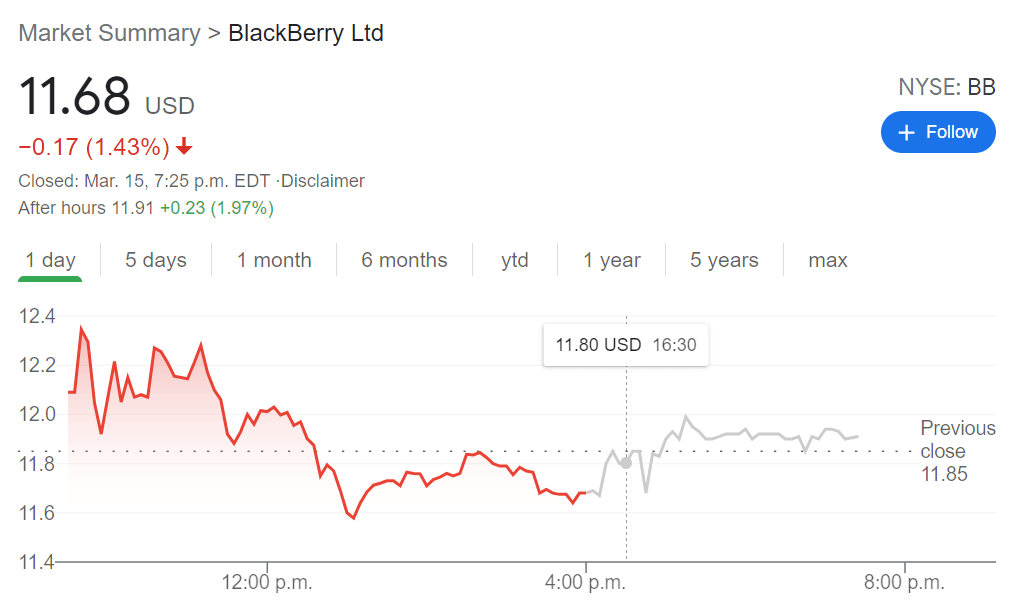

BB Stock Price and news: BlackBerry Ltd starts strong but still closes the day in the red

- NYSE:BB dipped by 1.43% lagging the broader markets to start the week.

- BlackBerry announces BlackBerry Alert, a new critical-event management solution.

- BlackBerry strengthens ties to Chinese electric vehicle sector with its QNX on board software platform.

NYSE:BB started the day off well on the strength of its newest software announcement, but this momentum quickly tapered off by the closing bell. By the end of Monday’s trading session, BlackBerry had trimmed 1.43% to close at $11.68, despite reaching an intraday high of $12.51 shortly after the markets opened. It has been a rocky six weeks for BlackBerry shareholders as the stock has steadily declined since reaching a 52-week high level of $28.77 during the Reddit short squeeze event at the end of January.

Stay up to speed with hot stocks' news!

Monday also saw BlackBerry announce the development of a new critical-event management software called BlackBerry Alert. The platform is designed to protect enterprises from critical events such as cyberattacks or IT system outages, or even non technological issues like extreme weather or an infectious disease outbreak. Needless to say, after 2020, companies around the world are looking at beefing up their cybersecurity systems so BlackBerry Alert certainly presents itself at an opportune time. The new software is set to be integrated with such enterprise software solutions as Microsoft Teams and ServiceNow.

BB Stock forecast

The announcement of BlackBerry Alert comes on the heels of another partnership with Desay SV Automotive to provide its QNX software platform into the next generation of Chinese vehicles. In January, BlackBerry also teamed up with Baidu to provide QNX to the upcoming line of Baidu’s electric vehicles. QNX not only turns these vehicles into smart, interactive devices, but also provides a platform for autonomous, self-driving functionality which is the next frontier that global automakers are trying to tackle.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet