- AZN covid 19 vaccine under increased scrutiny after reports of blood clots.

- Austria stops using a batch of AZN's covid 19 vaccine.

- AZN vaccine shows no evidence so far of being linked to Austrian cases according to EMA.

Update: Germany has now added to the growing list of countries that have suspended AstraZeneca's covid 19 vaccine. Germany's Health Minister says need to wait for approval for European Medicines Agency, says risk is very low but connection with vaccine cannot be ruled out, Reuters.

Update: AstraZeneca has been under increasing scrutiny this weekend as further countries announce temporary usage suspensions of AZN's covid-19 vaccine. Ireland and the Netherlands announced a temporary suspension on Sunday, joining Iceland who earlier had also suspended the vaccine. Indonesia has joined the delay saying it will await a review from the WHO. On Friday the WHO said there is no indication that the reported events were caused by the vaccine and earlier last week the European Medicines Agency has echoed this view. AstraZeneca said it had staged a review of over 17 million people who had received the vaccine in the EU and UK and saw no evidence of increased risk of blood clots, according to Reuters. It is a further problem for the EU's sluggish start to vaccinating its population as the EU block struggles with vaccine supply.

AZN shares are currently trading £69.60 in London, up 0.1%

Stay up to speed with hot stocks' news!

AstraZeneca shares were under pressure on Thursday as Reuters reports that Denmark has temporarily suspended its covid 19 vaccine, after reports of cases of blood clots forming. AZN shares are currently $49 down 1.6% in Thursday's pre-market. AZN shares in London are trading £70.24 down 2.3%.

AZN Stock News

Denmark is to suspend the use of AstraZeneca's covid 19 vaccine for two weeks according to Reuters. Denmark is to investigate reported cases of blood clots forming. Denmark did not say how many cases. "Both we and the Danish Medicines Agency have to respond to reports of possible serious side-effects, both from Denmark and other European countries," the director of the Danish Health Authority, Soren Brostrom, said in a statement, "It is important to emphasise that we have not opted out of using the AstraZeneca vaccine, but that we are putting it on hold," Brostrom said. Reuters.

Reports from Austria say it is also investigating a particular batch of the AstraZeneca vaccine again coming from Reuters. "We informed all European colleagues in the European network as this batch, which amounted to roughly a million doses in total, was sent to 17 European countries," Christa Wirthumer-Hoche, the head of Austrian public health agency AGES' medicines market supervisory body said-Reuters.

AstraZeneca said all batches are subject to strict and rigorous quality controls and "no confirmed serious adverse events associated with the vaccine".

The European Medicines Agency said on Wednesday "The Austrian national competent authority has suspended the use of a batch of COVID-19 Vaccine AstraZeneca (batch number ABV5300) after a person was diagnosed with multiple thrombosis (formation of blood clots within blood vessels) and died 10 days after vaccination, and another was hospitalised with pulmonary embolism (blockage in arteries in the lungs) after being vaccinated. The latter is now recovering. As of 9 March 2021, two other reports of thromboembolic event cases had been received for this batch.

"There is currently no indication that vaccination has caused these conditions, which are not listed as side effects with this vaccine", the EMA said.

Spain also said on Thursday that it has not seen any issues with blood clots related to AstraZeneca's covid vaccine and will keep using it, according to Health Minister Carolina Darias, "so far, no causal relation between the vaccine and the blood clot events has been established", Reuters reports.

AstraZeneca said on Thursday that the safety of the vaccine has been extensively studied in Phase III clinical trials, peer reveiwed data confirms the vaccine has been generally well tolerated.

AZN Stock forecast

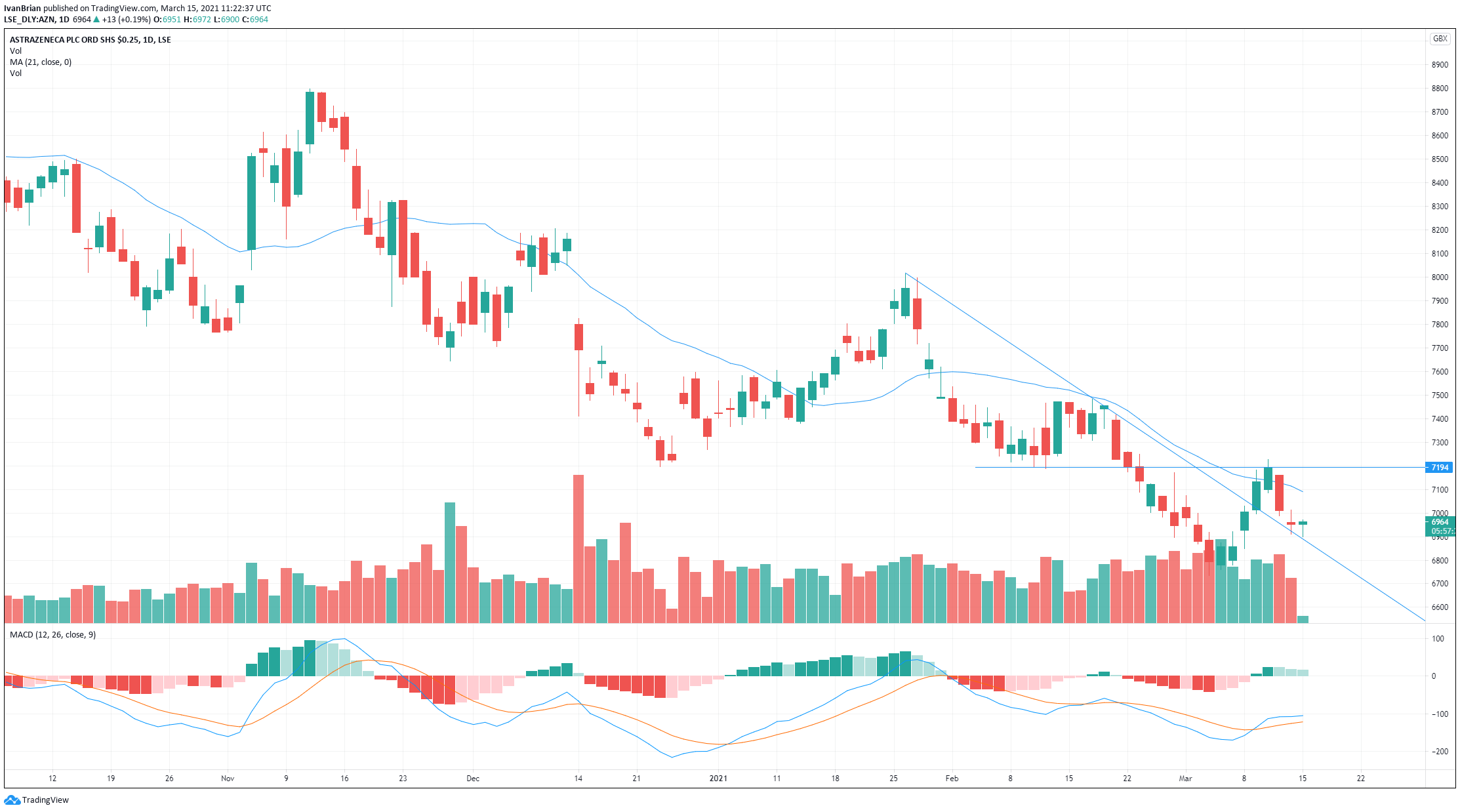

AZN shares are currently £70.24 in London, their main listing. AZN shares have recovered from recent pressure as global markets have rallied. Resistance comes at £71.94 and then a test of £74.68 which would break the bearish cycle of lower highs. Support at £68

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD retreats from fresh multi-year highs, holds above 1.1000

EUR/USD neared 1.1150 in the European session on Thursday, shedding roughly 100 pips afterwards. The Euro holds on to solid gains amid broad US Dollar weakness, after US President Trump unveiled aggressive tariffs on the "Liberation Day." Markets await mid-tier US data releases.

GBP/USD surges to multi-month tops near 1.3200 ahead of US data

GBP/USD paused its rally after briefly surpassing the 1.3200 mark, yet holds on to most of its intraday gains. The US Dollar plunged to a fresh YTD low amid worries about a tariff-driven US economic slowdown, lifting Fed rate cut bets and weighing on the Greenback. The focus now remains on the US data for further impetus.

Gold retreats below $3,100 from all-time peak

Gold price extends its steady intraday pullback from the all-time peak touched this Thursday, and pierces the $3,100 mark in the European session. Bullish traders opt to take some profits off the table and lighten their bets around the commodity amid slightly overbought conditions.

SOL is the winner as Solana chain turns into battleground for meme coin launchpad and DEX

Solana (SOL) gains nearly 2% in the last 24 hours and trades at 118.28 at the time of writing on Thursday. A Decentralized Exchange (DEX) and a meme coin launchpad built on the Solana blockchain have waged a war for users and compete for the trade volume on the chain.

Trump’s “Liberation Day” tariffs on the way

United States (US) President Donald Trump’s self-styled “Liberation Day” has finally arrived. After four straight failures to kick off Donald Trump’s “day one” tariffs that were supposed to be implemented when President Trump assumed office 72 days ago, Trump’s team is slated to finally unveil a sweeping, lopsided package of “reciprocal” tariffs.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.