Bajaj Auto Elliott Wave technical analysis [Video]

![Bajaj Auto Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Industries/Transportation/road-transport-truck-637435358188416671_XtraLarge.jpg)

Bajaj Auto Elliott Wave technical analysis

Function: Larger Degree Trend Higher (Intermediate degree, orange).

Mode: Motive.

Structure: Impulse.

Position: Minor Wave 5 Grey.

Details: Minor Wave 5 Grey is now progressing higher against 9382 low. Prices have taken out 11060 mark confirming larger degree trend higher as Intermediate Wave (5) is unfolding. One more push above 11500 looks possible.

Invalidation point: 9382.

Bajaj Auto daily chart technical analysis and potential Elliott Wave counts

Bajaj Auto daily chart is clearly indicating a progressive rally, which has more room, and potentially terminate above 11500 mark going forward. That peak should ideally terminate Intermediate Wave ((5)) Orange and pave way for a correction.

The stock has produced nearly 300% returns since its December 2021 lows registered around 3050 mark. Intermediate Wave (5) has been unfolding since then and is still looking to push one last time before terminating.

Bajaj Auto is a classic case of a third (Minute Wave ((iii)) Navy) of third (Minor Wave 3 Grey) extension when prices rallied between 3400 through 9300-400 levels in nearly 18 months. The fibonacci extensions are pointing towards 13000 price targets for Minor Wave 5.

Bajaj Auto Elliott Wave technical analysis

Function: Larger Degree Trend Higher (Intermediate degree, orange).

Mode: Motive.

Structure: Impulse.

Position: Minor Wave 5 Grey.

Details: Minor Wave 5 Grey is now progressing higher against 9382 low. Prices have taken out 11060 mark confirming larger degree trend higher as Intermediate Wave (5) is unfolding. Furthermore, Minute Wave ((iv)) Navy is unfolding towards 10000 mark. Once complete, Minute Wave ((v)) should be underway higher through 11500.

Invalidation point: 9382.

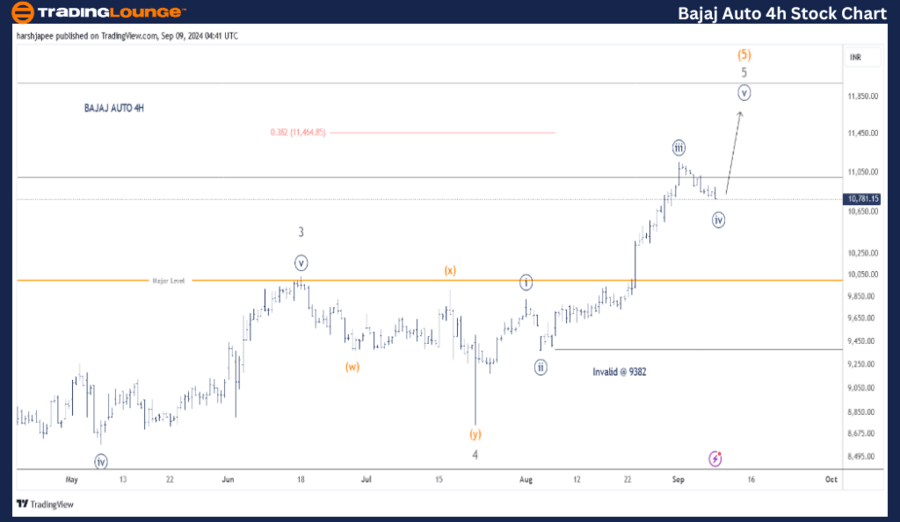

Bajaj Auto four-hour chart technical analysis and potential Elliott Wave counts

Bajaj Auto 4H chart highlights wave counts between Minor Wave 3 Grey termination and current price around 10800 mark. The corrective wave through Minor 4 unfolded as a combination (w)-(x)-(y) around 8790 on July 23, 2024.

Since then, the rally can be sub divided into a potential impulse as Minute Waves ((i)), (ii)) ((iii)) and ((iv)) complete as prices approach the 10800 mark. If correct, Minute Wave ((v)) should turn higher from here and push through 11500 at least.

Conclusion

Bajaj Auto is progressing within Minute Wave ((iii)) higher towards 11500 levels, as Minor Wave 5 of Intermediate Wave (5) looks to produce one more high before bears are back.

Bajaj Auto Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.