AXISBANK Elliott Wave technical analysis

Function: Counter Trend (Minor degree, Grey. Wave A unfolding).

Mode: Corrective.

Structure: Potential Impulse.

Position: Minute Wave ((ii)) Navy of 1/A complete.

Details: Minute Wave ((iii)) Navy is now underway towards 1000 at least, against 1345. A minor pullback is seen unfolding before bears are back in control.

Invalidation point: 1340-50.

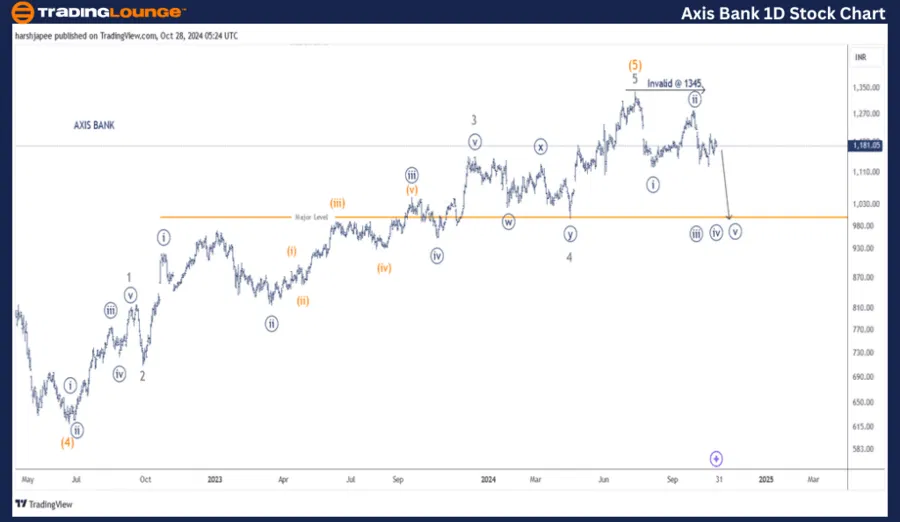

AXIS Bank daily chart technical analysis and potential Elliott Wave counts:

AXIS Bank daily chart is indicating a progressive rally complete around 1345, which is Intermediate Wave (5) Orange termination. The stock might have turned lower since then as Minute Wave ((i)) and ((ii)) also seem to be complete with Minute Wave (((iii)) now underway towards 1000 mark.

The stock had terminated Intermediate Wave (4) Orange around 620 in January 2022.Since then Minor Waves 1 through 5 seem complete, terminating around 1345 high. Minor Wave 3 was an extension terminating around 1155, while Minor Wave 4 as a combination terminating around 995 mark.

A counter trend at Minute degree might be unfolding against 1345 high. Within the drop, Minute Wave ((iii)) might be unfolding at the time of writing.

AXISBANK Elliott Wave technical analysis

Function: Counter Trend (Minor degree, Grey. Wave A unfolding).

Mode: Corrective.

Structure: Potential Impulse.

Position: Minute Wave ((ii)) Navy of 1/A complete.

Details: Minute Wave ((iii)) Navy is now underway towards 1000 at least, against 1345. A minor pullback is seen unfolding before bears are back in control.

Invalidation point: 1340-50.

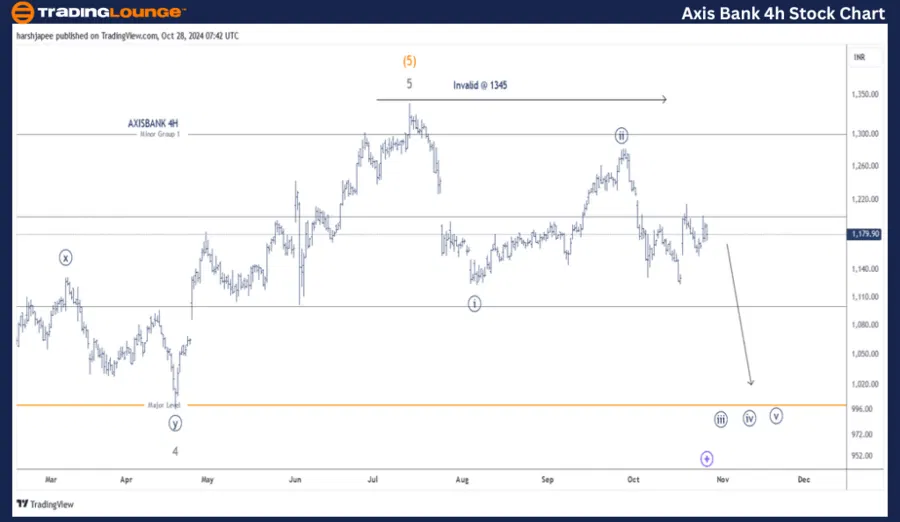

AXIS Bank four-hour chart technical analysis and potential Elliott Wave counts:

AXIS Bank 4H chart highlights sub waves from Minor Wave 3 Grey onwards. Please note Wave 4 was a combination before Wave 5 rallied through 1345 high. Furthermore, a lower degree impulse wave Minute ((i)) looks complete around 1128 low, followed by a corrective rally Minute Wave ((ii)) around 1290. High probability remains for bears to remain in control as Minute Wave ((iii)) is underway.

Conclusion

AXIS Bank could be unfolding Minute Wave ((iii)) lower towards 1000 mark, as long as prices stay below 1345.

Axis Bank Ltd. Elliott Wave technical analysis [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.

Recommended content

Editors’ Picks

EUR/USD extends gains above 1.0800 as mood improves

EUR/USD preserves its recovery momentum and trades in positive territory above 1.0800 on Monday. In the absence of high-tier data releases, the improving risk mood makes it difficult for the US Dollar to find demand and helps the pair edge higher.

GBP/USD rises toward 1.3000 on renewed USD weakness

GBP/USD holds its ground and advances to the 1.3000 area in the second half of the day on Monday. Following the previous week's rally, the US Dollar struggles to find demand as the risk mood improves on Monday, allowing the pair to stretch higher.

Gold price remains on the defensive below $2,748-2,750 hurdle amid positive risk tone

Gold price struggles to capitalize on its intraday bounce and remains below the $2,748-2,750 supply zone through the early part of the European session on Monday. Safe-haven demand stemming from Middle East tensions and US election jitters continues to act as a tailwind for the precious metal.

Metaplanet stock jumps after announcing $10.5 million Bitcoin purchase

Japanese investment firm Metaplanet Inc. said on Monday that it had expanded its Bitcoin holdings by around 156 BTC, worth around $10.5 million. With the latest purchase, the Tokyo-listed firm has more than doubled its Bitcoin holdings in Q3, holding 1,018 BTC valued at around $69 million.

US elections: The race to the White House tightens

Trump closes in on Harris’s lead in the polls. Neck and neck race spurs market jitters. Outcome still hinges on battleground states.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.