- BB one of the meme stocks for 2021 is back.

- Gamestop rally helps other meme stocks higher.

- Blackberry shares up again in Thursday pre-market.

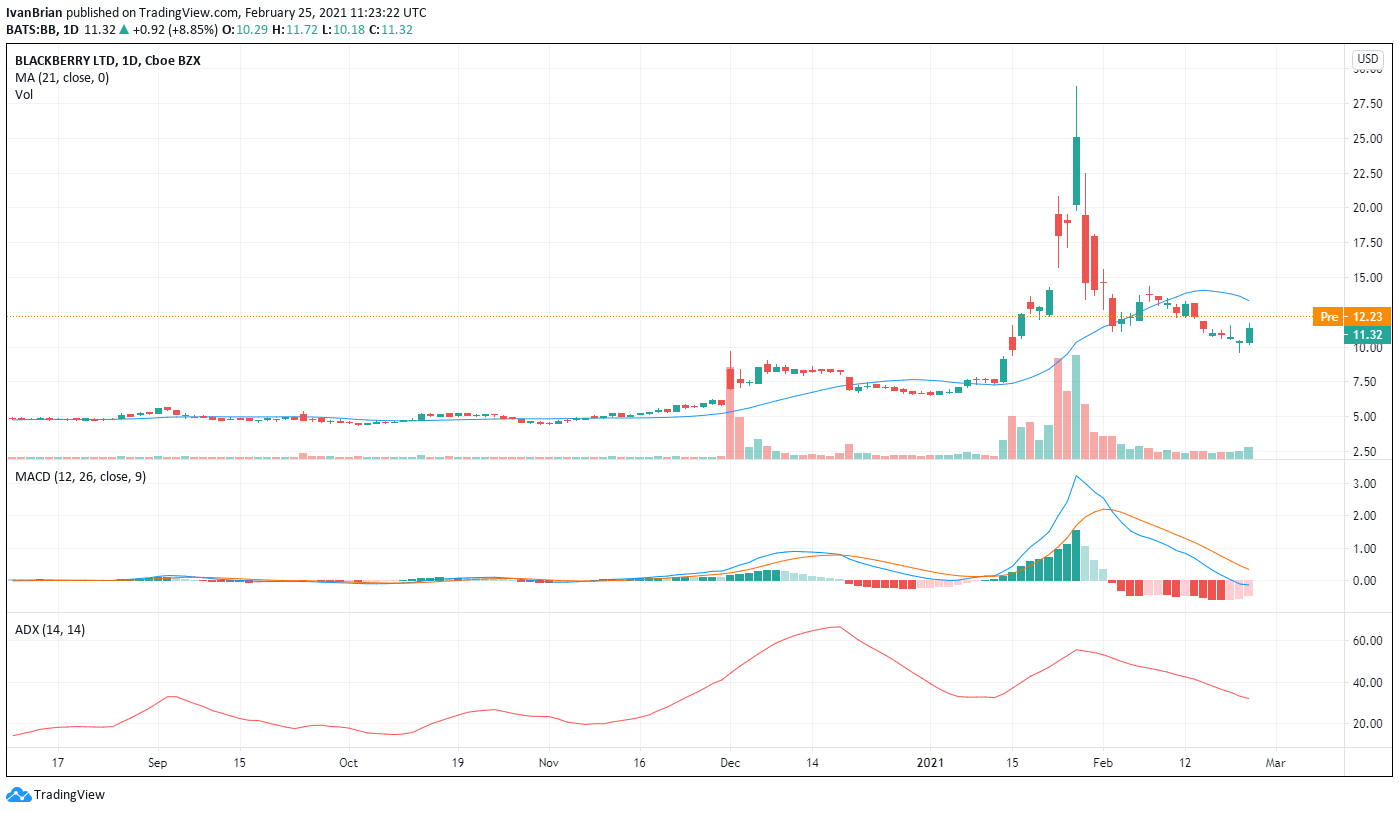

Just when you thought it was safe to come back out, the trend of 2021 comes back for a sequel. Gamestop 2.0 was released on trading screens across the world on Wednesday and the sequel proved every bit as compelling as the original. Meme stocks joined the ride and Blackberry didn't want to be seen to be missing out. Shares in BB closed at $11.32 up nearly 9%. Gamestop as usual had to be the headline grabber and closed for a gain of over 100%!

The trend continues in Thursday's pre-market with Gamestop up 58% while BB plays a supporting role for a gain of 6%. Both shares will surely pick up nods at the end-of-season awards galas for best newcomer and most exciting performance!!

BB Stock forecast

Forecast you say well of course that should be easy! Actually no, but let us look at what is happening and see if we can go from there. So Gamestop appears to once again have caught the attention of retail traders. Last weekend it was one of the most discussed stocks on the /wallstreetbets site with traders urging to "do it again". News on Tuesday that Gamestop CFO was to step down further added to retail trader's bullishness. Traders are looking at the big picture amid hopes Ryan Cohen can do for Gamestop what he did for Chewy.

So on Wednesday Gamestop took off again as broader markets decided it was risk back on. Other meme stocks also had positive news flow which helped the meme sector. AMC shares rallied as New York had announced earlier that it was to partially reopen cinemas.

Many regulators and lawmakers must have been watching development thinking oh no not again and CNBC's Jim Crammer tweeted "We need fair, deep markets. We want investing, good investing and we want to trust prices. What happened at the end of the day was a mockery of what is supposed to happen. Where is the government?"

Berkshire Hathaway Vice President and long-time Warren Buffet business associate Charlie Munger said before the rally started on Wednesday “That’s the kind of thing that can happen when you get a whole lot of people who are using liquid stock markets to gamble the way they would in betting on racehorses. And that’s what we have going in the stock market.” He was apparently referring to the original Gamestop rally in January!

BB Technical analysis

Tuesdays long-tail green candle gave the first clues that the bears may be losing power. This was followed up with Wednesday's strong rebuttal to the downside for most broader indices and BB gave a nice bullish engulfing candle on Wednesday as did S&P. From here resistance at $12.20 is where BB shares are currently in Thursdays pre-market. Above that, a take back of the 21 day moving average and then the $14.35 high from Feb 8 give us our immediate resistance levels.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds above 1.0400 in quiet trading

EUR/USD trades in positive territory above 1.0400 in the American session on Friday. The absence of fundamental drivers and thin trading conditions on the holiday-shortened week make it difficult for the pair to gather directional momentum.

GBP/USD recovers above 1.2550 following earlier decline

GBP/USD regains its traction and trades above 1.2550 after declining toward 1.2500 earlier in the day. Nevertheless, the cautious market mood limits the pair's upside as trading volumes remain low following the Christmas break.

Gold declines below $2,620, erases weekly gains

Gold edges lower in the second half of the day and trades below $2,620, looking to end the week marginally lower. Although the cautious market mood helps XAU/USD hold its ground, growing expectations for a less-dovish Fed policy outlook caps the pair's upside.

Bitcoin misses Santa rally even as on-chain metrics show signs of price recovery

Bitcoin (BTC) price hovers around $97,000 on Friday, erasing most of the gains from earlier this week, as the largest cryptocurrency missed the so-called Santa Claus rally, the increase in prices prior to and immediately following Christmas Day.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.