AXISBANK Elliott Wave technical analysis [Video]

![AXISBANK Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Industries/Media/music-board_XtraLarge.jpg)

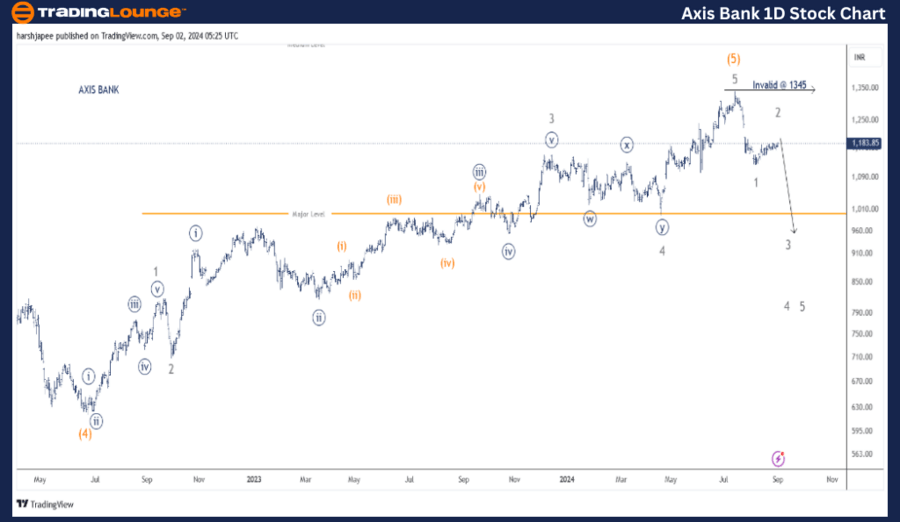

AXIS BANK LTD – AXISBANK (1D Chart) Elliott Wave/Technical Analysis

Function: Counter Trend (Minor degree, Grey. Wave A unfolding).

Mode: Corrective.

Structure: Potential Impulse.

Position: Minor Wave 2 Grey of A complete.

Details: Minor Wave 3 Grey should turn lower from here soon against 1345.

Invalidation point: 1340-50.

Axis Bank Daily Chart Technical Analysis and potential Elliott Wave Counts:

Axis Bank daily chart is indicative of the larger degree trend complete around 1345 in July 2024. The stock might have terminated its fifth wave at multiple degree as marked on the chart here. If correct, a larger degree corrective wave is now underway against 1345.

Axis Bank has been trending higher since its June 2022 low registered around 620 levels, also terminating intermediate Wave (4) Orange. The entire rally can be sub divided into five ways through 1345 mark, terminating Intermediate Wave (5).

With the above structure holding well, prices should drag lower towards 998 levels in the medium term. This would confirm a much deeper correction ahead. Minor Waves 1 and 2 might be complete at the writing bears prepare to resume Wave 3 lower.

AXIS BANK LTD – AXISBANK (4H Chart) Elliott Wave/technical analysis

Function: Counter Trend (Minor degree, Grey. Wave A unfolding).

Mode: Corrective.

Structure: Potential Impulse.

Position: Minor Wave 2 Grey of (A) complete.

Details: Minor Wave 2 is either complete around 1190 or is near to completion. If correct, Minor Wave 3 Grey should turn lower from here.

Invalidation point: 1340-50.

Axis Bank 4H Chart Technical Analysis and potential Elliott Wave Counts:

Axis Bank 4H chart gives a closer look since Minor Wave 4 terminated around 998 mark in April 2024. The rally through 135 could be sub divided into five waves, terminating Minor Wave 5 Grey. If correct, prices should now stay below 1345 going forward.

Furthermore, the stock might have produced its first impulse drop since 1345 highs around 1125 levels. Alternatively, Minute Wave ((iv)) is still unfolding with one more leg lower to complete Minor Wave 1 Grey. Either way, the stock should be under pressure until below 1345.

Conclusion

Axis Bank is expected to turn lower as Minor Wave 3 begins to unfold against 1345 highs.

Elliott Wave analyst: Harsh Japee.

AXIS BANK LTD – AXISBANK (4H Chart) Elliott Wave/technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.