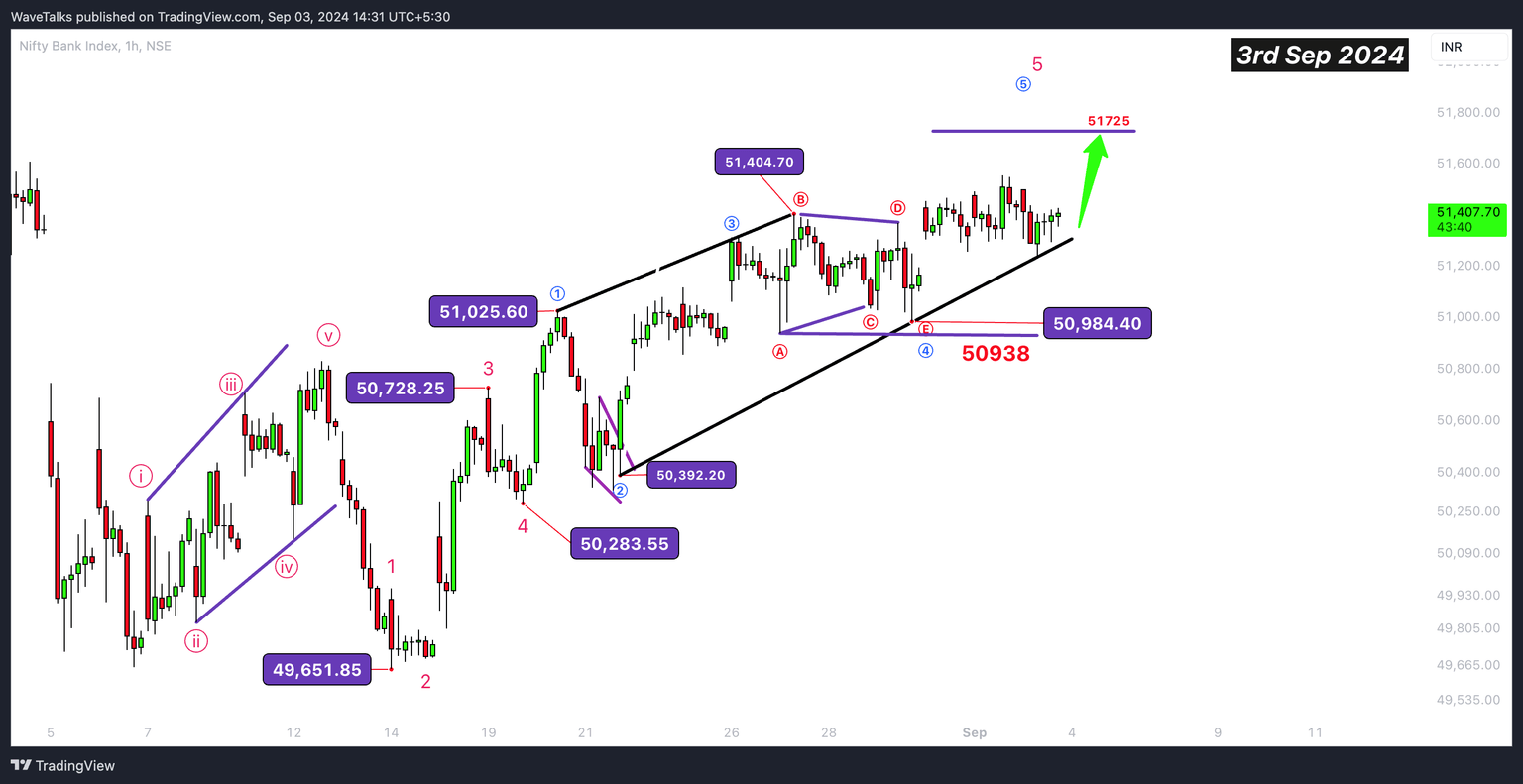

BankNifty (Elliott Wave) will 51,700+ be the short term top

BankNifty WaveTalks update

Patience rewarded: BankNifty’s explosive move beyond 51,404

As discussed in the last idea published on 29th August, it was suggested that holding the 50938 / 50939 critical level, Index can make new highs beyond 51404 which is very much possible. The market tested traders' patience on Friday, 30th August, and continued to do so on Monday, 2nd September, and even on 3rd September, with many feeling the urge to give up. However, bulls were fortunate as a last-minute explosive move took BankNifty from 51400 to 51750—a 350-point jump towards the end of the session.

Is BankNifty poised for a downturn amid US market declines?

Now, with U.S. markets trading in deep red, with major indices like S&P, Dow, and Nasdaq all down more than 1%, the big question arises: Has the BankNifty pattern we’ve been discussing since last week finally completed? Are we about to fall below 50939, potentially slipping down to the 50300 support level?

Only time will reveal the answers to these questions.

Author

Abhishek H. Singh

WaveTalks

Abhishek is a seasoned financial analyst with over a decade of experience specializing in Elliott Wave Theory.