Australian Dollar holds its ground amid weaker US Dollar, ASX 200 Index

- Australian Dollar could face challenges as the RBA is expected to maintain its current rates.

- Australia's S&P/ASX 200 Index tracks softer commodity prices.

- Chinese Retail Sales (YoY) increased by 5.5% in February, against the expected 5.2% and 7.4% prior.

- US Dollar retraces gains on weaker US Treasury yields.

The Australian Dollar (AUD) snaps its losing streak on Monday. The AUD/USD pair receives upward support as the US Dollar (USD) retraces its gains on lower US Treasury yields. However, market participants adopt caution ahead of the Reserve Bank of Australia's (RBA) policy decision scheduled for Tuesday. Additionally, investors are awaiting interest rate decisions from both the People's Bank of China (PBoC) and the US Federal Reserve (Fed), expected to be released on Wednesday.

Australian Dollar could have faced pressure as the S&P/ASX 200 Index extends its decline for the third consecutive session. Mining and energy stocks are leading the downturn, reflecting softer commodity prices. Meanwhile, severe Tropical Cyclone Megan is expected to bring destructive winds and heavy rainfall to Australia’s far north. Evacuations are underway, and a major manganese mine has been closed in anticipation of the cyclone's arrival.

The US Dollar Index (DXY) loses ground amidst the market confusion surrounding the Federal Reserve, which is expected to maintain its higher interest rates in response to recent inflation pressure. Traders will likely observe the housing data from the United States (US) on Tuesday.

Daily Digest Market Movers: Australian Dollar appreciates amid a market risk aversion

- According to Bloomberg, Westpac anticipates the Reserve Bank of Australia could maintain its cash rate at 4.35% at Tuesday's meeting.

- RBA Governor Michele Bullock recently stated that inflation in Australia is primarily "homegrown" and "demand-driven," attributable to the strength of the labor market and increasing wage inflation. The RBA does not anticipate this phenomenon occurring until 2026.

- China's Retail Sales (YoY) increased by 5.5% in February, against the expected 5.2% and 7.4% prior.

- Chinese Industrial Production (YoY) rose by 7.0%, compared to the market expectation of a 5.0% figure in February and 6.8% previous reading.

- According to the CME FedWatch Tool, the probability of a rate cut in March currently stands at 1.0%, while it has decreased to 6.1% for May. The likelihood of a rate cut in June and July is lower, at 56.3% and 75.2%, respectively.

- The preliminary US Michigan Consumer Sentiment Index for March decreased to 76.5, from the previous reading of 76.9. This decline comes in contrast to expectations of it remaining unchanged.

- The Board of Governors of the Federal Reserve released Industrial Production (MoM), which increased by 0.1% in February, against the expected reading of flat 0.0% and from the previous decline of 0.5%.

- The US Core Producer Price Index (PPI) remained consistent with the rise of 2.0% year-over-year in February, maintaining its position above the 1.9% expected. The monthly report showed an increase of 0.3% against 0.5% prior, exceeding the expected 0.2% reading.

- US PPI (YoY) increased by 1.6% in February, surpassing the expected 1.1% and 1.0% prior. PPI (MoM) rose by 0.6% above the market expectation and the previous increase of 0.3%.

- US Retail Sales rose by 0.6% monthly, below the expected 0.8% in February, swinging from the previous decline of 1.1%. While Retail Sales Control Group improved to a flat 0.0%, compared to the previous decline of 0.3%.

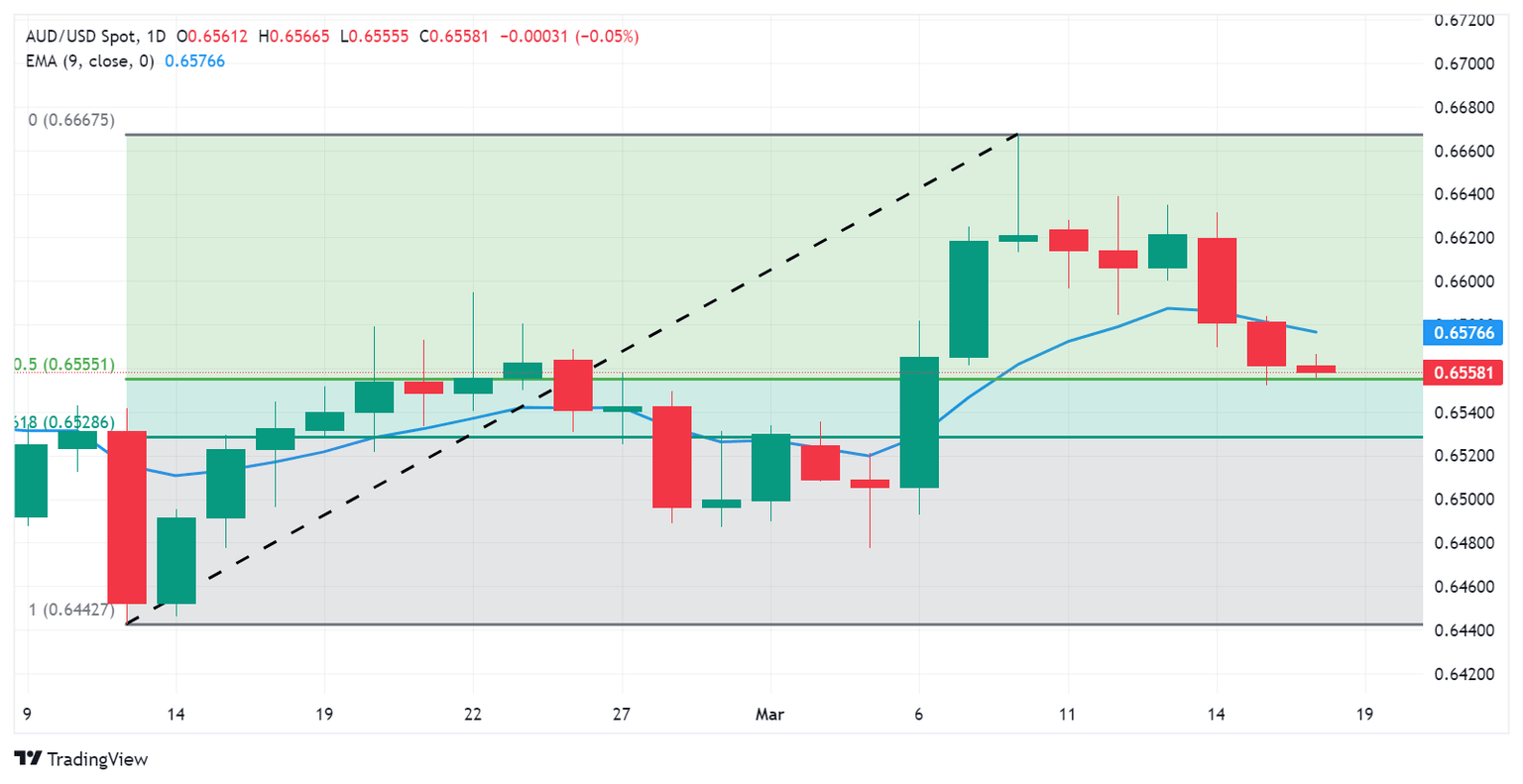

Technical Analysis: Australian Dollar hovers above the major support at 0.6550

The Australian Dollar is trading near 0.6560 on Monday. The AUD/USD pair could find immediate support around the 50.0% retracement level of 0.6555, coinciding with a significant support level of 0.6550. A breach below this level could potentially exert downward pressure on the pair, with further support expected around the 61.8% Fibonacci retracement level of 0.6528, followed by the psychological level of 0.6500. On the upside, the AUD/USD pair may face resistance near the nine-day Exponential Moving Average (EMA) at 0.6576, followed by the psychological barrier at 0.6600.

AUD/USD: Daily Chart

Australian Dollar price today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.05% | 0.00% | -0.06% | -0.09% | 0.13% | -0.10% | 0.01% | |

| EUR | 0.04% | 0.04% | -0.02% | -0.06% | 0.16% | -0.06% | 0.03% | |

| GBP | 0.00% | -0.03% | -0.05% | -0.09% | 0.13% | -0.09% | 0.00% | |

| CAD | 0.06% | 0.02% | 0.05% | -0.03% | 0.19% | -0.04% | 0.06% | |

| AUD | 0.09% | 0.06% | 0.09% | 0.04% | 0.22% | 0.00% | 0.09% | |

| JPY | -0.13% | -0.19% | -0.08% | -0.17% | -0.22% | -0.23% | -0.13% | |

| NZD | 0.11% | 0.06% | 0.09% | 0.04% | 0.00% | 0.22% | 0.09% | |

| CHF | 0.01% | -0.03% | 0.00% | -0.05% | -0.09% | 0.12% | -0.09% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought-after exports, then its currency will gain in value purely from the surplus demand created by foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.