nearly 15% of the cloud market but it trades at a P/E 36 compared to a P/E 14 for IBM. IBM pays out a 5% dividend, Microsoft pays out less than 1%. IBM has underperformed the broader market this year down nearly 8% versus S&P 500 up 14%.

Insider buying, acquisitions, dividend king

IBM is gearing up aggressively for this play on cloud services and AI announcing 10,000 job cuts to its legacy business in October and spinning out the old legacy business in the first half of 2021. IBM just announced an acquisition of Nordcloud to “turbocharge” its cloud business, a collaboration with Samsung on hybrid cloud and 5G solutions and an acquisition of fintech company Expertus to expand hybrid cloud payment solutions. IBM has also appointed as its new CEO the former head of its cloud division, so it is clear where it sees the future. In the last two months, multiple directors have bought stock in reasonable values $250K to $1m. IBM has been a tech laggard for too long and is moving on. IBM has increased its dividend for 25 straight years.

From the chart, we can see the poor performance of the stock over the last 5 years. But more importantly, the new low in March was not matched with corresponding new lows in MACD or RSI.

Source:Tradingview.com

Alibaba (BABA): The Chinese Amazon, so what is not to like

- The amazon is in China!

- Strong results despite the recent pullback.

- Geopolitical should help, Wall Street analysts bullish.

Alibaba (BABA) is the Chinese amazon and with China being a country of nearly 1.5 billion people that is an impressive marketplace. But...

Headwinds provide buying opportunity

Recently, BABA has perhaps become a bit too big for the Chinese government's liking. It was due to spin off its fintech division into ANT which was going to be 2020’s biggest IPO but was pulled at the last minute as Chinese regulators stepped in. The US has also just passed the Holding Foreign Companies Accountable Act (HFCAA) which means foreign companies (BABA and others) will be subjected to tougher accounting standards and to certify that they are not owned or controlled by a foreign government. But according to the South China Morning Post, Beijing and state media are downplaying the investigation into BABA saying it has no intention of harming the major tech platforms. So definitely a few headwinds!

This though has presented a nice buying opportunity as the stock has pulled back nearly $100 in December! BABA has $40b in cash, revenue has gone from $23B to $73B between 2016 to 2019, net income in the same period has gone from $6b to $21b with margins increasing from 27% to 29% over the period. P/E ratio is lower than Amazon's, coming from a high of 49 in 2017 to 37 currently.

Strong recent results

Alibaba recently announced second-quarter results for the year with 30% revenue growth, cash flow up 15% and BABA cloud business which I have spoken about for IBM has increased its revenue by 60%. BABA expects near 40% growth in earnings for FY2021 and EPS estimate for 2022 was increased from $11.68 to $12.45. BABA, like Amazon (AMZN) is well diversified across multiple sectors and the US-China political backdrop should improve with President Biden.

Outlook strong, wall st sees upside

The outlook for BABA is strong, the macro-political backdrop should be favorable, President Biden and multi country macro stimulus keeping interest rates to zero meaning investable assets hold sway. The Chinese government does not want to destroy it, just keep tighter control. The average Wall Street price target for the stock is near $340 leaving us plenty of upside. The chart shows the uptrend in place, with RSI just ticking upwards. The MACD is at its widest signaling oversold conditions.

Source: Tradingview.com

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet

-637453703307351874.png&w=1536&q=95)

-637453706963676091.png&w=1536&q=95)

-637453708567626863.png&w=1536&q=95)

-637453710077555870.png&w=1536&q=95)