Barrick Gold (GOLD): Testing key level

Barrick Gold (#BarrickGold) is a Canadian-based company founded in 1983 which focuses on the production and sales of gold and copper, exploration activities and mine development. The company has 16 operating sites in 13 countries and operates 5 of the 10 largest gold mines in the world.

Fig 1:Comparison Chart: VanEck Gold Miners ETF vs. Barrick Gold.

Barrick Gold has outperformed the gold stocks which are represented by the VanEck Gold Miners ETF since late January this year, with YTD gains of +15.07% versus the latter at +7.07%. This outstanding result has been driven by the company’s solid fundamentals. As stated in its latest earnings report, total production in 2021 was on par with guidance for the third successive year. It has a long record of exploration success and a high quality target pipeline which contributed to its ability to stand out from peers. In the report, Barrick Gold announced a $1B share buyback and dividend increment by 11% to $0.10/share, suggesting the company has attractive financial stance.

The heightened geopolitical tension between Russia and Ukraine also serves as another positive catalyst. Economic sanctions are further disrupting supply chains, adding more pressures to already heightened prices and thus driving the inflation rate higher – a desirable condition for more money flowing into the gold market and related companies to hedge against inflation.

Fig.2: US Non-Farm Payrolls. Source: Trading Economics

The latest non-farm payroll (NFP) reported an increase of 678k jobs, the largest gain since July last year. The overall employment is 2.1 million (or -1.4%) below the pre-pandemic levels in February 2020. Unemployment ticked lower to 3.8%(or 6.3 million, about 600k above the pre-pandemic levels). Despite wages growth (5.1%y/y) lagging market expectations, it should not affect the Fed’s decision to raise rates by 25 bp later this month. Even more, based on the Fed watch data, probability for a rate hike has increased to 98.8%(was 94.9%before NFP). The Fed’s decision may temporarily suppress the bullish momentum of the safe-haven asset due to the price-in effect, however the inflation problem is not going to be cooled any sooner. As rising prices continue to erode consumers’ purchasing power, they may seek gold as a strategic hedge, thus benefiting companies like Barrick Gold.

Technical analysis

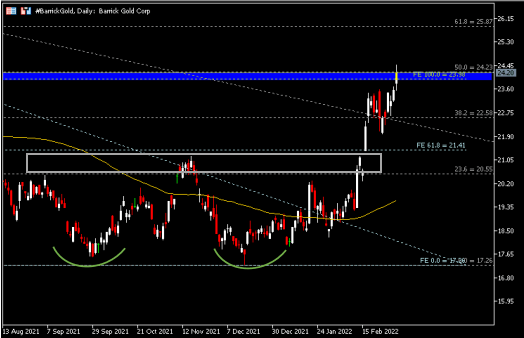

Last December, #BarrickGold found support at$17.26 , the lowest level since March 2020. It extended its bullish thrust after breaking the $20.55-$21.40 zone, which is also the neckline of a double bottom pattern. The company’s share price is currently testing resistance $24.00-$24.25. If a breakout is successful, the highest point of 2021 ($25.36) will be the next target, followed by $25.90(FR 61.8% extended from the high in August 2020 to the low in December 2021). On the other hand, a strong retrace from the key level would bring the first support $22.60 into test (FR 38.2%), followed by the neckline zone $20.55-$21.40 and the 100-SMA.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.