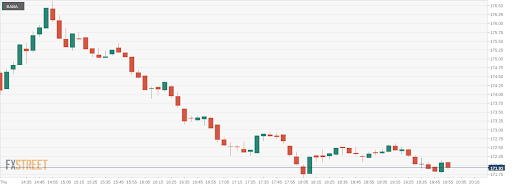

BABA Stock News: Alibaba Group Holding retreats for second consecutive day

- NYSE:BABA fell by 0.74% on Thursday as Chinese ADRs pulled back.

- AliBaba pledges to spend $15.5 billion towards ‘common prosperity’ in China.

- Ark Invest sells its final shares of AliBaba from its various ETFs.

NYSE:BABA snapped its three-day win streak on Thursday as its recovery from the recent sell off stalled. Shares of BABA fell by 0.74% during the session, and closed the day at $172.00. The move came as the S&P 500 and NASDAQ once again eked out fresh new all-time highs, and the Dow rallied for its first positive day of the week. After climbing higher the past few sessions, Chinese ADRs pulled back today, with PinDuoDuo (NASDAQ:PDD) lagging the sector as shares dropped 3.81% during trading hours and nearly 5.0% in after hours trading.

Stay up to speed with hot stocks' news!

AliBaba is the latest company to ‘pledge’ a large sum of money to China in the name of ‘common property’. The company has agreed to pledge the equivalent of $15.5 billion by 2025, which is meant to improve economic inequality amongst citizens. Other companies that have already pledged money to President Xi Jinping’s initiative include Tencent and Geely Automobile. AliBaba is also planning to set up a common prosperity development fund worth over 20 billion yuan. Whether this is seen as supporting the nation or paying off the government for the recent crackdown, investors will be watching to see if this is the end for the government’s scrutiny of AliBaba.

BABA stock price target

Take these signs for what they are worth, but Ark Invest has sold off the last of its position in AliBaba across all of its ETFs. This doesn’t necessarily mean that Ark is done with AliBaba as the company closed out its position in PinDuoDuo only to re-add the stock after it dipped. Catherine Wood has been known to avoid uncertainty, so it may just be a temporary move until things have stabilized in China.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet