Australian Dollar holds steady as US Dollar remains firm ahead of FOMC Minutes

- The Australian Dollar depreciated as Australia's trimmed mean fell to an annual 3.2% from 3.5%.

- Australia's monthly Consumer Price Index increased by 2.3% YoY in November, the highest level recorded since August.

- The US Dollar appreciated as the 10-year yield on US Treasury bonds rose by over 1% on Tuesday.

The Australian Dollar (AUD) faced challenges for the second consecutive session against the US Dollar (USD), with the AUD/USD pair holding losses despite stronger-than-expected monthly inflation data released on Wednesday. Traders are now focused on the upcoming FOMC Minutes, scheduled for release later in the day, as well as the US jobs data, including the Nonfarm Payroll (NFP) report on Friday, for additional insights into policy direction.

However, the trimmed mean, a closely watched measure of core inflation, fell to an annual 3.2% from 3.5%, edging closer to the Reserve Bank of Australia's (RBA) target band of 2% to 3%. Traders are currently pricing in a 55% probability that the RBA will lower its cash rate by 25 basis points to 4.35% in February, with a full quarter-point cut expected by April.

Australia's monthly Consumer Price Index (CPI) rose 2.3% year-over-year in November, surpassing the market forecast of 2.2% and marking an increase from the 2.1% rise seen in the previous two months. This is the highest reading since August. However, the figure remains within the RBA’s target range of 2–3% for the fourth consecutive month, aided by the ongoing impact of the Energy Bill Relief Fund rebate.

The Australian Bureau of Statistics reported on Tuesday that permits for new construction projects in Australia dropped by 3.6% month-on-month to 14,998 units in November 2024, falling short of market expectations for a 1.0% decline. This downturn followed an upwardly revised 5.2% increase in October, marking the first decrease in three months.

The People’s Bank of China (PBoC) is collaborating with the State Planner to bolster the country's economy. PBoC official Peng Lifeng announced that the central bank will assist banks in expanding loans under the trade-in initiative.

Australian Dollar declines due to hawkish shift in Fed’s rate trajectory

- The US Dollar Index (DXY), which measures the US Dollar’s (USD) performance against six major currencies, holds its position above 108.50 at the time of writing.

- The US Dollar strengthened as the 10-year yield on US Treasury bonds rose by over 1% in the previous session, currently standing at 4.67%. This spike is a stark reminder of the shifting investor sentiment regarding the Federal Reserve's interest rate trajectory.

- The US ISM Services PMI increased to 54.1 in November, up from 52.1, exceeding the market expectation of 53.3. The Prices Paid Index, which reflects inflation, rose significantly to 64.4 from 58.2, while the Employment Index dipped slightly to 51.4 from 51.5.

- The US ISM Manufacturing PMI improved to 49.3 in December, from 48.4 in November. This reading came in better than the market expectation of 48.4.

- According to Bloomberg, Federal Reserve Bank of Atlanta President Raphael Bostic stated on Tuesday that Fed officials should exercise caution with policy decisions due to uneven progress in reducing inflation. Bostic emphasized the need to lean toward keeping interest rates elevated to ensure the achievement of price stability goals.

- Richmond Fed President Thomas Barkin highlighted on Friday that the benchmark policy rate should remain restrictive until there is greater confidence that inflation will return to the 2% target.

- Fed Governor Adriana Kugler and San Francisco Fed President Mary Daly underscored the challenging balancing act facing US central bankers as they aim to slow the pace of monetary easing this year.

- Traders are cautious regarding President-elect Trump’s economic policies, fearing that tariffs could increase the cost of living. These concerns were compounded by the Federal Open Market Committee’s (FOMC) recent projections, which indicated fewer rate cuts in 2025, reflecting caution amid persistent inflationary pressures.

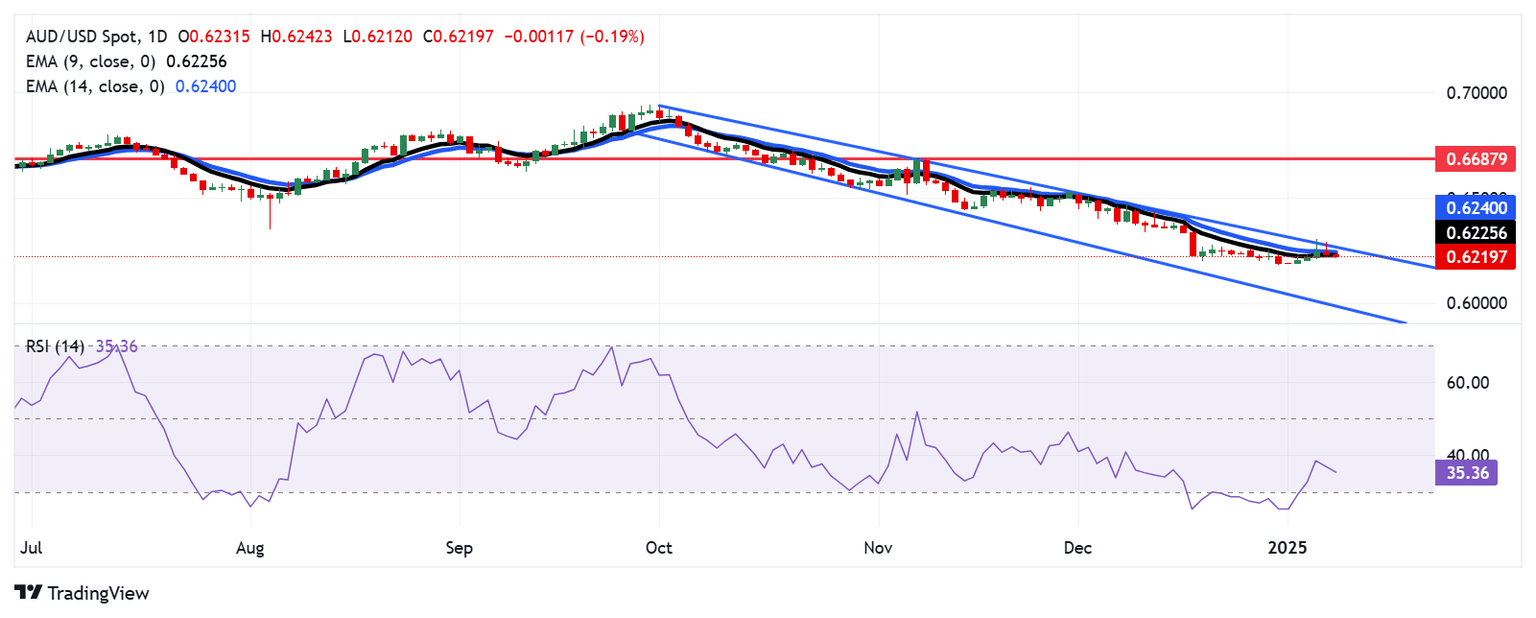

Technical Analysis: Australian Dollar moves below nine-day EMA toward 0.6200

AUD/USD trades near 0.6210 on Wednesday, maintaining its bearish outlook as it remains confined within a descending channel on the daily chart. The 14-day Relative Strength Index (RSI) retreats toward the 30 level, signaling a potential intensification of bearish momentum.

On the downside, the AUD/USD pair may navigate the region around the lower boundary of the descending channel, at the 0.5990 level.

The AUD/USD pair may test the immediate resistance around the nine-day Exponential Moving Average (EMA) at 0.6224, followed by the 14-day EMA at 0.6239. A further barrier appears around the upper boundary of the descending channel, at 0.6270 level.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.06% | -0.02% | 0.22% | -0.06% | 0.00% | 0.03% | -0.00% | |

| EUR | 0.06% | 0.04% | 0.26% | -0.01% | 0.06% | 0.09% | 0.05% | |

| GBP | 0.02% | -0.04% | 0.26% | -0.05% | 0.02% | 0.05% | 0.01% | |

| JPY | -0.22% | -0.26% | -0.26% | -0.28% | -0.21% | -0.19% | -0.22% | |

| CAD | 0.06% | 0.00% | 0.05% | 0.28% | 0.07% | 0.10% | 0.06% | |

| AUD | -0.01% | -0.06% | -0.02% | 0.21% | -0.07% | 0.03% | -0.01% | |

| NZD | -0.03% | -0.09% | -0.05% | 0.19% | -0.10% | -0.03% | -0.04% | |

| CHF | 0.00% | -0.05% | -0.01% | 0.22% | -0.06% | 0.00% | 0.04% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Economic Indicator

FOMC Minutes

FOMC stands for The Federal Open Market Committee that organizes 8 meetings in a year and reviews economic and financial conditions, determines the appropriate stance of monetary policy and assesses the risks to its long-run goals of price stability and sustainable economic growth. FOMC Minutes are released by the Board of Governors of the Federal Reserve and are a clear guide to the future US interest rate policy.

Read more.Next release: Wed Jan 08, 2025 19:00

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Minutes of the Federal Open Market Committee (FOMC) is usually published three weeks after the day of the policy decision. Investors look for clues regarding the policy outlook in this publication alongside the vote split. A bullish tone is likely to provide a boost to the greenback while a dovish stance is seen as USD-negative. It needs to be noted that the market reaction to FOMC Minutes could be delayed as news outlets don’t have access to the publication before the release, unlike the FOMC’s Policy Statement.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.