Blackberry (BB) Stock Price & News: BlackBerry bounces as company announces EV wins

- NYSE: BB powers ahead by over 4% on Monday.

- Blackberry's Facebook page cited as BB announces EV wins.

- BB remains favoured by retail traders, still one of Reddit favourites.

Update Monday, February 8: Blackberry (BB) shares are trading higher on Monday, up by nearly 4% at $13.70. Shares in BB are being pushed higher as Blackberry announced via its Facebook page that "Blackberry QNX has design wins with 19 of the top 25 electric vehicle OEM's, which together have 61% of the EV market".

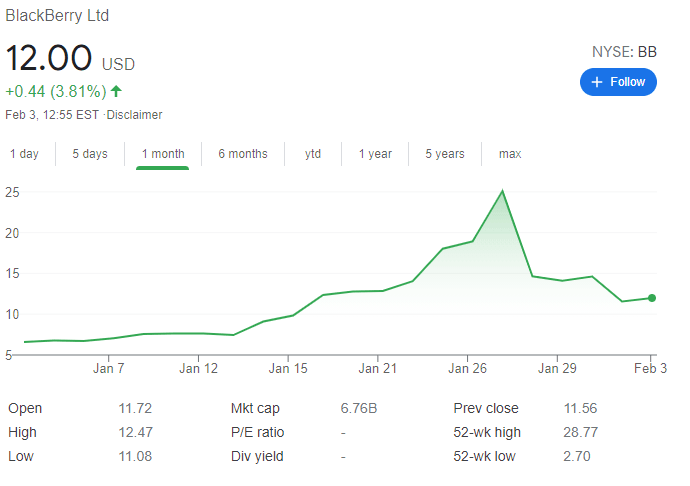

Update: Blackberry (BB) shares lost more than 20% on Tuesday and edged lower in the early trading hours of Wall Street. However, the rebound witnessed in the so-called "meme stocks", led by a 10% increase in GameStop Corp. shares, provided a boost to BB, which was last seen gaining 4.6% on a daily basis at $12.08.

Meanwhile, major equity indexes in the US continue to trade mixed with the S&P 500 rising 0.35% and the Dow Jones Industrial Average losing 0.05% on a daily basis.

Reuters reported on Wednesday that US Treasury Secretary Janet Yellen will meet with the head of the US SEC and the heads of the Federal Reserve and the Commodity Futures Trading Commission to discuss the retail trading frenzy.

February 3: Shares in Blackberry (BB) suffered on Tuesday as the ramifications of the recent wallstreetbets rally continued to be felt. Markets, in general, were buoyed by the return to "normality" as many seasoned traders put it. But the retail-driven stocks continued to suffer as the long thesis unwound. BB shares fell over 20% and are currently down another 4% in Wednesday's pre-market session.

See also: GME collapses as short interest drops.

Link to FXStreet New Equity News home page

Is silver the new gold? The attention of retail traders on WallStreetBets has shifted from Gamestop and AMC to the precious metal and also cryptocurrencies. That may leave an opening for BlackBerry Ltd. (NYSE: BB).

The maker of once-ubiquitous handheld devices has long shifted away to other businesses such as the futuristic Internet of Things (IoT) and also enterprise software. It has also reached agreements with Facebook, Amazon and Huawei – all allowing it either let go of its past or move more firmly into fresh ventures.

Amid the market frenzy, the Canadian company has another advantage of being partially out of the spotlight that GameStop (NYSE: GME) and AMC (NYSE: AMC) were. It is has been able to find its feet and stabilize around $14 after hitting a 52-week high above $28.

BB Stock Forecast

Is it ready to recover? One hurdle still needs to fall – getting out of Robinhood's blacklist of limited stocks. NYSE: BB remains among eight shares that suffer restrictions, but the online trading platform – which suffered its own cash squeeze – is likely to continue its gradual reduction of the list.

Once BlackBerry is out, traders may feel unshackled and could push it significantly higher. Moreover, it is set to fall by some 8% according to Tuesday's premarket trading data. That would make it even more attractive to buyers.

Best Stocks to Buy Forecast 2021: Vaccines and zero rates to broaden recovery

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.