BABA Stock News: Alibaba Group Holding eyes a positive start to the week

- NYSE:BABA futures edged higher in quiet start to the week

- Investors seem to be suspicious of the Common Prosperity donations from big tech firms.

- Ride-hailing firm Didi Global gains on news that Beijing may take over operations.

/stock-market-graph-gm532464153-55981218_XtraLarge.jpg)

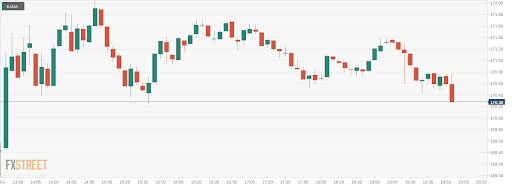

Update September 7: After finishing August about 14% down, NYSE: BABA staged an impressive recovery on the first day of September, only to lose legs on Friday. BABA continues to bear the brunt of the continued concerns over the regulation of China's tech sector. With the US full market returning on Tuesday, BABA stock price is seen opening higher, as the S&P 500 futures trade with gains amid a risk-on market mood, courtesy of the fading Fed’s tapering expectations. BABA share price settled on Friday at $170.30, down 1% on the day.

NYSE:BABA fell for the second straight session as Chinese ADRs sold off into the September Labor Day weekend. On Friday, shares of AliBaba fell by 0.99% and closed the trading day at $170.30. The markets lacked any sort of real direction on Friday, as Wall Street mostly shrugged off a disappointing jobs report for the month of August. The Dow and S&P 500 closed the day lower, while the NASDAQ rallied to a new all-time high on tech strength and impressive quarters from the likes of DocuSign (NASDAQ:DOCU) and MongoDB (NASDAQ:MDB).

Stay up to speed with hot stocks' news!

After news broke of AliBaba joining other tech giants like Tencent (TCEHY) and PinDuoDuo (NASDAQ:PDD) in donating to President Xi Jingping’s Common Prosperity movement, shares of the eCommerce giant fell. In fact, most of the tech companies that also trade on the Hang Seng index fell after the report, despite what appears to be these companies squaring up with the government. The truth is, the donations do not mean that the ongoing regulations and crackdowns from the government are over. In fact, it may mean more donations and payments to come which has investors retreating from AliBaba after its recent attempt to rebound.

BABA stock price target

In other regulatory news, a report surfaced that ride-hailing company Didi Global (NYSE:DIDI) could see its troubled operations taken over by the Chinese government in the near future. This does not mean that Didi would be a government institution, rather it would be operated by government associated firms. Shares of Didi gained 2.38% on Friday, as the stock closed out its most successful week as a publicly traded company.

Previous updates

Update: NYSE:BABA heads into the Asian opening trading at $170.75 per share, marginally up on futures, as Wall Street remained closed due to Labor Day. However, substantial gains in European indexes pushed US futures higher. Market participants remain in risk-on mood, which could provide additional support to BABA on Tuesday once traders return to their desks.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet