Australian Dollar depreciates due to risk aversion despite a hawkish RBA

- The Australian Dollar declines despite a risk-on sentiment following the dovish Fed Chair Powell.

- The downside of the AUD may be restrained due to the hawkish mood surrounding the RBA.

- The US Dollar loses ground due to rising expectations of a 25 basis points rate cut in September.

The Australian Dollar (AUD) edges lower, still hovering around a seven-month high of 0.6798 on Monday. However, the AUD/USD pair gained ground due to the rising risk-on sentiment following the dovish speech from the US Federal Reserve (Fed) Chairman Jerome Powell at the Jackson Hole Symposium on Friday.

The Aussie Dollar also received support from the hawkish sentiment surrounding the Reserve Bank of Australia (RBA) regarding its policy outlook. the recent RBA Minutes showed that the board members agreed that a rate cut is unlikely soon. Additionally, RBA Governor Michele Bullock expressed that the Australian central bank will not hesitate to raise rates again to combat inflation if needed.

The US Dollar (USD) depreciates due to rising odds of a rate cut in September. According to the CME FedWatch Tool, markets are now fully anticipating at least a 25 basis point (bps) rate cut by the Federal Reserve at its September meeting.

Fed Chair Jerome Powell stated at the Jackson Hole Symposium "The time has come for policy to adjust." However, Powell did not specify when rate cuts would begin or their potential size.

Daily Digest Market Movers: Australian Dollar edges lower despite the hawkish RBA

- Philadelphia Fed President Patrick Harker stated on Friday that the US central bank's approach to interest rate adjustments needs to be "methodical," signaling that policymakers are planning a series of rate cuts throughout the remainder of 2024 as the US central bank prepares for a dovish shift, according to Bloomberg.

- Chicago President Austan Goolsbee noted on Friday that the Fed has seen broad success in achieving its goals and that inflation should continue to head toward the US central bank's target range. Policy is now at its tightest point of the entire hike cycle. Everything we wanted to happen to get rates down, has happened, per Reuters.

- The US Composite PMI dipped slightly to 54.1 in August, a four-month low, down from 54.3 in July, yet remained above market expectations of 53.5. This suggests that US business activity continues to expand, marking 19 straight months of growth.

- Australia's Judo Bank Composite Purchasing Managers Index (PMI) rose to 51.4 in August, up from 49.9 in July. This increase marks the fastest expansion in three months, driven by a stronger performance in the services sector, despite a more pronounced contraction in manufacturing production.

- FOMC Minutes for July’s policy meeting indicated that most Fed officials agreed last month that they would likely cut their benchmark interest rate at the upcoming meeting in September as long as inflation continued to cool.

- On Tuesday, the RBA Minutes suggested that the board members had considered a rate hike earlier this month before ultimately deciding that maintaining current rates would better balance the risks. Additionally, RBA members agreed that a rate cut is unlikely soon.

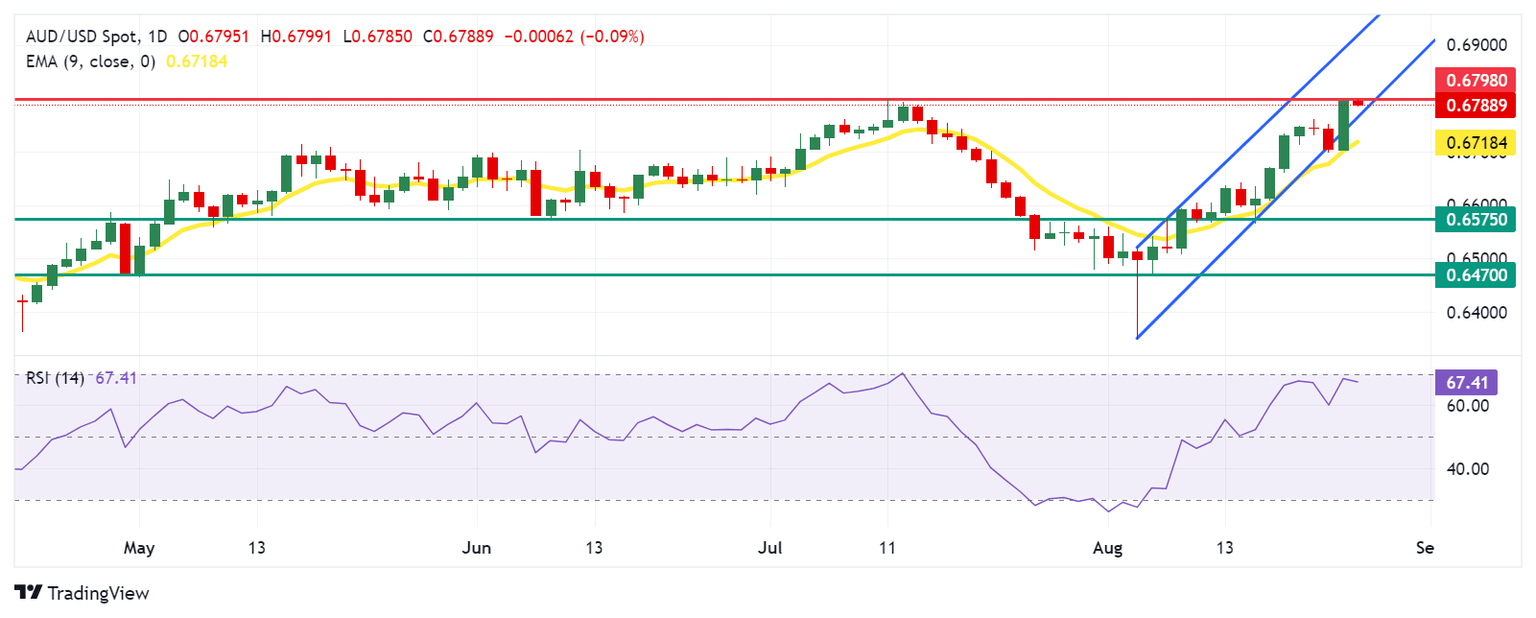

Technical Analysis: Australian Dollar rises to seven-month highs around 0.6800

The Australian Dollar trades around 0.6790 on Monday. Daily chart analysis shows the AUD/USD pair has returned to the ascending channel, suggesting reinforcing a bullish bias. However, the 14-day Relative Strength Index (RSI) reaches near the 70 mark, supporting the ongoing bullish momentum.

In terms of resistance, the AUD/USD pair tests the seven-month high of 0.6798. A break above this level could lead the pair to explore the region around the upper boundary of the ascending channel at the 0.6910 level.

On the downside, the AUD/USD pair may find support around the lower boundary of the ascending channel at the 0.6770 level, followed by the nine-day Exponential Moving Average (EMA) at the 0.6718 level. A break below the nine-day EMA could weaken the bullish bias and put downward pressure on the pair to navigate the region around the throwback level at 0.6575, followed by another throwback level at 0.6470.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.07% | 0.15% | -0.22% | -0.01% | 0.30% | 0.21% | -0.08% | |

| EUR | -0.07% | 0.02% | -0.29% | -0.07% | 0.14% | 0.15% | -0.13% | |

| GBP | -0.15% | -0.02% | -0.42% | -0.16% | 0.12% | 0.07% | -0.21% | |

| JPY | 0.22% | 0.29% | 0.42% | 0.23% | 0.61% | 0.67% | 0.24% | |

| CAD | 0.01% | 0.07% | 0.16% | -0.23% | 0.31% | 0.26% | -0.07% | |

| AUD | -0.30% | -0.14% | -0.12% | -0.61% | -0.31% | 0.00% | -0.28% | |

| NZD | -0.21% | -0.15% | -0.07% | -0.67% | -0.26% | -0.01% | -0.29% | |

| CHF | 0.08% | 0.13% | 0.21% | -0.24% | 0.07% | 0.28% | 0.29% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

RBA FAQs

The Reserve Bank of Australia (RBA) sets interest rates and manages monetary policy for Australia. Decisions are made by a board of governors at 11 meetings a year and ad hoc emergency meetings as required. The RBA’s primary mandate is to maintain price stability, which means an inflation rate of 2-3%, but also “..to contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people.” Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will strengthen the Australian Dollar (AUD) and vice versa. Other RBA tools include quantitative easing and tightening.

While inflation had always traditionally been thought of as a negative factor for currencies since it lowers the value of money in general, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Moderately higher inflation now tends to lead central banks to put up their interest rates, which in turn has the effect of attracting more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in the case of Australia is the Aussie Dollar.

Macroeconomic data gauges the health of an economy and can have an impact on the value of its currency. Investors prefer to invest their capital in economies that are safe and growing rather than precarious and shrinking. Greater capital inflows increase the aggregate demand and value of the domestic currency. Classic indicators, such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can influence AUD. A strong economy may encourage the Reserve Bank of Australia to put up interest rates, also supporting AUD.

Quantitative Easing (QE) is a tool used in extreme situations when lowering interest rates is not enough to restore the flow of credit in the economy. QE is the process by which the Reserve Bank of Australia (RBA) prints Australian Dollars (AUD) for the purpose of buying assets – usually government or corporate bonds – from financial institutions, thereby providing them with much-needed liquidity. QE usually results in a weaker AUD.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Reserve Bank of Australia (RBA) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the RBA stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It would be positive (or bullish) for the Australian Dollar.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.