Australian Dollar holds gains as US Dollar remains subdued ahead of Fed Powell speech

- The Australian Dollar gains ground due to a divergent policy outlook between the RBA and the Fed.

- China's Caixin Manufacturing PMI declined to 49.3 in September, down from August's 50.4 reading.

- Traders will likely focus on Fed Chair Jerome Powell’s speech on Monday.

The Australian Dollar (AUD) continues its winning streak for the third consecutive session on Monday. The AUD remains stronger despite the mixed Purchasing Managers’ Index (PMI) data from China, Australia’s largest trading partner. Additionally, the rising expectations that the US Federal Reserve (Fed) may continue its policy easing in November is weakening the US Dollar and underpinning the AUD/USD pair.

China's Caixin Manufacturing Purchasing Managers' Index (PMI) fell to 49.3 in September, indicating contraction, down from 50.4 in August. Meanwhile, the Caixin Services PMI saw a significant decline, dropping to 50.3 from August’s 51.6 reading, reflecting a slowdown in the services sector.

The US Dollar received downward pressure following Friday’s US Core Personal Consumption Expenditures (PCE) Price Index data for August. The monthly index increased by 0.1% MoM, falling short of the expected 0.2% rise, aligning with the Federal Reserve's outlook that inflation is easing in the US economy. This has reinforced the possibility of an aggressive rate-cutting cycle by the Fed.

The CME FedWatch Tool indicates that markets are assigning a 42.9% probability to a 25 basis point rate cut by the Federal Reserve in November, while the likelihood of a 50-basis-point increase to 57.1%, up from 50.4% a week ago.

Daily Digest Market Movers: Australian Dollar rises due to RBA’s hawkish stance

- China’s NBS Manufacturing Purchasing Managers' Index (PMI) improved to 49.8 in September, up from 49.1 in the previous month and surpassing the market consensus of 49.5. However, the Non-Manufacturing PMI declined to 50.0 in September, compared to 50.3 in August and below the expected 50.4.

- The Reserve Bank of Australia’s (RBA) hawkish stance contributes to the upside of the Australian Dollar. The RBA kept its cash rate at 4.35% for a seventh consecutive meeting and stated that the policy would need to stay restrictive to ensure inflation slowed.

- St. Louis Federal Reserve President Alberto Musalem stated on Friday, according to the Financial Times, that the Fed should begin cutting interest rates "gradually" following a larger-than-usual half-point reduction at the September meeting. Musalem acknowledged the possibility of the economy weakening more than anticipated, saying, "If that were the case, then a faster pace of rate reductions might be appropriate."

- During his China visit, Australian Treasurer Jim Chalmers had candid and productive discussions with the National Development and Reform Commission (NDRC). Chalmers highlighted China's economic slowdown as a key factor in weaker global growth while welcoming the country's new stimulus measures as a "really welcome development."

- US Gross Domestic Product Annualized increased at a rate of 3.0% in the second quarter, as previously estimated, according to the US Bureau of Economic Analysis (BEA) on Thursday. Meanwhile, the GDP Price Index rose 2.5% in the second quarter.

- China plans to inject over CNY 1 trillion in capital into its largest state banks, facing challenges such as shrinking margins, declining profits, and increasing bad loans. This substantial capital infusion would mark the first of its kind since the 2008 global financial crisis.

- According to the Reserve Bank of Australia's Financial Stability Review from September 2024, the Australian financial system remains resilient, with risks largely contained. However, notable concerns include stress in China's financial sector and the limited response from Beijing to address these issues. Domestically, a small but growing portion of Australian home borrowers are falling behind on their payments, though only about 2% of owner-occupier borrowers are at serious risk of default.

- The Commonwealth Bank of Australia (CBA) anticipates that the RBA must revise its consumption forecasts downward in November. The RBA has already acknowledged downside risks to its current outlook. This potential revision, combined with expectations of a further rise in unemployment and trimmed mean inflation aligning with CBA's forecasts, could position the RBA to implement rate cuts before the end of the year.

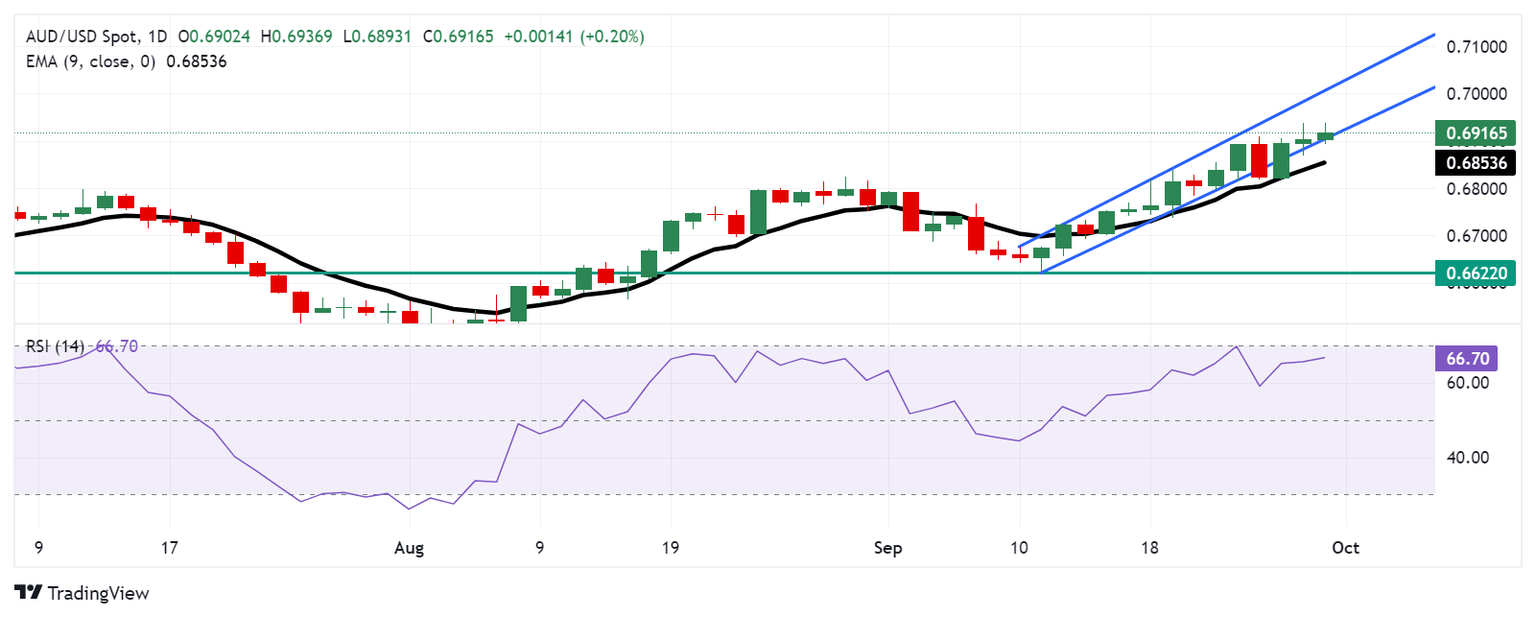

Technical Analysis: Australian Dollar remains above 0.6920, lower boundary of an ascending channel

The AUD/USD pair trades near 0.6920 on Monday. Technical analysis of the daily chart shows that the pair is trekking along the lower boundary of an ascending channel pattern. The AUD/USD pair stays above the boundary, indicating continued bullish momentum. Additionally, the 14-day Relative Strength Index (RSI) remains above the 50 level, confirming the bullish sentiment.

In terms of resistance, the AUD/USD pair could target the region near the upper boundary of the ascending channel, which is around the 0.7000 level. If the pair successfully breaks above this level, it could signal further bullish potential. However, failure to break through could result in a pullback within the channel.

On the downside, a break below the lower boundary of the ascending channel could weaken the bullish bias and lead the AUD/USD pair to test the nine-day Exponential Moving Average (EMA) at the 0.6853 level. A break below this level could cause the emergence of the bearish bias and lead the pair to navigate the region around its six-week low of 0.6622.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.02% | -0.08% | -0.38% | -0.03% | -0.34% | -0.41% | -0.01% | |

| EUR | -0.02% | -0.08% | -0.40% | -0.01% | -0.30% | -0.40% | 0.06% | |

| GBP | 0.08% | 0.08% | -0.19% | 0.07% | -0.22% | -0.32% | 0.14% | |

| JPY | 0.38% | 0.40% | 0.19% | 0.41% | -0.02% | -0.00% | 0.43% | |

| CAD | 0.03% | 0.01% | -0.07% | -0.41% | -0.27% | -0.39% | 0.07% | |

| AUD | 0.34% | 0.30% | 0.22% | 0.02% | 0.27% | -0.10% | 0.35% | |

| NZD | 0.41% | 0.40% | 0.32% | 0.00% | 0.39% | 0.10% | 0.43% | |

| CHF | 0.00% | -0.06% | -0.14% | -0.43% | -0.07% | -0.35% | -0.43% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.