Bajaj Finserve Indian Stocks Elliott Wave technical analysis [Video]

![Bajaj Finserve Indian Stocks Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Industries/ConsumerServices/woman-consumer-office-637435344173237349_XtraLarge.jpg)

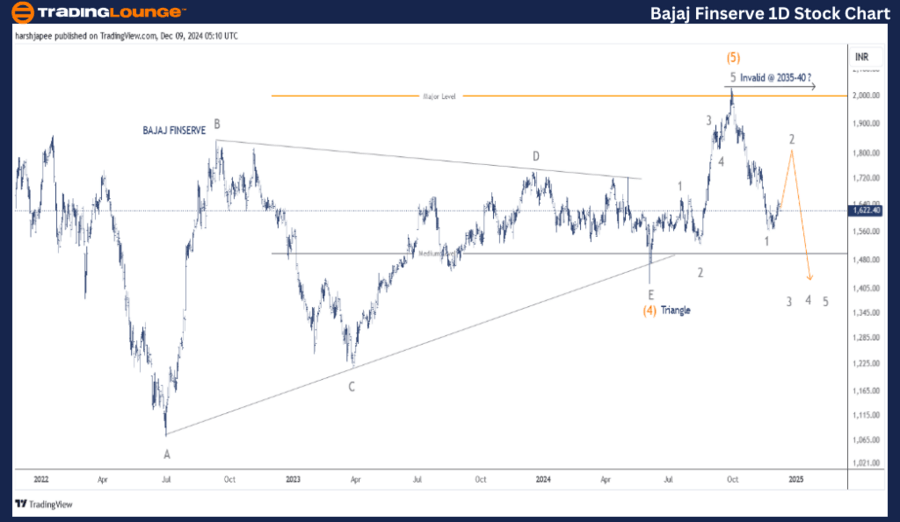

Bajaj Finserve (one day chart) Elliott Wave technical analysis

Function: Counter Trend (Minor degree Grey).

Mode: Corrective.

Structure: Impulse within larger degree correction.

Position: Minor Wave 1 Grey.

Details: Minor Wave 1 is potentially complete below 1600. If correct, Minor Wave 2 rally should unfold towards 1800 levels before bears are back in control.

Invalidation point: 2040.

BAJAJ FINSERVE Daily Chart Technical Analysis and potential Elliott Wave Counts:

BAJAJ FINSERVE daily chart is indicating a potential trend reversal against 2040 high, which was registered in September 2024. The larger degree uptrend looks complete as bears remain poised to complete the first impulse wave lower around 1400-1550 zone.

Earlier, the stock had unfolded a larger degree triangle consolidation between July 2022 and June 2024, terminating Intermediate Wave (4) Orange around 1420 mark. Bulls managed to terminate Intermediate Wave (5) as a thrust impulse wave before prices reversed sharply lower.

If the above holds well, price action would slip through the 1400 mark in the near term, before producing a counter trend rally.

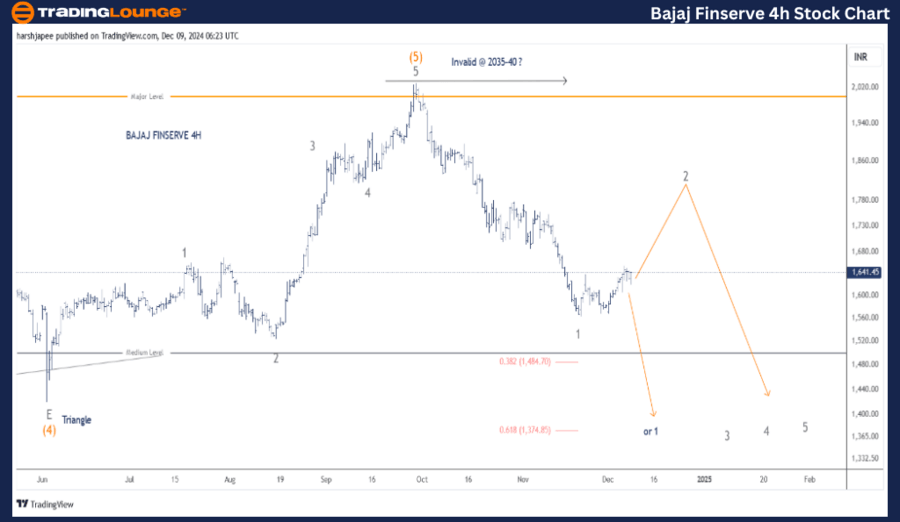

Bajaj Finserve (four-hour chart) Elliott Wave technical analysis

Function: Counter Trend (Minor degree Grey).

Mode: Corrective.

Structure: Impulse within larger degree correction.

Position: Minor Wave 1 Grey.

Details: Minor Wave 1 is potentially complete below 1600. If correct, Minor Wave 2 rally should unfold towards 1800 levels before bears are back in control. Alternatively, Minor Wave 1 could complete around 1400 mark before the corrective rally begins.

Invalidation point: 2040.

BAJAJ FINSERVE four-hour chart technical analysis and potential Elliott Wave counts:

BAJAJ FINSERVE 4H chart is highlighting the sub waves after Intermediate Wave (4) Orange terminated as a triangle around 1420 mark in June 2024. Intermediate Wave (5) unfolded as an impulse, terminating around 2035-40 mark.

Furthermore, the stock has turned lower since then as a potential impulse lower could be either complete around 1565 mark or could extend through 1400 zone. Please note 1400 zone is close to the triangle termination of previous Wave (4) as well. Once Minor Wave 1 lower is complete, we can expect a counter trend rally to materialize.

Conclusion:

BAJAJ FINSERVE has potentially turned lower against 2040 high and it has potentially completed its first impulse drop around 1550 mark. If correct, a counter trend rally should be underway soon to unfold Minor Wave 2 Grey.

Elliott Wave analyst: Harsh Japee.

Bajaj Finserve Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.