AutoZone Inc. (AZO Stock) should test its 52W high at around $2610

Today’s instrument is the AutoZone Inc., a retailer and distributor of automotive replacement parts and accessories in the United States, traded in the NYSE exchange under the ticker AZO.

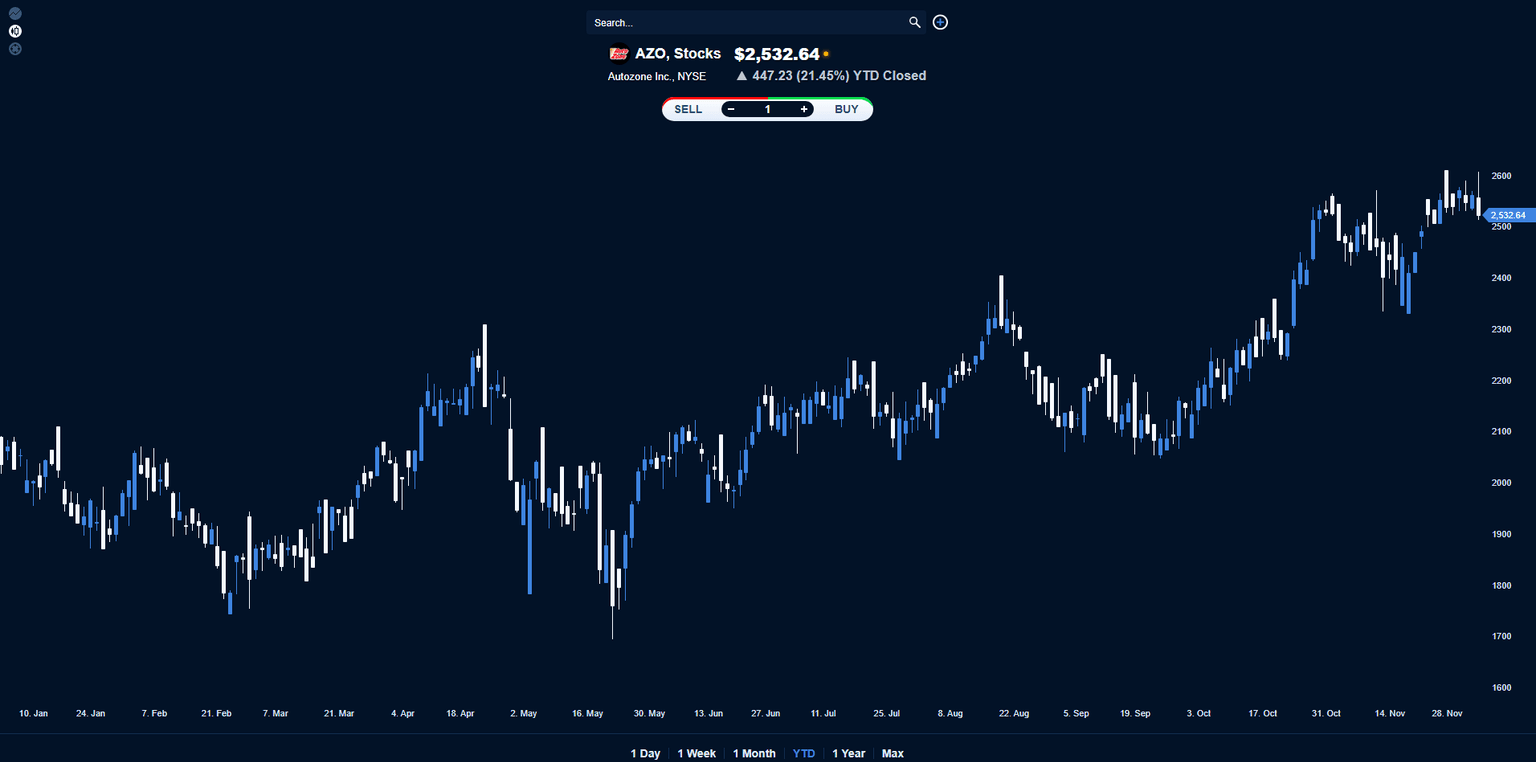

Looking at the AZO’s chart, we can see that it was lastly traded at around $2530.

Today it is announcing its quarterly earnings and if the market’s anticipation is positive then it should test its 52W high at around $2610 otherwise it could test its support level at around $2350.

Author

AAATrade Team

AAATrade

The AAATrade Team has extensive experience in content writing for the financial industry. Stelios Nikolaou is the lead writer of the team, he currently works at AAATrade to provide research and content writing services.