Australian Dollar hovers near a major level ahead of RBA, FOMC Meeting Minutes

- Australian Dollar gains ground after China’s interest rate decision.

- Australia's Dollar receives upward support due to the downbeat Greenback.

- PBoC kept LPR unchanged at 3.45% as expected.

- US Dollar plunged on Friday despite upbeat US housing data.

The Australian Dollar (AUD) receives upward support after China’s interest rate decision. The People’s Bank of China (PBoC) kept its loan prime rate (LPR) unchanged at 3.45% as expected. However, the AUD/USD pair faced a challenge as the US Dollar (USD) attempted to rebound from a two-month low recorded on Friday.

Australia’s central bank is expected to hike again in the first half of 2024. The Reserve Bank of Australia (RBA) Assistant Governor Marion Kohler mentioned that inflation is expected to decrease but won't hit the RBA's 2%-3% target until the end of 2025. Investors will likely focus on the RBA Meeting Minutes and RBA Governor Bullock's speech on Tuesday.

Australia's Dollar (AUD) might have gained support as the United States (US) reported soft inflation figures and weak economic activity, contributing to a decline in the Greenback. Signs of inflationary pressures and a cooling labor market in the US led markets to believe that the Federal Reserve (Fed) may have concluded its hiking cycle, causing the US Dollar (USD) to weaken over the previous week.

US Dollar Index (DXY) continues to lose ground for the second successive session due to the pressure on the US Treasury yields. The yield on the 2-year Treasury note stands lower at 4.88%, down by 0.10%, by the press time. US Dollar (USD) faced pressure despite upbeat US housing data released on Friday. Building Permits (MoM) improved to 1.487M against the market consensus of 1.450M for October. Housing Starts (MoM) rose to 1.372M from the previous figure of 1.346M.

Boston Federal Reserve (Fed) President Susan Collins expressed optimism on Friday that the Fed can lower inflation without causing significant damage to the labor market by being "patient" with further interest rate moves. The Federal Open Market Committee (FOMC) minutes on Tuesday are expected to provide some insights into the Fed's stance on inflationary pressure and its approach to monetary policy.

Daily Digest Market Movers: Australian Dollar trades higher after China’s interest rate decision

- Australia’s seasonally adjusted Employment Change reported an increase of 55K in October, compared with the market anticipation of 20K and 6.7K in the previous month.

- Aussie Unemployment Rate came in at 3.7% in October as expected against the previous figure of 3.6%.

- Australia’s Wage Price Index grew 1.3% as expected compared to the previous reading of 0.8%. The year-over-year data showed an increase of 4.0% more than the anticipated 3.9%.

- US Continuing Jobless Claims for the week ending on November 3 reached the highest level since 2022 at 1.865M from the previous reading of 1.833M.

- US Initial Jobless Claims for the week ending on November 10 rose to 231K against the 220K as expected, marking the highest level in nearly three months.

- The October's US Consumer Price Index (CPI) showed lower readings than expected, with the annual rate slowing from 3.7% to 3.2%, falling below the consensus forecast of 3.3%. The monthly CPI reduced to 0.0% from 0.4%.

- The US Core CPI rose by 0.2% below the expectations of 0.3%, and the annual rate decreased to 4.0% from 4.1% prior.

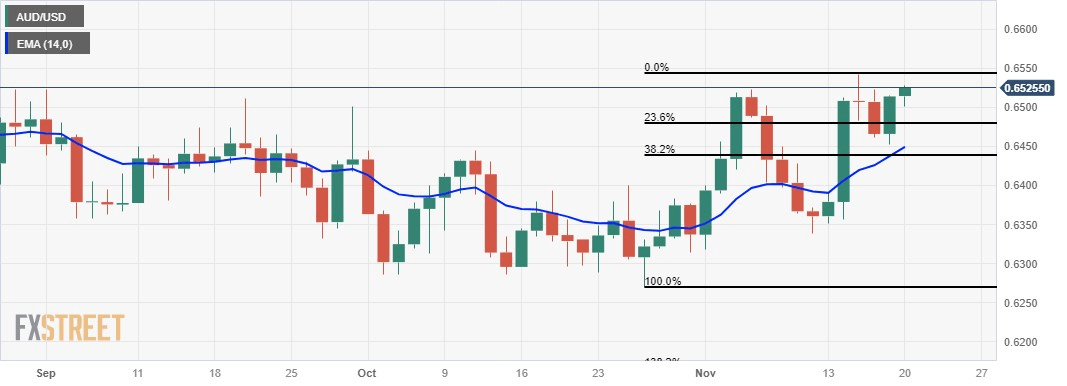

Technical Analysis: Australian Dollar looks to revisit the previous week’s high near 0.6550 major level

The Australian Dollar trades higher around the 0.6550 major level on Monday. The AUD/USD pair could find a barrier around the psychological level at 0.6600. On the downside, the psychological level at 0.6500 appears to be the immediate support, followed by the 23.6% Fibonacci retracement at 0.6478. If a break occurs below the level, the 14-day Exponential Moving Average (EMA) at 0.6448 could be the next support backed by a 38.2% Fibonacci retracement at 0.6438.

AUD/USD: Daily Chart

Australian Dollar price today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.09% | -0.19% | -0.10% | -0.56% | -0.53% | -0.49% | -0.21% | |

| EUR | 0.10% | -0.10% | -0.01% | -0.46% | -0.42% | -0.39% | -0.11% | |

| GBP | 0.19% | 0.08% | 0.09% | -0.36% | -0.32% | -0.29% | 0.00% | |

| CAD | 0.10% | -0.01% | -0.10% | -0.46% | -0.42% | -0.39% | -0.10% | |

| AUD | 0.55% | 0.46% | 0.36% | 0.45% | 0.02% | 0.07% | 0.35% | |

| JPY | 0.52% | 0.43% | 0.11% | 0.43% | -0.03% | 0.05% | 0.33% | |

| NZD | 0.49% | 0.40% | 0.30% | 0.38% | -0.07% | -0.05% | 0.28% | |

| CHF | 0.20% | 0.11% | 0.01% | 0.10% | -0.35% | -0.33% | -0.28% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Economic Indicator

Australia RBA Meeting Minutes

The minutes of the Reserve Bank of Australia meetings are published two weeks after the interest rate decision. The minutes give a full account of the policy discussion, including differences of view. They also record the votes of the individual members of the Committee. Generally speaking, if the RBA is hawkish about the inflationary outlook for the economy, then the markets see a higher possibility of a rate increase, and that is positive for the AUD.

Read more.Why it matters to traders

The Reserve Bank of Australia (RBA) publishes the minutes of its monetary policy meeting two weeks after the interest rate decision is announced. It provides a detailed record of the discussions held between the RBA’s board members on monetary policy and economic conditions that influenced their decision on adjusting interest rates and/or bond buys, significantly impacting the AUD. The minutes also reveal considerations on international economic developments and the exchange rate value.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.