Australian Dollar extends its losing streak due to increased risk aversion

- The Australian Dollar could limit its downside due to a potential rate hike from the RBA.

- The PBoC has cut one- and five-year loan prime rates by ten basis points to 3.35% and 3.85%, respectively.

- US President Joe Biden announced that he will not seek re-election against former President Donald Trump.

The Australian Dollar (AUD) loses ground for the sixth successive session due to increased risk-off mood on Monday. The AUD could limit its downside as robust employment data indicate tight labor market conditions and raise concerns about a potential interest rate hike from the Reserve Bank of Australia (RBA). Investors look forward to Australian manufacturing and services PMI figures this week to gauge the health of the economy.

The People’s Bank of China (PBoC) has cut one- and five-year loan prime rates by ten basis points to 3.35% and 3.85%, respectively. Any change in the Chinese economy could impact the Australian markets as both countries are close trade partners.

The decline of the US Dollar (USD) provides some support for the AUD/USD pair. The Greenback faces challenges as bets on a Federal Reserve (Fed) rate cut in September increase and concerns about the fragility of the US labor market persist. According to CME Group’s FedWatch Tool, markets now indicate a 91.7% probability of a 25-basis point rate cut at the September Fed meeting, up from 90.3% a week earlier.

According to Reuters, markets are adjusting to a new US electoral landscape after President Joe Biden's unexpected announcement on Sunday that he will no longer seek re-election against former President Donald Trump.

Daily Digest Market Movers: Australian Dollar improves due to hawkish mood surrounding RBA

- China's $715 billion hedge fund industry braces for increased pressure as new regulations take effect next month. These stricter guidelines will require funds to meet higher asset thresholds and more stringent rules for investments and marketing. As a result, some investment firms are now seeking additional capital, according to a Reuters report.

- Federal Reserve Bank of New York President John Williams stated on Friday that the long-term trends that caused declines in neutral interest rates before the pandemic continue to prevail. Williams noted, "My own Holston-Laubach-Williams estimates for r-star in the United States, Canada, and the Euro area are about the same level as they were before the pandemic," according to Bloomberg.

- Australian Bureau of Statistics on Thursday showed that Employment Change increased by 50,200 in June from May, surpassing market forecasts of 20,000, data showed on Thursday.

- Reuters cited Sean Langcake, head of macroeconomic forecasting for Oxford Economics Australia, saying, "The current pace of employment growth suggests demand is resilient and cost pressures will remain. We think the RBA will stay the course and keep rates on hold, but August is certainly a live meeting."

- Westpac's summary of a note on inflation in Australia and the RBA indicates that Australia is expected to follow the same broad disinflation trend as other countries, given that they face largely similar economic shocks.

- Fed Chair Powell stated last week that the three US inflation readings from this year "add somewhat to confidence" that inflation is on track to meet the Fed’s target sustainably, suggesting that a shift to interest rate cuts may be imminent.

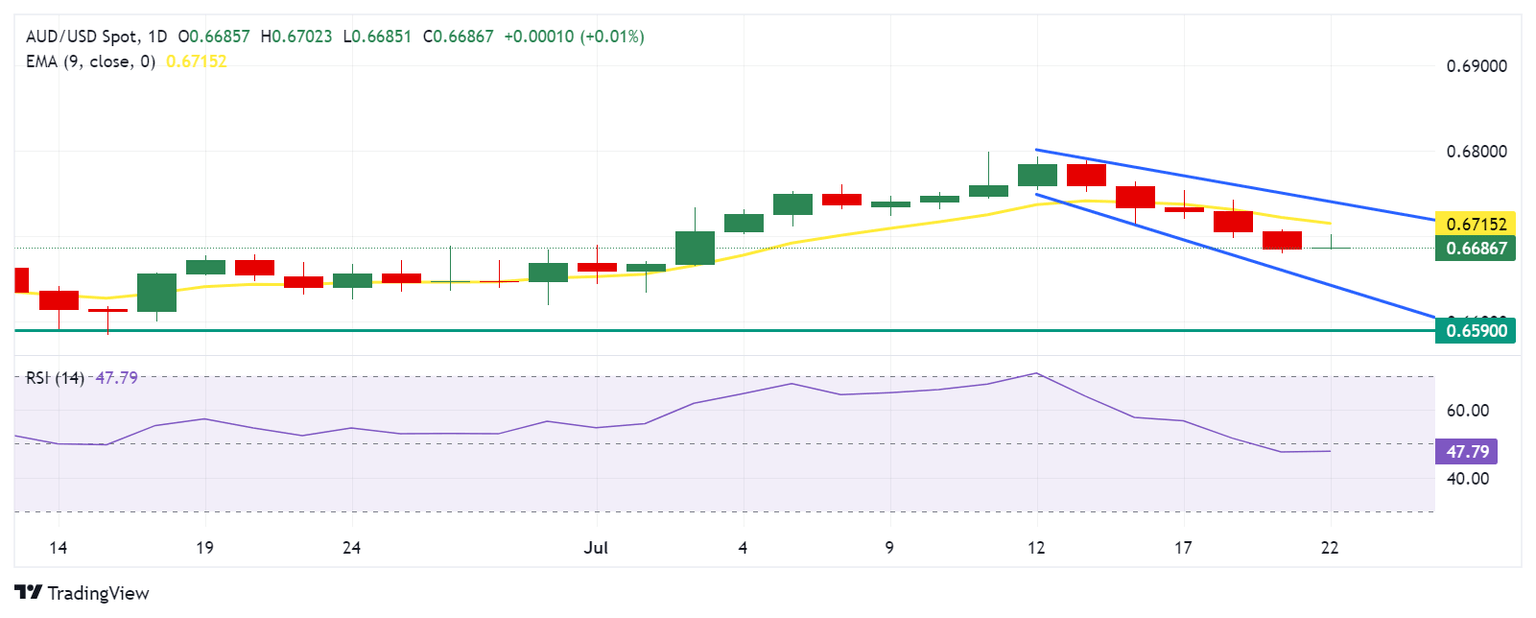

Technical Analysis: Australian Dollar remains below 0.6700

The Australian Dollar trades around 0.6690 on Monday. The daily chart analysis shows that the AUD/USD pair depreciates within a descending channel, signaling a bearish bias. Although the 14-day Relative Strength Index (RSI) is slightly below the 50 level, suggesting an emergence of a bearish trend.

The AUD/USD pair might test the lower boundary of the descending channel around the 0.6640 level. A decline below this level could pressure the pair to navigate the throwback support around 0.6590.

The immediate resistance appears at the psychological level of 0.6700, followed by the nine-day Exponential Moving Average (EMA) at 0.6715. A breakthrough above the latter could lead the AUD/USD pair to test the upper boundary of the descending channel around the 0.6740 level.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.01% | -0.03% | -0.61% | 0.17% | 0.31% | 0.25% | -0.01% | |

| EUR | 0.00% | -0.03% | -0.65% | 0.13% | 0.35% | 0.21% | -0.08% | |

| GBP | 0.03% | 0.03% | -0.71% | 0.15% | 0.39% | 0.22% | -0.07% | |

| JPY | 0.61% | 0.65% | 0.71% | 0.81% | 0.99% | 0.83% | 0.52% | |

| CAD | -0.17% | -0.13% | -0.15% | -0.81% | 0.24% | 0.09% | -0.20% | |

| AUD | -0.31% | -0.35% | -0.39% | -0.99% | -0.24% | -0.15% | -0.46% | |

| NZD | -0.25% | -0.21% | -0.22% | -0.83% | -0.09% | 0.15% | -0.26% | |

| CHF | 0.01% | 0.08% | 0.07% | -0.52% | 0.20% | 0.46% | 0.26% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Economic Indicator

PBoC Interest Rate Decision

The People’s Bank of China’s (PBoC) Monetary Policy Committee (MPC) holds scheduled meetings on a quarterly basis. However, China’s benchmark interest rate – the loan prime rate (LPR), a pricing reference for bank lending – is fixed every month. If the PBoC forecasts high inflation (hawkish) it raises interest rates, which is bullish for the Renminbi (CNY). Likewise, if the PBoC sees inflation in the Chinese economy falling (dovish) and cuts or keeps interest rates unchanged, it is bearish for CNY. Still, China’s currency doesn’t have a floating exchange rate determined by markets and its value against the US Dollar is fixed mainly by the PBoC on a daily basis.

Read more.Last release: Mon Jul 22, 2024 01:15

Frequency: Irregular

Actual: 3.35%

Consensus: 3.45%

Previous: 3.45%

Source: The People's Bank of China

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.