- NYSE: BB is on course to top the $10/share level amid its patent sale to Huawei.

- BlackBerry Ltd. settlement with Facebook also provides room to the upside.

- The Canadian firm's lucrative accord with Amazon is also helping out.

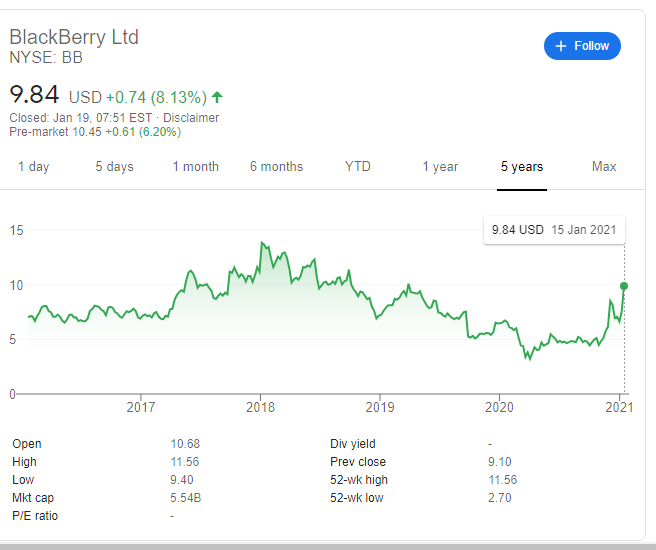

Update: Thursday's premarket trading is showing that NYSE:BB shares are set for a decline of around 2%, following a surge of 3.60% on Wednesday. BlackBerry's shares closed Wednesday's trading at $12.79 after hitting a high of $13.64 – showing that the consolidation process has already begun. It is essential to note that the Canadian firm's shares changed hands at around $7 at the end of 2020, and have surged since then. However, there are several reasons to remain bullish on BB, as explained below. Bargain-seekers may opt to take advantage of this slide to make the classic "buy the dip" trade.

Former President Barack Obama was famous for his BlackBerry – and stocks are rising as his Vice-President Joe Biden is set to enter the White House. Canada's BlackBerry Ltd (NYSE: BB) is no longer focused on hand-held devices but rather on enterprise software and the Internet of Things (IoT). However, the firm is enjoying a blast that sends its to price seen in the past – shares are hitting the highest since 2018.

Update: BlackBerry Ltd (NYSE: BB) has been extending its gains on Wednesday, hitting a high of $13.63. Developments related to the firm's dealings with Amazon, Facebook, and Huawei continue convincing investors to pile in. For more seasoned traders, BlackBerry's handheld devices are a blast from the past, but its recent ventures into the enterprise software and IoT promise a future. At the current price, BB is just shy of the $13.83 closing high in the first days of 2018. If it extends its gains, there it would hit prices last recorded back in early 2002 – when the dot-com bubble was unaveling.

Update: NYSE: BB has soared by 25.51% on Monday, taking it to a new 52-week high of $12.39 before closing the day at $12.35, near that peak. Tuesday's premarket trading is pointing to additional advances – another increase of around 6% to $13.09. Apart from the deals that BlackBerry made (described below) the veteran mobile phone firm turned IoT company could be benefitting from positioning on options. According to a report, futures set to expire in December 2021 signal implied volatility is on the rise. The Waterloo, Ontario-based firm is now trading near the 2018 peak, and surpassing it would lead to levels last seen in the dot-com bubble of the early 2000s.

Three deals with larger tech firms are boosting the stock.

1) Huawei: BlackBerry sold some 30 mobile phone patents to the Chinese telecom giant. The prominent firm sells cellphones and is also a leader in 5G technology. Getting rid of its legacy business allows BlackBerry to focus on the future.

2) Facebook: Huawei is not the only controversial firm BlackBerry is dealing with. Also with Mark Zuckerberg's social behemoth, BB is letting go of its past. The two firms have settled an ongoing dispute related to patent infringements. The burden of having BB's financial might was a weight on BlackBerry's shoulders.

3) Amazon: Moving from one giant to another, the Canadian firm's future may lie with the retail behemoth. The two companies are collaborating around the IVY car platform, combining software abilities.

BB Stock Forecast

Investors are cheering these developments and pushing stocks higher. After closing at $9.84, Tuesday's premarket trading is pointing to another increase of over 6% to above $10. That would be the highest since late 2018.

The peak seen around that time was around $14, which is a stretch target for bulls. Support awaits at the previous peak of $8, followed by $7.

Best Stocks to Buy Forecast 2021: Vaccines and zero rates to broaden recovery

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold trades near record-high, stays within a touching distance of $3,100

Gold clings to daily gains and trades near the record-high it set above $3,080 earlier in the day. Although the data from the US showed that core PCE inflation rose at a stronger pace than expected in February, it failed to boost the USD.

EUR/USD turns positive above 1.0800

The loss of momentum in the US Dollar allows some recovery in the risk-associated universe on Friday, encouraging EUR/USD to regain the 1.0800 barrier and beyond, or daily tops.

GBP/USD picks up pace and retests 1.2960

GBP/USD now capitalises on the Greenback's knee-jerk and advances to the area of daily peaks in the 1.2960-1.2970 band, helped at the same time by auspicious results from UK Retail Sales.

Donald Trump’s tariff policies set to increase market uncertainty and risk-off sentiment

US President Donald Trump’s tariff policies are expected to escalate market uncertainty and risk-off sentiment, with the Kobeissi Letter’s post on X this week cautioning that while markets may view the April 2 tariffs as the "end of uncertainty," it anticipates increased volatility.

US: Trump's 'Liberation day' – What to expect?

Trump has so far enacted tariff changes that have lifted the trade-weighted average tariff rate on all US imports by around 5.5-6.0%-points. While re-rerouting of trade will decrease the effectiveness of tariffs over time, the current level is already close to the highest since the second world war.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.