BRK.B Elliott Wave Analysis Trading Lounge

Berkshire Hathaway Inc., (BRK.B) Daily Chart

BRK.B Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave 1 of (5).

Direction: Upside in wave (5).

Details: Looking for upside into wave (5) as we seem to have bottomed in wave (4) after what appears to be a three wave move. Looking for further upside as we are just below TradingLevel5 at 500$.

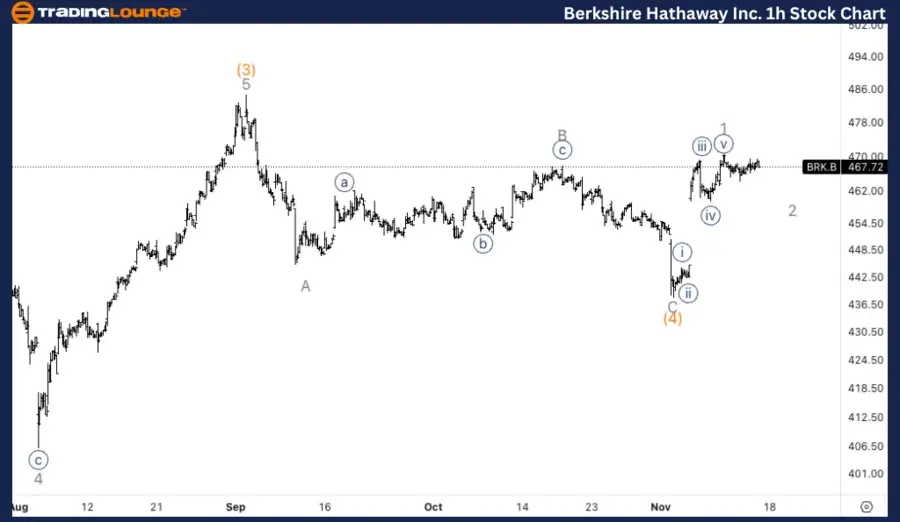

Berkshire Hathaway Inc., (BRK.B) 1H Chart

BRK.B Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave 1 of (5).

Direction: Pull back in wave 2.

Details: Looking for completion in wave 2 of (5), as we seem to be missing at least another leg lower after what appears to be a three wave move in wave 1. We could see a pullback around 465$.

This analysis of Berkshire Hathaway Inc., (BRK.B) focuses on both the daily and 1-hour charts, using the Elliott Wave Theory to assess current market trends and forecast future price movements.

BRK.B Elliott Wave technical analysis – Daily chart

On the daily chart, BRK.B is expected to continue rising as it begins wave (5) after what looks like a completed three-wave corrective structure in wave (4). The stock is positioned just below the TradingLevel5 at $500, which is expected to act as resistance. Breaking through this level would confirm further upside potential into wave (5).

BRK.B Elliott Wave Technical Analysis – One-hour chart

On the 1-hour chart, BRK.B is in the process of completing wave 2 of wave (5). There appears to be another leg down missing before this wave is complete, suggesting that wave 2 is still unfolding. A support level around $465 could provide a potential turning point, where the stock may find a bottom before resuming the upward movement in wave 3 of (5).

Technical analyst: Alessio Barretta.

BRK.B Elliott Wave technical analysis [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.

Recommended content

Editors’ Picks

EUR/USD stays near 1.0400 in thin holiday trading

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD struggles to find direction, holds steady near 1.2550

GBP/USD consolidates in a range at around 1.2550 on Tuesday after closing in negative territory on Monday. The US Dollar preserves its strength and makes it difficult for the pair to gain traction as trading conditions thin out on Christmas Eve.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.