Australian Dollar consolidates despite improved market optimism

- The Australian Dollar moves sideways despite positive economic data on Monday.

- Australia’s Building Permits increased by 10.4% MoM in July, marking the strongest growth since May 2023.

- The US Dollar may depreciate due to the rising odds of a 25 basis point rate cut by the Fed.

The Australian Dollar (AUD) experiences volatility against the US Dollar (USD) following the release of key economic data on Monday. However, improved risk sentiment could limit the downside of the risk-sensitive AUD, as dovish expectations surrounding the US Federal Reserve (Fed) continued to rise.

Australia’s Building Permits surged by 10.4% month-over-month in July, sharply rebounding from a 6.5% decline in June, marking the strongest growth since May 2023. On an annual basis, the growth rate reached 14.3%, a significant recovery from the previous 3.7% decline. Additionally, China’s Caixin Manufacturing PMI rose to 50.4 in August, up from 49.8 in July, which is particularly noteworthy given China’s close trade relationship with Australia.

The US Dollar receives downward pressure following the rising expectations of a 25 basis point rate cut by the Fed in September. However, the Greenback found support from the US July Personal Consumption Expenditures (PCE) Index data released on Friday.

Traders are now likely to focus on the upcoming US employment figures, including the Nonfarm Payrolls (NFP) for August, to gain further insights into the potential size and pace of Fed rate cuts.

Daily Digest Market Movers: Australian Dollar consolidates after the key economic figures

- The US Bureau of Economic Analysis reported on Friday that the headline Personal Consumption Expenditures (PCE) Price Index increased by 2.5% year-over-year in July, matching the previous reading of 2.5% but falling short of the estimated 2.6%. Meanwhile, the core PCE, which excludes volatile food and energy prices, rose by 2.6% year-over-year in July, consistent with the prior figure of 2.6% but slightly below the consensus forecast of 2.7%.

- The US Gross Domestic Product (GDP) grew at an annualized rate of 3.0% in the second quarter, exceeding both the expected and previous growth rate of 2.8%. Additionally, Initial Jobless Claims showed that the number of people filing for unemployment benefits fell to 231,000 for the week ending August 23, down from the previous 233,000 and slightly below the expected 232,000.

- Australia's Private Capital Expenditure unexpectedly declined by 2.2% in the second quarter, reversing from an upwardly revised 1.9% expansion in the previous period and falling short of market expectations for a 1.0% increase. This marks the first contraction in new capital expenditure since the third quarter of 2023.

- Australia's Monthly Consumer Price Index (CPI) increased by 3.5% year-on-year in July, down from June's 3.8% but slightly above the market consensus of 3.4%. Despite the slight decrease, this marks the lowest CPI figure since March.

- Federal Reserve Atlanta President Raphael Bostic, a prominent hawk on the FOMC, indicated last week that it might be "time to move" on rate cuts due to further cooling inflation and a higher-than-expected unemployment rate. FXStreet’s FedTracker, which gauges the tone of Fed officials’ speeches on a dovish-to-hawkish scale from 0 to 10 using a custom AI model, rated Bostic’s words as neutral with a score of 5.6.

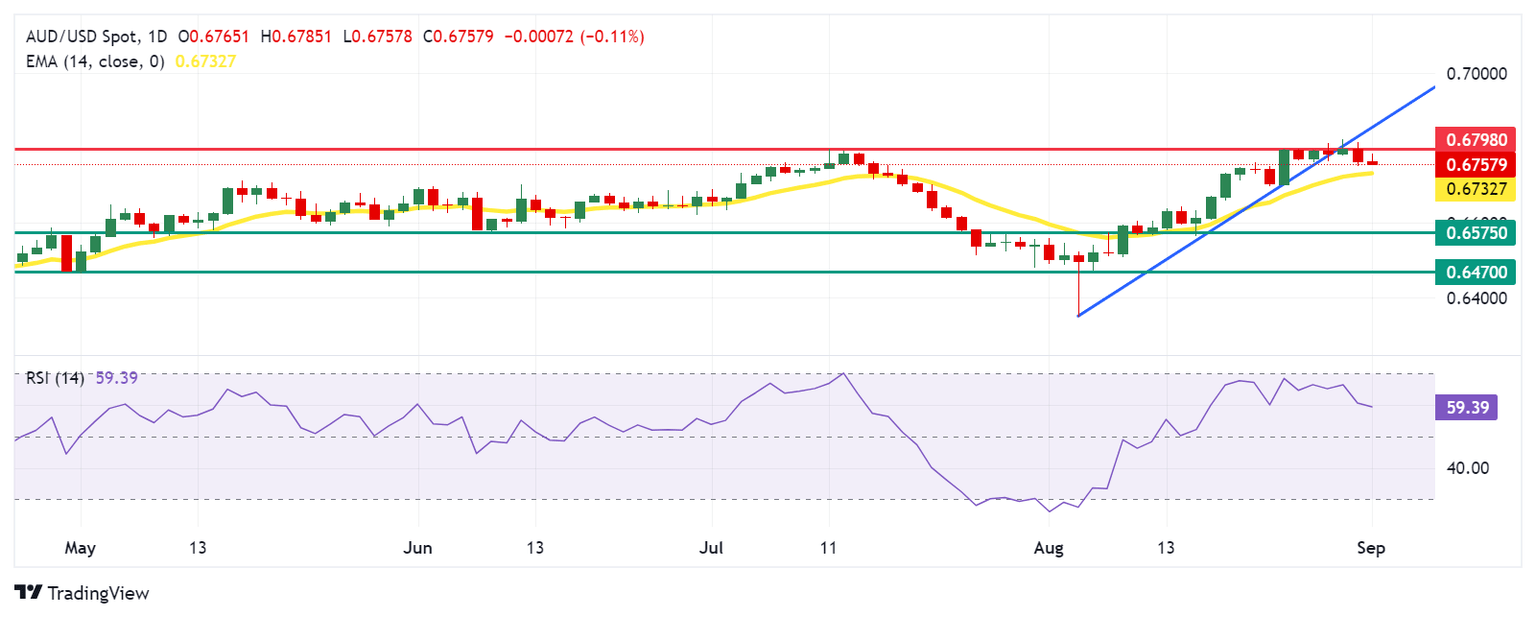

Technical Analysis: Australian Dollar falls to near 0.6750

The Australian Dollar trades around 0.6760 on Monday. Analyzing the daily chart, the AUD/USD pair is positioned below an uptrend line, suggesting a potential weakening of the bullish bias. However, the 14-day Relative Strength Index (RSI) remains above the 50 level, which continues to support the overall bullish trend.

Regarding resistance, the AUD/USD pair may test the immediate barrier at the seven-month high of 0.6798, followed by the uptrend line around the level of 0.6860. A break above this level could reinforce the ongoing bullish bias and lead the pair to navigate the area around the psychological level of 0.6900.

On the downside, the AUD/USD pair may find support around the 14-day Exponential Moving Average (EMA) at the 0.6732 level. A break below this EMA could undermine the bullish bias and increase downward pressure, potentially driving the pair toward the throwback level at 0.6575, with a further decline possibly targeting the lower support at 0.6470.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.00% | 0.00% | -0.01% | 0.08% | 0.01% | 0.13% | 0.16% | |

| EUR | -0.01% | 0.01% | -0.03% | 0.05% | 0.00% | 0.11% | 0.13% | |

| GBP | -0.00% | -0.01% | -0.06% | 0.02% | -0.03% | 0.13% | 0.09% | |

| JPY | 0.01% | 0.03% | 0.06% | 0.04% | 0.05% | 0.27% | 0.09% | |

| CAD | -0.08% | -0.05% | -0.02% | -0.04% | -0.03% | 0.05% | 0.08% | |

| AUD | -0.01% | -0.01% | 0.03% | -0.05% | 0.03% | 0.09% | 0.11% | |

| NZD | -0.13% | -0.11% | -0.13% | -0.27% | -0.05% | -0.09% | 0.01% | |

| CHF | -0.16% | -0.13% | -0.09% | -0.09% | -0.08% | -0.11% | -0.01% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

RBA FAQs

The Reserve Bank of Australia (RBA) sets interest rates and manages monetary policy for Australia. Decisions are made by a board of governors at 11 meetings a year and ad hoc emergency meetings as required. The RBA’s primary mandate is to maintain price stability, which means an inflation rate of 2-3%, but also “..to contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people.” Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will strengthen the Australian Dollar (AUD) and vice versa. Other RBA tools include quantitative easing and tightening.

While inflation had always traditionally been thought of as a negative factor for currencies since it lowers the value of money in general, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Moderately higher inflation now tends to lead central banks to put up their interest rates, which in turn has the effect of attracting more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in the case of Australia is the Aussie Dollar.

Macroeconomic data gauges the health of an economy and can have an impact on the value of its currency. Investors prefer to invest their capital in economies that are safe and growing rather than precarious and shrinking. Greater capital inflows increase the aggregate demand and value of the domestic currency. Classic indicators, such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can influence AUD. A strong economy may encourage the Reserve Bank of Australia to put up interest rates, also supporting AUD.

Quantitative Easing (QE) is a tool used in extreme situations when lowering interest rates is not enough to restore the flow of credit in the economy. QE is the process by which the Reserve Bank of Australia (RBA) prints Australian Dollars (AUD) for the purpose of buying assets – usually government or corporate bonds – from financial institutions, thereby providing them with much-needed liquidity. QE usually results in a weaker AUD.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Reserve Bank of Australia (RBA) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the RBA stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It would be positive (or bullish) for the Australian Dollar.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.