Baba Stock Price News: Alibaba Group Holding Ltd set to surpass $700 billion value, amid ANT IPO talk

- NYSE: BABA is set to kick off trading at $267, up over 3% after leaping by nearly 9% on Wednesday.

- Alibaba is benefiting from reports that Ant Financial is on the verge of an IPO.

- Jack Ma's firm has been caught in the Sino-American trade wars.

Alibaba Group Holding Inc. may benefit from its holding in Ant Financial Services Group – the same way as Japan's Softbank holds up thanks to its holding in NYSE: BABA.

Despite China's tightening grip in Hong Kong, Jack Ma's firm is planning to offer shares of its financial arm in the city-state. According to Reuters, Alibaba is aiming for a high value of around $200 billion for Ant, but these details are yet to be confirmed.

Reports that the White House may wish to destabilize the peg of the Hong Kong dollar to punish China have not moved investors – not in HK nor those investing in BABA stock. Founder Ma has been on good terms with the Chinese Communist Party, as well as with Americans. He personally contributed protection gear to American hospitals.

The firm was seen as a successful giant yet without a future. Alibaba founded the Single's Day shopping holiday on November 11 – competing with Black Friday. However, analysts said it focuses too much on online sales rather than developing new products. Floating Ant would allow CEO Daniel Zhang and his firm to move forward and better compete with US tech giants – including the world's No. 1 e-tailer Amazon.

China's largest online retailer may

BABA stock forecast

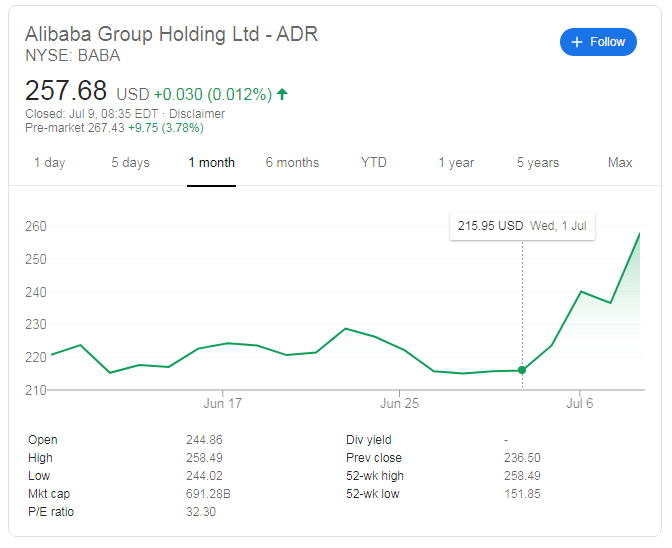

NYSE: BABA advanced by around 9% on Wednesday, following these reports, scoring a 52-week high of $258.49. According to Thursday's premarket pricing, Alibaba is changing hands at above $267, representing another substantial increase. That would send the e-commerce behemoth to a valuation of over $700 billion.

It is far above the 52-week low of $151.85 and traded below $220 just last week.

Here is the BABA stock chart:

The BABA stock forecast remains positive while coronavirus remains under control in China – and as long as American investors focus on both the ANT IPO and BABA stock earnings.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.