Australian Dollar falls as US Dollar steadies due to rising hawkish mood surrounding Fed

- The Australian Dollar loses ground after releasing mixed domestic data on Thursday.

- China's Consumer Price Index rose by 0.1% YoY in December, against the previous 0.2% increase.

- The US Dollar rose as the 10-year yield on Treasury bonds advanced following the FOMC Minutes release.

The Australian Dollar (AUD) extends its losses for the third consecutive day against the US Dollar (USD), with the AUD/USD pair hovering near two-year lows following domestic economic data, along with China's CPI inflation report released on Thursday. Traders are now focused on Friday’s US Nonfarm Payroll (NFP) report, for additional policy direction insights.

Australia's trade surplus rose to 7,079 million in November, surpassing the expected 5,750 million and the previous reading of 5,670 million (revised from 5,953 million). Exports increased by 4.8% month-on-month (MoM) in November, up from 3.5% (revised from 3.6%) in October. Meanwhile, imports grew by 1.7% MoM in November, compared to 0% (revised from 0.1%) in the previous month.

Australia's Retail Sales, a key indicator of consumer spending, increased by 0.8% month-on-month in November, up from the 0.5% growth recorded in October (revised from 0.6%). However, the figure fell short of market expectations, which had anticipated a 1.0% rise.

The AUD faces challenges as China's Consumer Price Index (CPI) data points to growing deflationary risks. The annual inflation increased by 0.1% in December, slightly lower than the 0.2% rise in November, matching market expectations. On a month-on-month (MoM) basis, CPI inflation remained unchanged at 0% in December, aligning with estimates, following a 0.6% decline in November. Any change in Chinese economic conditions could impact the Australian markets as both nations are close trading partners.

Australian Dollar extends losses due to increased hawkish sentiment surrounding Fed

- The US Dollar Index (DXY), which measures the US Dollar’s (USD) performance against six major currencies, holds its position near 109.00 at the time of writing. The Greenback received support from hawkish Federal Open Market Committee (FOMC) Meeting Minutes and concerns about tariff plans by the incoming Trump administration.

- The US Dollar strengthened as the 10-year yield on US Treasury bonds rose to near 4.73% in the previous session, currently standing at 4.67%, while the 30-year approached 4.93%.

- The FOMC Minutes from the December meeting revealed that most participants supported a 25 basis point cut but remained cautious, factoring in potential trade and immigration policy changes that could prolong elevated inflation.

- US Initial Jobless Claims fell to 201,000 for the week ending January 3, beating the 218,000 consensus. ADP Employment Change rose by 122K in December, though below market expectations of 140K.

- The US ISM Services PMI increased to 54.1 in November, up from 52.1, exceeding the market expectation of 53.3. The Prices Paid Index, which reflects inflation, rose significantly to 64.4 from 58.2, while the Employment Index dipped slightly to 51.4 from 51.5.

- According to Bloomberg, Federal Reserve Bank of Atlanta President Raphael Bostic stated on Tuesday that Fed officials should exercise caution with policy decisions due to uneven progress in reducing inflation. Bostic emphasized the need to lean toward keeping interest rates elevated to ensure the achievement of price stability goals.

- Richmond Fed President Thomas Barkin highlighted on Friday that the benchmark policy rate should remain restrictive until there is greater confidence that inflation will return to the 2% target. Meanwhile, Fed Governor Adriana Kugler and San Francisco Fed President Mary Daly underscored the challenging balancing act facing US central bankers as they aim to slow the pace of monetary easing this year.

- The Australian Dollar faced challenges as the trimmed mean, a closely watched measure of core inflation, fell to an annual 3.2% from 3.5%, edging closer to the Reserve Bank of Australia's (RBA) target band of 2% to 3%. Traders are currently pricing in a 55% probability that the RBA will lower its cash rate by 25 basis points to 4.35% in February, with a full quarter-point cut expected by April.

- Australia's monthly Consumer Price Index (CPI) rose 2.3% year-over-year in November, surpassing the market forecast of 2.2% and marking an increase from the 2.1% rise seen in the previous two months. This is the highest reading since August. However, the figure remains within the RBA’s target range of 2–3% for the fourth consecutive month, aided by the ongoing impact of the Energy Bill Relief Fund rebate.

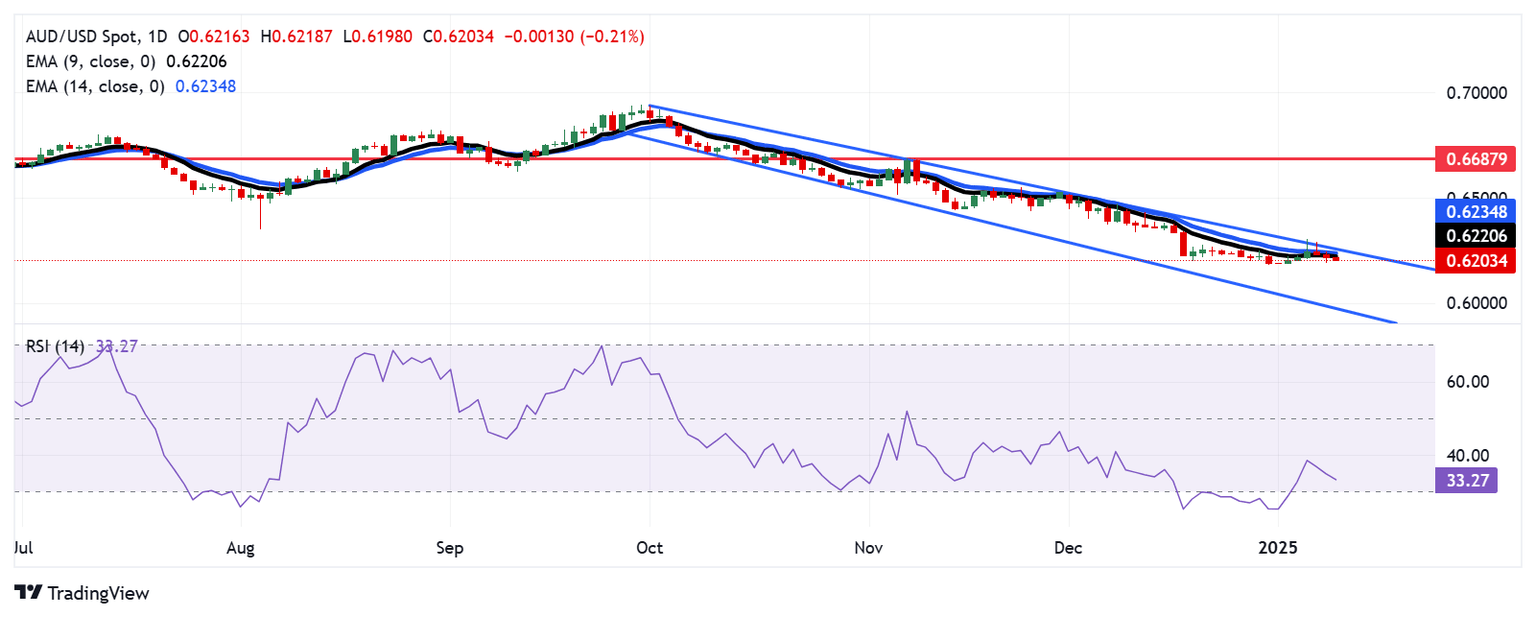

Australian Dollar hovers around 0.6200, next barrier appears at nine-day EMA

The AUD/USD pair hovers near 0.6200 on Thursday, maintaining a bearish outlook as it continues to trade within a descending channel on the daily chart. The 14-day Relative Strength Index (RSI) remains slightly above 30, suggesting the potential for an intensification of bearish momentum.

On the downside, the AUD/USD pair could approach the lower boundary of the descending channel around the 0.5980 level.

The immediate resistance is seen near the nine-day Exponential Moving Average (EMA) at 0.6220, followed by the 14-day EMA at 0.6234. A stronger resistance level lies near the upper boundary of the descending channel, around 0.6260.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.06% | 0.25% | -0.17% | -0.06% | 0.27% | 0.17% | -0.13% | |

| EUR | -0.06% | 0.19% | -0.23% | -0.11% | 0.22% | 0.11% | -0.19% | |

| GBP | -0.25% | -0.19% | -0.43% | -0.31% | 0.02% | -0.07% | -0.36% | |

| JPY | 0.17% | 0.23% | 0.43% | 0.10% | 0.44% | 0.29% | 0.05% | |

| CAD | 0.06% | 0.11% | 0.31% | -0.10% | 0.34% | 0.22% | -0.05% | |

| AUD | -0.27% | -0.22% | -0.02% | -0.44% | -0.34% | -0.10% | -0.38% | |

| NZD | -0.17% | -0.11% | 0.07% | -0.29% | -0.22% | 0.10% | -0.27% | |

| CHF | 0.13% | 0.19% | 0.36% | -0.05% | 0.05% | 0.38% | 0.27% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.